GTM Research Managing Director Shayle Kann spoke at the SolarTech Solar Leadership Summit in San Jose, California this morning.

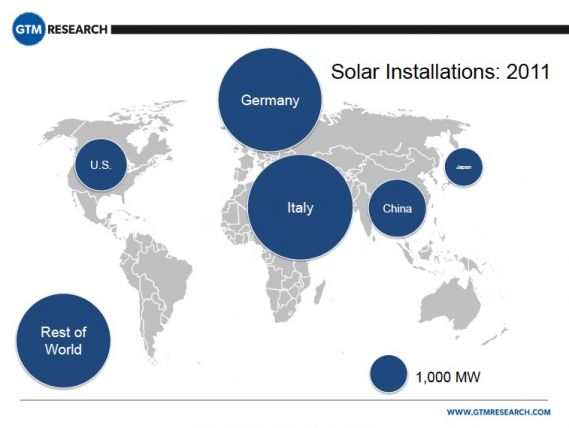

Kann provided data from the U.S. perspective. Until now, the global solar industry hadn't paid a lot of attention to the U.S. But that's changing.

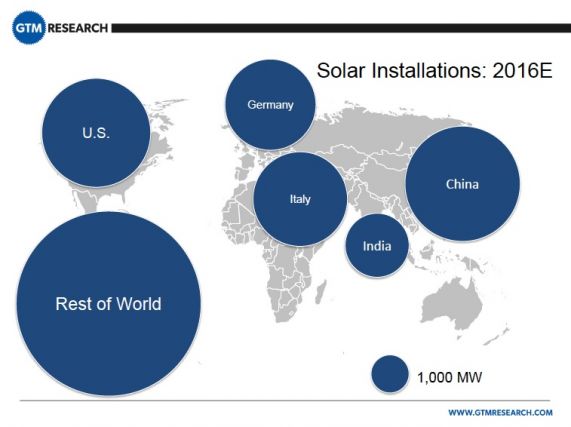

According to Kann, the action in the coming years is going to occur in China, U.S. and the rest of the world. He cited First Solar's focus on new markets and untapped markets where solar can be installed at grid parity.

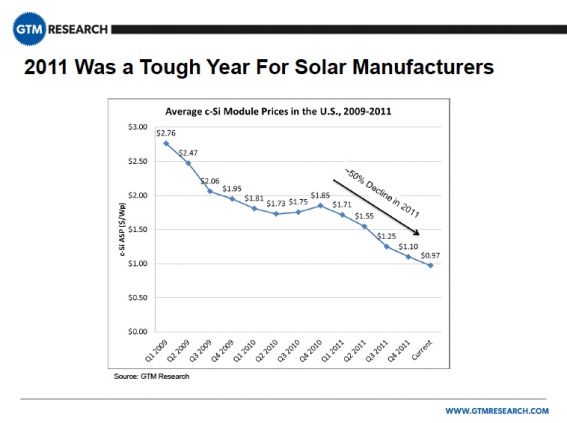

Coming as no news to the attendees, Kann noted that 2011 was a bad year for solar manufacturers. Manufacturing capacity grew 55 percent while demand was relatively flat. Italy re-jiggered its feed-in tariffs, while Germany was slow for most of the year.

As a result, module prices dropped 50 percent.

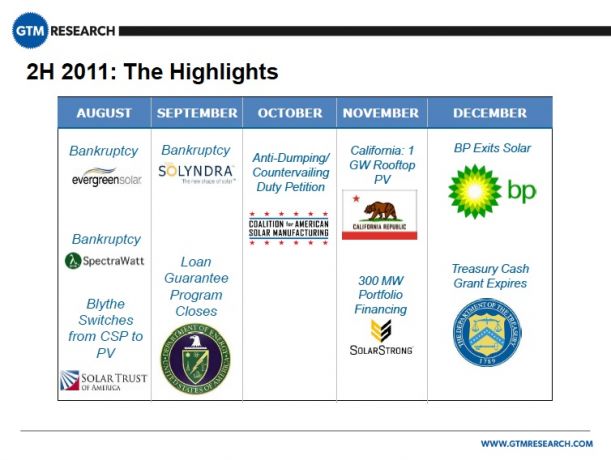

Kann notes that we had a monumental second half of the year, and not in a good way. Here are the highlights (well, mostly lowlights) of the year. Kann suggested we use the opportunity of the Solyndra news platform to tell the real story of solar -- its job creation story and the approach of grid parity.

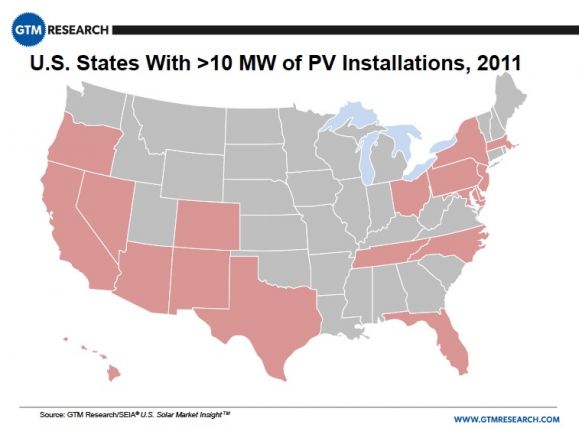

GTM Research will be releasing 2011 U.S. PV numbers next week. We've seen big growth in U.S. markets -- Q4 was by far the strongest quarter and 2011 could finish at 1.8 gigawatts to 1.9 gigawatts. The other trend is geographic diversification, as the number of states with greater than 10 megawatts of installations continues to increase.

The utility market is becoming the big story in the U.S. There's a 9-gigawatt PV project pipeline with utility PPAs. Not every one of these projects will get built, but even if half of those projects are completed, the utility sector will dominate over residential and commercial. Kann maintains that there are still a lot of issues like interconnection and other potential obstacles: "Still," he said, "I don't envy utility-scale developers in the U.S."

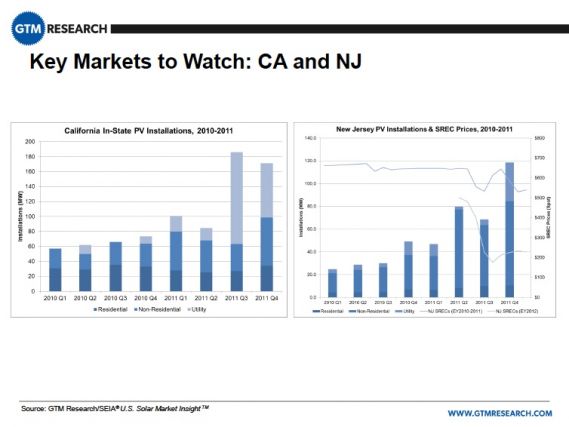

The action is in California and New Jersey, while some of the states to watch are Massachusetts and Hawaii. Hawaii was strong in 2011 and looks to be even stronger in 2012, according to Kann.

Kann also predicts that the United States' solar market share will become far more significant in the years to come. The U.S. market doubled last year and will continue to see growth despite any potential import tariffs. There is still an impressive pipeline and the growth rate will be strong for the next few years.

However, the U.S. is starting to run up against interconnection issues and net energy metering caps and must confront these obstacles to maintain steady growth.

Expect an increasing number of global players to make their way to the U.S. in the near future.