New York City has the largest commercial steam system in the world. In a city where many rooftops are not suitable for solar, it allows large buildings to increase their efficiency by using the steam for combined-heat-and-power (CHP) systems or even for cooling. The steam system is one of the world's oldest, but for new projects, leveraging the district heating system doesn't always pencil out.

In some cases, it is utility standby charges that kill a project. “Standby tariffs are a pain in the ass and can really cause some trouble,” Vishnu Barran, senior business development manager at ENER-G Rudox, said during a Clean Energy Connections panel in New York on Wednesday. His clients are often aiming for a five-year payback.

Barran and his fellow panelists are not looking for the elimination of standby rates, but rather for more transparency in terms of how they’re calculated, as well as more consideration on the part of utilities and regulators for how the rates can kill projects that could otherwise be an asset at the grid edge. For large corporations that are looking to take on increasingly complex energy projects, whether CHP, EV charging or solar-plus-storage, the rates add an additional layer of confusion when it comes to dealing with utilities, even those with which they generally have good relationships.

The hometown utility, Consolidated Edison, took the brunt of the criticism, but not because it was particularly unique. “Most utilities have a standby tariff,” said Barran. “Con Edison’s might just be a bit more onerous.”

Philip Skalaski, VP of engineering and Energy Services at The Durst Organization, said that skyrocketing steam rates in New York City make it particularly difficult to model large co-generation projects.

For the Bank of America Tower at One Bryant Park, the steam rate tripled from the time it was planned to when the combined-heat-and-power system in the building became operational three years later, in 2009. “If we don’t use an ounce of steam, we’ll still pay $1 million per year,” Skalaski said of the project.

New York regulators are instituting some changes that alter the cost-benefit of CHP systems by eliminating standby rates if CHP plants in large buildings run in the summer to reduce peak demand on the system. That change saved One Bryant Park about $300,000 in 2015. Even so, the demand charges are so substantial that Durst is considering installing a central boiler plant, because that would have a six-year payback.

Dynamic modeling of technology options within a given rate structure for investments like CHP or energy storage is increasingly important as rates become more complicated. For example, knowing when to run the system to make a project financially viable is one of the biggest challenges, said Barran. “It’s one of the trickiest things for business development guys on our end,” he added. It is even more important if microgrids are going to become financially viable, particularly in the Northeast, where CHP is a common element of microgrids.

Outside of the Northeast, however, it is solar and not CHP that the C&I sector is increasingly adopting. “Solar is just free money to us,” Randy Gaines, VP of operations in the Americas for Hilton, said at a recent event hosted by GE’s Current. Kirby Brendsel, associate director of sustainability at Starwood Hotels & Resorts, expressed his enthusiasm regarding the federal Investment Tax Credit extension that will allow his company to pursue more solar projects.

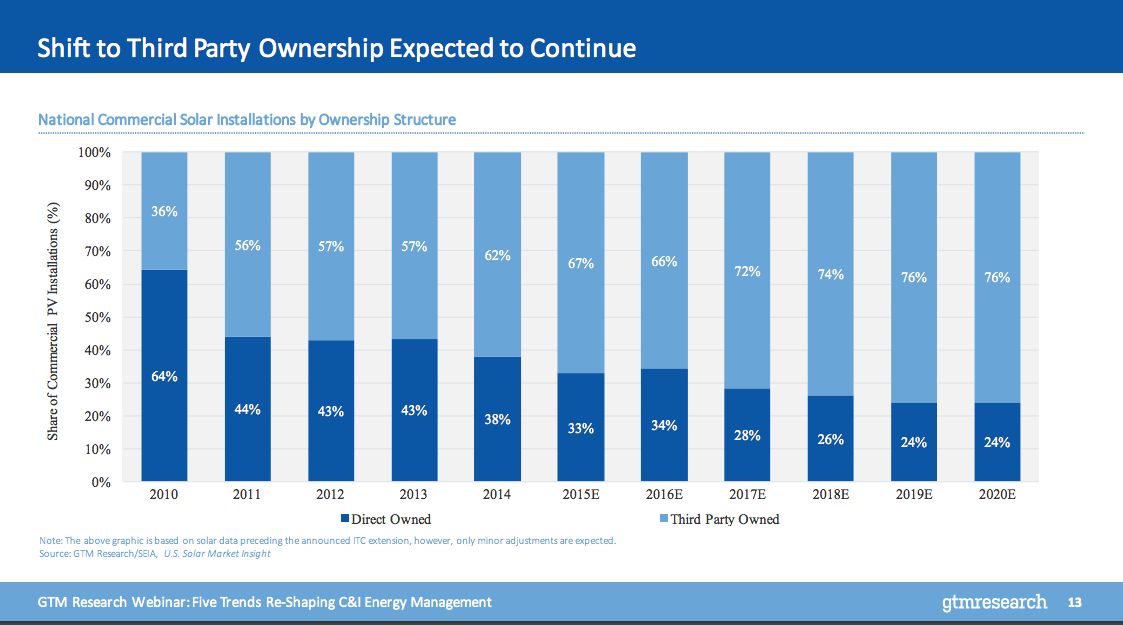

Commercial solar continues to rebound, but some significant challenges remain. Third-party financing, an increasingly common form of ownership for C&I solar, is highly variable. “We see a gradual standardization of third-party financing in commercial solar,” Omar Saadeh, senior analyst at GTM Research, said during a recent webinar on trends in C&I energy management.

