U.S. states’ responses to the coronavirus pandemic have already driven a shift in demand profiles, and new Genscape data from the Midwest and Northeast shows the extent of the transformation.

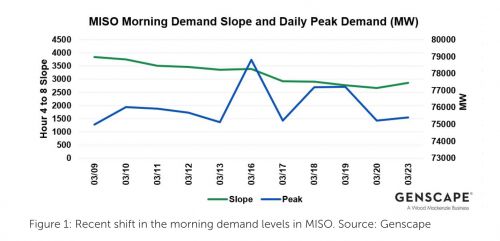

The first noticeable impact of COVID-19 in the territory of the Midcontinent Independent System Operator (MISO) was a decrease in the velocity of the morning demand ramp.

School and office closures have prompted many employees to work from home and contributed to a steady decline in morning load levels.

Since the start of the widespread social-distancing and work-from-home mandates on March 9, the rate of increase in load from 5 a.m. to 9 a.m. has declined, as shown below.

This flattened demand curve has shifted the peak demand hour into the early afternoon.

Historically, the normal MISO “shoulder season" (i.e., spring or fall) load curve has distinct morning and evening peaks that occur as most Midwesterners leave the house in the morning and return home at night. Now, with most people home throughout the day, the load profile has shifted due to a combination of later wakeup times and increased daytime lighting load.

The slowed morning demand ramp and the absence of an evening ramp have driven the two peaks to converge in the early afternoon.

The Northeast

In a typical spring, both New York and New England see a demand ramp between 5 a.m. and 8 a.m. The peak takes usually place between 7 a.m. and 8 a.m. on clear sunny days and somewhere between 8 a.m. and 11 a.m. on overcast days. The evening demand ramp takes place between 6 p.m. and 8 p.m.

However, with COVID-19 measures in place, Genscape has identified a shift in the timing of residential demand patterns across the region.

Many people are now working and attending school from home — or on a more somber note, not working at all. This means the vast majority of the population is likely waking up later in the day and starting their evening routine earlier in the day.

As a result, Genscape's analysis has identified a softening of the morning demand ramp in both New York and New England — and to a significant extent. On exceedingly clear, sunny days, demand now peaks between 8 a.m. and 9 a.m. in New York.

Because of New England's abundant rooftop solar generation, the region has retained a peak between 7 a.m. and 8 a.m. on the clearest days.

On days of unsettled weather, the morning demand peak becomes a midday demand peak, typically occurring between 10 a.m. and 12 p.m., and sometimes as late as 1 p.m.

Other market effects

Each state is in a different stage of imposing COVID-19 procedures and regulations, making demand analysis an extremely complex undertaking. It’s possible that generation maintenance and transmission outages may be postponed to limit people working in close proximity to one another, which would ultimately lower congestion risks.

This also connects to concerns around staffing, as widespread infection among plant operators could prevent plants from functioning normally.

Prior to the spread of the virus, MISO saw uncharacteristically cheap pricing stemming from mild demand and extremely low gas prices.

With the COVID-19 pandemic, many industry observers are worried that MISO prices will remain low, as gas prices and the capacity of generation on outage appear unlikely to rise. However, the evidence is not yet substantial at this point in time.

In the Northeast, gas demand in March 2020 fell far short of expectations, largely as a result of weakening commercial demand.

Peak demand is expected to fall by at least several gigawatts in many parts of North America over the next few quarters and beyond, according to Wood Mackenzie.

Demand will continue to rapidly shift and evolve as human behavior changes at an unprecedented rate in this uncertain era.

***

Genscape is analyzing the impacts of the COVID-19 pandemic on pricing, generation and congestion across the power industry. An upcoming Genscape webinar focused on MISO goes into more detail on the region. Register for the webinar here.

McGara DeWan is a power market analyst at Genscape (part of Wood Mackenzie).