California is becoming a poster child for the risks utilities face from climate change, from power lines starting wildfires to heat waves forcing increasingly renewable-powered grids to the brink of system collapse.

But utilities around the world are facing similar risks as they seek to decarbonize their generation fleets and make their grids more resilient to extreme weather events that are becoming more extreme and more common.

While the costs of mitigating those risks are hard to quantify, they’re likely much smaller than the costs of doing nothing and facing the alternatives. We’re seeing this calculation reflected in many ways, from massive asset manager BlackRock’s decision to move away from investments in coal and other global-warming-causing industries, to the maintenance and planning failures that led to the power-line-sparked wildfires that forced Pacific Gas & Electric into bankruptcy last year.

Data — the lifeblood of investors, insurers and other professional calculators of risk — can help utilities better identify these climate-change challenges and optimize their methods to mitigate them. Take the example of two startups that have raised early-stage funding in the past month, both aimed at predicting some very hard-to-predict futures.

Myst AI: Smarter energy forecasting from "non-stationary" data

Pieter Verhoeven, CEO and co-founder of Myst AI, sees value in turning time series data into predictions of how energy systems operate — particularly futures that have no corresponding past to model them.

Take the COVID-19 pandemic, which has drastically altered energy consumption patterns in ways that lack historical precedent, or last month’s heat wave covering the Western U.S., which forced California grid operators to institute rolling blackouts.

Traditional forecasting approaches that rely on historical data to predict what’s going to happen next aren’t suited to work with this kind of novel data. But time series data from disparate sources that is fed into machine-learning algorithms can adapt to changing circumstances far more quickly to yield more accurate forecasts, Verhoeven said.

Doing so requires careful management of that data’s changeability over time, or in data science terms, its “non-stationarity,” he said.

Myst AI applies a number of machine-learning techniques, such as the sequence modeling techniques developed for natural language processing adapted to time-series data, to deliver forecasts of renewable energy production, utility customer loads and energy market fluctuations.

“Depending on who you compare us to, [we are] 30 to 60 percent more accurate” than traditional forecasts, Verhoeven said.

Verhoeven's previous experience Google-owned Nest taught him two things: “Time series data is everywhere,” and it’s very hard to convert to accurate forecasts due to its non-stationarity.

Nest’s work capturing energy value from its thermostats also introduced him to “how relevant time-series forecasting is for the energy space.”

Verhoeven launched Myst AI in 2018 with co-founder and former manager in Rocky Mountain Institute's electricity practice Titiaan Palazzi. Since then, the startup has landed customers in Europe and North America, including large-scale renewable energy developers like Enel Green Power and utilities including Finland-based Fortum.

On Thursday, the San Francisco-based startup announced a $6 million Series A round led by Valo Ventures, with participation from Google’s AI-focused venture fund Gradient Ventures, which led the startup's seed round. The funding will serve to expand its “forecasting-as-a-service” business, which can be provided from the cloud or integrated into a customer’s IT systems, Palazzi said.

Howard Chang, chief operating officer of East Bay Community Energy, said that Myst AI has proven to be “very accurate” in its load-modeling forecasts since the California community-choice aggregator started a proof-of-concept testing this spring.

“Particularly in this environment of uncertainty, with COVID [and] this recent heat wave, we value having this additional input,” Chang said.

In terms of projecting the load changes from COVID-19 pandemic lockdowns and economic disruptions, “We’ve seen their forecasts come in a couple of percentage points more accurate. That’s reflective of the fact that their machine-learning algorithms can pick up trends that have a very limited history," Chang added.

Overstory: A space-eye view of wildfire risk

Utilities can spend hundreds of millions of dollars per year on trucks, helicopters and drones to inspect their grids for vegetation that can spark fires and dispatching crews to clear dangers like dying trees, overhanging limbs and tinder-dry brush.

But it’s impossible for utilities to track the vegetation changes that occur between inspections; it can take years to cycle through thousands of miles of power lines. And as the scrutiny over PG&E’s wildfire prevention efforts indicates, even intensified regimes can fail to spot conditions that could spark the next conflagration.

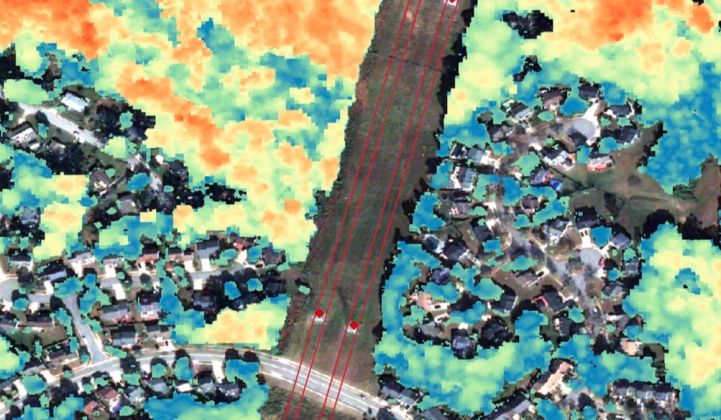

Indra den Bakker, CEO of Overstory, says his company’s satellite-imagery-based forestry analytics can yield far more accurate and timely data on dangers like these at a fraction of the cost of traditional methods. Last month Overstory raised a $1.7 million seed round led by Pale Blue Dot and joined by Powerhouse Ventures, Techstars and Futuristic VC.

Overstory got its start combining satellite images of forests with correlating data to gain insight that photographs taken from space can’t reveal, much as the Climate Trace project is doing to track carbon emissions.

In Overstory’s case, it combines data on rainfall, temperature, insect infestations and other sources to predict tree age and health, their susceptibility to drought or high temperature and their likelihood of being felled by strong winds or lit ablaze by sparks thrown from damaged power lines.

Its first utility contract with Portugal’s EDP, which faces similar climate challenges to those that have plagued California, led it to refocus on the utility-wildfire nexus. “We can scan the entire grid every day if we want,” den Bakker said. That allows utilities to direct vegetation management operations and investment more strategically, discover and correct high-risk areas more quickly, or even check the work of contractors sent out to clear corridors.

To prove out its findings, Overstory does blind validations with customers. “We say, ‘Here are where we think [there] are sick trees, here are the species, here are the heights of the trees,’ and then we have our customers measure on the ground.”

That data is fed back to its algorithms, in pursuit of the golden rule of data analytics: the more, the better.

To lower the upfront cost, Overstory offers its service on a per-mile, per-month basis, said Emily Kirsch, CEO of Powerhouse Ventures.

“If a utility can take a relatively minor and inexpensive action to prevent tens of billions of dollars of losses,” which is what the Nov. 2018 Camp Fire cost PG&E, “that is enough incentive for a utility to act," Kirsch said.