Home energy management systems (HEMS) are on the rise, and a lot has changed since the first wave of HEMS startups hit the market in 2008 and 2009.

But what are HEMS, really, and what does the market look like today?

First of all, the HEMS concept has entered the mainstream market. The next few years will mark a growth phase that will result in a number of company acquisitions, millions of homes subscribing to HEMS services, and product offerings that are more desirable for consumers. There are at least five HEMS vendors that have publicly announced passing the 1-million-customer mark: Alarm.com, Tendril, Opower, Vivint, and ADT. Nest will probably pass the marker as well in the next few months; iControl and EcoFactor are probably well past 1 million homes through their telecom partnerships; and a handful of other utility and non-utility HEMS firms are coming close.

The above list should have you questioning what is actually included in the definition of HEMS, and rightfully so. In the past five years, HEMS suppliers have changed their value propositions multiple times, products have gone digital, and new industries have taken notice and picked up HEMS offerings.

I define HEMS as encompassing any product or service that monitors, controls, or analyzes energy in the home. This definition includes residential utility demand response programs, home automation services, personal energy management, data analysis and visualization, auditing, and related security services.

While interviewing more than 30 HEMS vendors and industry groups for the new GTM Research report, Home Energy Management Systems 2013-2017, I asked each interviewee what they thought of this new definition. Almost all the participants agreed with this proposed definition, thus leading me to believe that HEMS is indeed a broader market these days, one with a number of viable subsectors forming. It is important to maintain such a broad view of HEMS as the market develops over the next few years and business models branch out, both within the utility sector and in the consumer-only market.

There are a number of ways to divide the HEMS market. One is to split solutions into utility and non-utility sectors.

Utility solutions include both the utility and the thousands of homes enrolled in the HEMS program. These solutions require a detailed economic analysis custom-tailored to each utility, and typically boil down to a single-load-per-home demand response program or an energy efficiency and customer engagement initiative. Demand response systems are in the low-to-mid hundreds of dollars range, and baseload reduction/energy efficiency programs save 2 percent to 20 percent. Utilities typically do a one-time hardware purchase with an annual subscription service for energy management and integration services provided by the vendor.

The utility benefits greatly from these services, and usually also has to pay for the entire solution. Utilities prefer communications-agnostic solutions that can integrate with their existing software platform. Top players in the utility area include EcoFactor, Sequentric, EnergyHub (recently acquired), Calico Energy Solutions, Comverge, Consert and Aclara.

Non-utility solutions focus solely on the home customer and integrate various smart-home services, which fall under the broad definition of HEMS proposed above. The detailed economic analysis used for utility customers is replaced with a smart marketing campaign targeting the needs of homeowners -- vendors often enter the home with a security solution and then offer HEMS as an add-on sale.

Homeowners can purchase the HEMS hardware in the mid-hundreds to low-thousands range, and pay between $15 and $60 per month for energy management, automation and security services. Between $5 and $15 of this monthly bill can be attributed to energy management services. Revenue quickly adds up, and telecom companies are extremely happy with this business model, as it can effectively double their revenue for a home and is easy to scale to their millions of existing customers. Top players include AlertMe, Nest, EcoFactor, Alarm.com, Vivint, and major telecom companies using HEMS vendors, such as Comcast and Verizon.

So, what's the five-year forecast for the HEMS market?

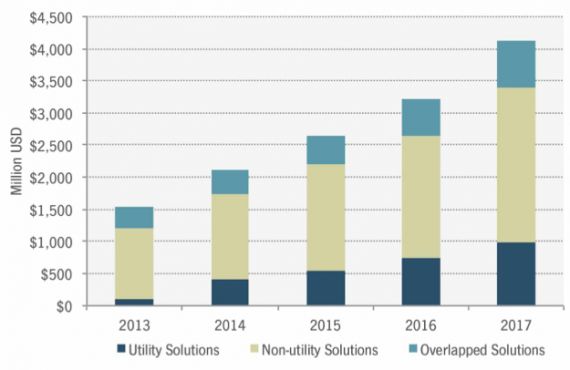

FIGURE: U.S. HEMS Forecast by Market Solution, 2013-2017

Source: GTM Research

As shown, utility solutions sales are still low, but will pick up in the next two years as vendors learn how to more quickly develop economic analyses for the utilities and as enough successful HEMS stories emerge to convince the rest of the utilities to join the race. Non-utility solutions already have a strong subscription revenue model and are waiting on word of mouth for sales to pick up. Overlapped solutions consist mainly of smart thermostats, and companies such as Honeywell, Emerson, and Nest are taking this segment by storm.

The HEMS sector is no longer about complex hardware solutions focused solely on maximizing energy reduction in the home while ignoring occupant comfort. Instead, the space is now a mix of utilities, customers and third-party vendors looking to find the right balance between energy reduction, cost and customer satisfaction.

***

To learn more, check out our new GTM Research report: Home Energy Management Systems: Vendors, Technologies and Opportunities, 2013-2017.

Kamil Bojanczyk is a consultant with GTM Research currently based out of Beijing. Over the past four years, his work has covered economic analysis, market research, product development, patent research, and technical simulations.