Plug-in vehicles currently have a negligible effect on the electrical grid, according to the results from six utility smart grid projects funded by the Department of Energy. But that’s likely to change as electric vehicle (EV) adoption continues to grow over the next decade.

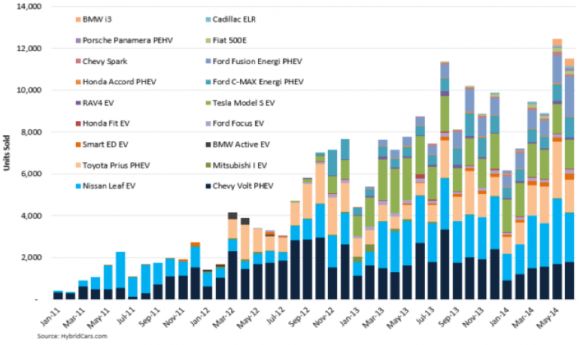

There are relatively few EVs in the U.S. today. Last year, new EV sales totaled 120,000, making up less than 1 percent of the entire new vehicle market. But while they currently account for a small portion of the more than 260 million passenger vehicles on the road, total EV numbers are expected to grow from nearly 296,000 in 2014 to more than 2.7 million in 2023.

As the numbers increase, utilities anticipate they’ll need to make distribution upgrades and capacity additions to handle large charging loads at peak times. In preparation, utilities face the challenge of determining where and when their customers will decide to charge up. The DOE sponsored six programs through the ARRA stimulus program to help utilities understand customer charging patterns and how they affect the grid, and summarized the findings in a recent report.

Figure 1: Monthly Sales of EVs in the U.S., 2011-2014

The six participating utilities were Burbank Water and Power, Duke Energy, Indianapolis Power & Light Company, Madison Gas and Electric, Sacramento Municipal Utility District and Progress Energy (now a part of Duke following a 2012 merger). In total, the utilities tracked 700 in-home and 240 public charging stations.

In all cases, the vast majority of people charged their cars during off-peak hours overnight. Indianapolis Power & Light, for instance, found that approximately 76 percent of electricity used for charging was used during off-peak hours.

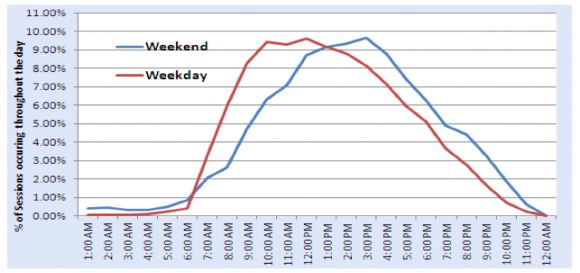

Public charging station usage was low, but typically took place during business hours when it could overlap with peak periods.

Figure 2: Percentage of Charging Sessions by Time of Day for Public Chargers at Progress Energy

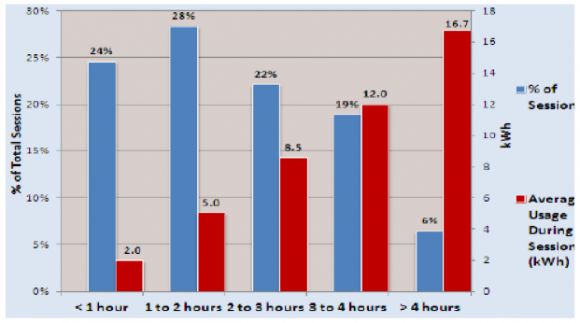

The average power demand to charge most vehicles was 3 kilowatts to 6 kilowatts, which is about the same as a residential air conditioner. Some vehicle models, however, can demand up to 19 kilowatts, which is a greater load than most single-family homes.

For Progress Energy, daily energy use at commercial stations averaged about 6.9 kilowatt-hours and varied between one to four hours of charging. Daily energy use for residential chargers averaged 7.1 kilowatt-hours and charging sessions generally lasted for three hours or less.

Figure 3: Energy Use and Duration of Residential Charging at Progress Energy

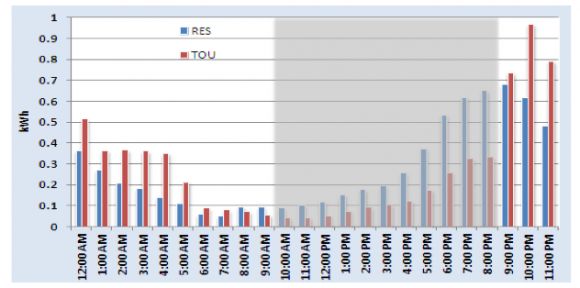

To encourage off-peak charging, utilities adopted new pricing options and advanced metering infrastructure (AMI) so that charging stations could integrate with time-based rates.

SMUD evaluated several time-of-use pricing plans: a whole-house time-of-use pricing plan, a dedicated meter pricing plan managed entirely by the customer during conservation day events, and a dedicated meter pricing plan managed by the utility during conservation day events. All of the options brought high customer satisfaction.

Progress Energy found time-of-use rates significantly reduced stress on the grid by shifting charging times to later in the evening.

Figure 4: Charging Patterns With and Without Time-of-Use Rates During Summer Weekdays

Utilities found the reliability of communications and ease of integration between smart meters and charging stations needs to improve significantly in order to allow them to offer effective time-of-use programs. SMUD, for instance, found that available products with ZigBee radios communicated with SMUD meters only 50 percent of the time due to poor radio signal quality, problems with power supply circuits in the EV supply equipment communications module, and environmental interference.

The DOE report called for better coordination with equipment vendors to ensure performance specifications are understood and effectively met.

To support the budding EV market, some utilities are investing directly in EV chargers. More EVs and more EV chargers represent an attractive opportunity that could allow utilities to grow electricity sales.

But because of high installation costs and low usage rates, public charging stations take a long time to recover their capital costs. Several utilities offered low-cost and even free charging to stimulate customer adoption, and the stations still had little use.

Burbank Water and Power calculated that if public charging station usage increased by 25 percent, the utility could expect a seven-year payback on those stations.

Use could be increasing. Madison Gas and Electric, for instance, saw driver enrollments from increase from eight to 123 in just one year. For the most part, though, high costs and current low use rates have led utilities to take a “wait-and-see” approach before installing additional public stations. “Several speculated that third-party providers may have greater success,” according to the report.

Fast chargers that allow drivers to charge up in less than 30 minutes could prove to be popular, but they also face challenges. Fast chargers are expensive, costing $50,000 to $100,000 each. They also draw 25 kilowatts to 50 kilowatts off of the grid at once and could easily overload most residential neighborhood circuits. None of the six utilities evaluated fast chargers in their programs.