Vinod Khosla and his Khosla Ventures have a war chest of more than $1 billion to put into greentech startups. And they are busy, having invested in more than 40 new firms.

Mr. Khosla is something of a contrarian and can always be counted on to say something that doesn't agree with the conventional wisdom. Actually, sometimes he says things that don't agree with things he's said before.

Last year Khosla said, “I do not believe carbon sequestration can work economically." This year he said "...clean coal will become economic."

And sometimes his investment portfolio does not always reflect what he says.

For example, last week at the Wall St. Journal's ECO:nomics event, Khosla said, "Solar and wind are not viable without storage." Yet that hasn't stopped him from investing in wind company Nordic Windpower and solar company Stion.

Mr. Khosla is seemingly able to compartmentalize Khosla the investor from Khosla the solver of the "Chindia problem," a term coined by the VC that suggests energy solutions must work in China and India if they are to have any material impact.

So while he's investing in solar he has said that photovoltaics are "not scalable and not sustainable without subsidies" and “rich San Franciscans and Germans putting PV on their roofs only delays the problem and diverts money from where it’s needed." Solar PV, wind and biofuels are “little markets," according to Mr. Khosla’s audacious worldview.

While making investments in wind, he has said that there’s little upside for innovation in wind, the Betz limit is being approached, and the available good sites are declining. And without storage, they don’t provide spinning reserve.

Prius hybrids driven by Bay Area liberal socialists? Not a solution to the climate or energy problem, according to Khosla. Better to take that money and paint your roof white to improve the earth’s albedo. And they certainly don’t meet the Chindia test. To meet the Chindia test they have to compete with the $2,500 Tata Nano. “Hybrids are an inefficient carbon solution."

T. Boone Pickens’ plan for LNG and wind? “A dead-end street."

New battery technology for EVs? It’s unlikely that Li-ion or Ni mH chemistries will yield significant breakthroughs according to The Vinod. That has not stopped him from investing in battery firms Sakti2 and Seeo.

Certainly, energy efficiency is a good thing? Sorry. According to Vinod “The Buzzkill" Khosla, “Too many people in the environmental movement think that efficiency is the answer. Efficiency is valuable but not sufficient."

According to Khosla, we need “relevant scale" solutions attacking oil, coal, cement and steel. “500 million people on earth enjoy a lifestyle that 9 billion people will want in 2050."

Khosla is looking for “black swan solutions" that cause “technology shock."

According to him, the new green is “Maintech" not “Cleantech," and we need to go after huge markets like engines, lighting, appliances, cement, water, glass and buildings and not fritter away our time and effort on PV and wind.

A few years ago during the "nanotech bubble," Mr. Khosla sounded the (sensible) alarm that nanotech wasn't a market and that the nanotech boom was an illusion. His concern in greentech is that "too many [non Khosla-backed?] companies have filed and we will get a nanotech moment." He's "much more concerned about premature IPOs" and gives an example: Codexis recently filed their S-1 form in preparation for an IPO but according to Khosla, the company is "pretending to be a biofuels company when it is an R&D firm."

The areas that Khosla sees as promising are internal combustion engines, bioplastics and agriculture, while he believes that LED lighting, biofuels and clean coal will soon become economic.

Fortunately for Khosla and his Limited Partners, he can afford to be wrong nine times out of ten -- as long as he's very right occasionally and finds that black swan.

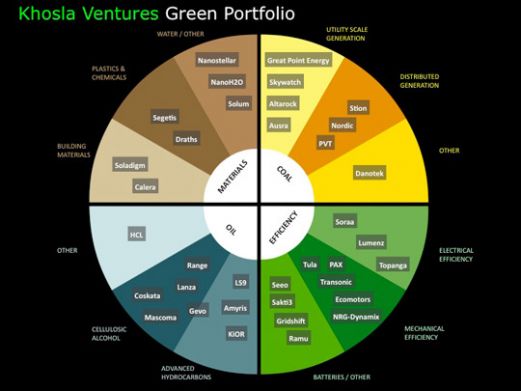

Here's a graphic of the Khosla greentech portfolio:

Green Kingpins Part 1: KR Sridhar of Bloom Energy

Green Kingpins Part 2: Craig Venter of Synthetic Genomics

Green Kingpins Part 3: John Doerr of KPCB

Green Kingpins Part 4: Vinod Khosla

Green Kingpins Part 5: Paul Holland and the VCs at Foundation Capital