The second quarter of 2020 provided a clearer picture of the dramatic impact that COVID-19 is having on the grid edge sector in the United States and abroad.

The restrictions imposed to fight the pandemic, coupled with the unfolding economic downturn, have created delays in grid edge project implementation schedules, according to a new grid edge market update from Wood Mackenzie.

This has in turn severely curbed growth trajectories for distributed energy resources (DERs) in the near term. Solar, storage, microgrids, residential EV charging outlets and other DERs have all been impacted, and the recession is expected to further weigh on growth in 2020.

However, momentum will pick back up for the grid edge sector over the next few years.

Wood Mackenzie also finds that the pandemic is providing an opportunity to accelerate some grid edge trends, such as electric-vehicle (EV) penetration and grid modernization.

Where COVID-19 is creating pockets of opportunity for DERs

WoodMac analysts find that coronavirus stimulus packages are a perfect opportunity to advance EV penetration and EV charging goals.

The stimulus packages adopted in Germany, France and China all boosted subsidies for purchasing EVs and promoted the construction of EV charging stations.

Conversely, the U.S. has not yet included any EV provisions in its coronavirus stimulus packages, but House Democrats have proposed a separate $1.5 trillion infrastructure bill — dubbed The Moving Forward Act — aimed at updating the nation’s aging transportation system.

The Moving Forward Act would, among other things, set aside hundreds of billions of dollars to the deployment of zero-emission buses and alternative-fuel charging infrastructure, as well as developing an EV charging network as part of a transformed electric grid and providing tax credits for purchasing zero-emission vehicles.

The pandemic has also emphasized the importance of remote meter readings and data analytics for grid forecasting amid shifting load patterns. As a result, the COVID-19 crisis could feasibly provide an argument for greater digitalization of power metering across U.S. distribution grids in the future.

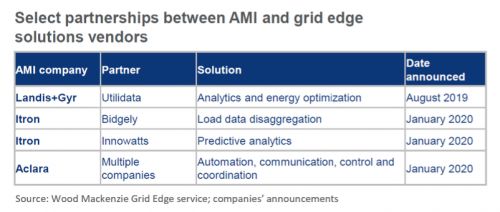

It's too early to say whether this will strengthen U.S. utilities’ case for advanced metering infrastructure deployment with regulators. However, analysts expect AMI vendors to double down on their strategy of partnering with providers of analytics and automation solutions to offer utilities more advanced functionalities.

Investment is down but not out in 2020

Growing policy support to electric vehicles and EV charging infrastructure aligns with the fact that the sector continues to receive funding, even though overall venture and strategic investment in DERs slowed down significantly in Q2 2020.

In fact, energy storage and EV charging vendors make up more than half of investment announcements in 2020 so far. In the second quarter of this year, Hevo Power, FreeWire Technologies and Tritium together raised more than $75 million. These vendors offer either wireless charging or DC fast-charging solutions.

At the same time, the pandemic has not stopped utilities from entering into contracts for AMI deployments, even though shelter-in-place orders have delayed meter installations in the U.S. and many other countries.

In the second quarter of 2020, utilities and vendors around the world announced that they contracted a total of over 1.1 million new electric AMI meters, with Landis+Gyr disclosing the biggest number of deals: two with utilities in the U.S. and one in Sweden and Hong Kong.

Quantifying the pandemic’s damage

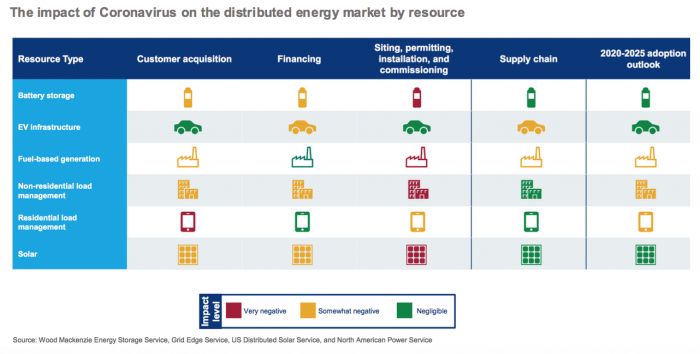

While no segment is unscathed, the impact of COVID-19 on the U.S. grid edge sector varies by type of DER and phases in the resource lifecycle. Overall, DER investment and deployments have continued to take place over the past quarter, though at a slower pace than in 2019.

Supply chains have been mostly unaffected, as most products are sourced from Asian markets where factories are ramping back to full capacity, given that the most severe effects of the virus seem to have passed in those locales.

Deployment phases that require face-to-face interaction — such as customer acquisition and project implementation — have been most at risk of delays and/or complete stoppage due to the social-distancing measures adopted to fight the spread of coronavirus.

Wood Mackenzie currently expects a V-shaped recovery of the overall DER market in 2021, after a 61 percent drop in aggregate DER capacity growth in 2020.

Looking past this year, lower economic activity and higher unemployment will decrease both consumers’ disposable income and business investment in the early 2020s, reducing investment in noncritical purchases such as customer-owned or leased energy infrastructure.

As a result, annual growth in DER capacity will not exceed its 2019 pre-pandemic high until 2024.

***

Francesco Menonna is part of Wood Mackenzie’s Grid Edge team, where he’s responsible for covering distribution grid modernization and advanced metering infrastructure. The Grid Edge Quarterly Executive Briefing is available here or via a Grid Edge research subscription.