Even for companies that are enthusiastic about installing solar, interconnection issues can be excruciating. “It feels like always putting a square peg through a round hole,” said Starwood’s Brendsel. Although there are technical hurdles to faster interconnection, it can also be as simple as having a better line of communication with a utility to move things along. Solving interconnection hurdles is another area where regulators can incentive utilities to provide better outcomes.

“It’s amazing with the better communicators how much faster projects get done,” Kylie Sale, resource management specialist at Whole Foods Market, said of working with different utilities.

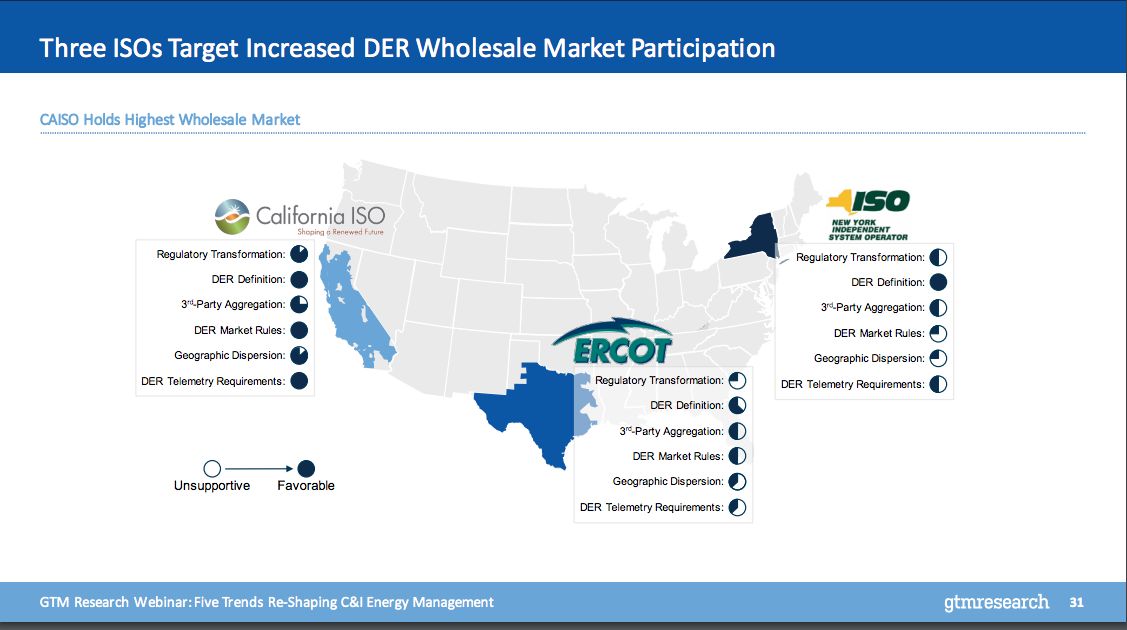

Regulators in some states, such as California and New York, are incentivizing utilities to think differently about interconnecting with and leveraging assets at the grid edge. They are also directing wholesale markets in those states to develop ways for behind-the-meter assets to play in those markets.

“Near-term wholesale market opportunities may shift the cost burden away from end users and bring new cost-benefits to light,” Saadeh said of behind-the-meter resources such as solar-plus-storage.

Even the most sophisticated corporations are looking for hand-holding as the world of energy procurement, generation and efficiency grows more complicated and compelling. However, while they work closely with their utilities, most corporations are not looking to utilities as those advisors.

“We’re not distributed-energy or demand-response consultants,” Granville Martin, JPMorgan’s managing director of sustainable finance, said of looking for opportunities to shave energy across all of its branches. To assist with a large LED retrofit and auditing project, for example, JPMorgan Chase picked GE’s Current.

Similarly, Sale said electric-vehicle charging was high on Whole Foods’ priority list, but the chain is enthusiastic about third-party ownership options. “Our primary purpose is to sell food,” she said.

These companies want to focus on their core businesses, but also meet the sustainability goals of their shareholders, customers and employees. It’s harder than ever before. Everyone from ESCOs to utilities to startups see that challenge as an enormous market opportunity.

“We’re seeing a lot of change in the already-fragmented C&I energy management space,” said Saadeh. “As energy consumers move to adopt increasingly analytics-driven beyond-the-meter strategies, we expect the current landscape to only get more complex.”

***

Download the slides and listen to the archived webinar here.

Learn more about the Grid Edge Customer Network here.