Between 2000 and 2009, global photovoltaic demand grew at an average annual rate of 51 percent, rising from 170 MW to 7,059 MW. It's hard to believe that just ten years ago, the global solar market was 170 megawatts. That's now the size of a typical utility-scale installation. Or a small solar factory.

Back in the ancient solar era of 2005 and 2006, there was a common refrain, amongst even the more conservative solar analysts, and it went like this:

"Demand is essentially unlimited."

That's what the German tariff situation did to normally staid pundits and manufacturers.

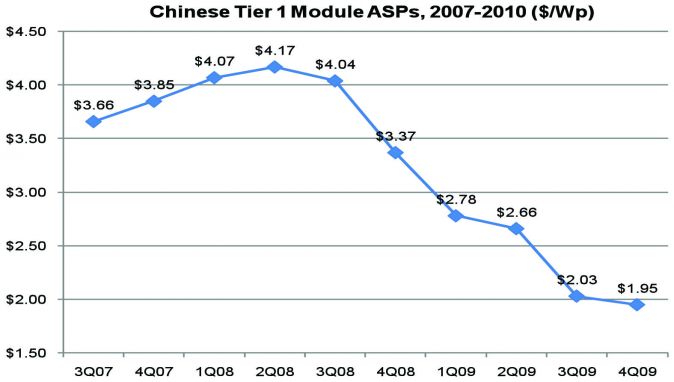

Since then, the solar market has lived through the annus miserabilis of 2008, the collapse of the Spanish FiT program, a global economic meltdown, and a comatose financing environment. Despite those factors, 2009 was a growth year in terms of megawatts shipped, if not in terms of revenue, and the solar market has emerged scarred but wiser in 2010. Module ASPs are still going to continue to drop due to an overcapacity situation and many companies will feel margin pressures. But, having lived through the pain of 2009 and while still in the midst of shakeout and consolidation, the global solar market will come through this bigger and healthier and poised for a new decade of growth. Grid parity will become a reality, starting in a few high-electricity rate markets and will spread from there.

Greentech Media Research analyst Shayle Kann has just authored an exhaustive study of global photovoltaic demand and the findings are encouraging. Here's a quote from Kann:

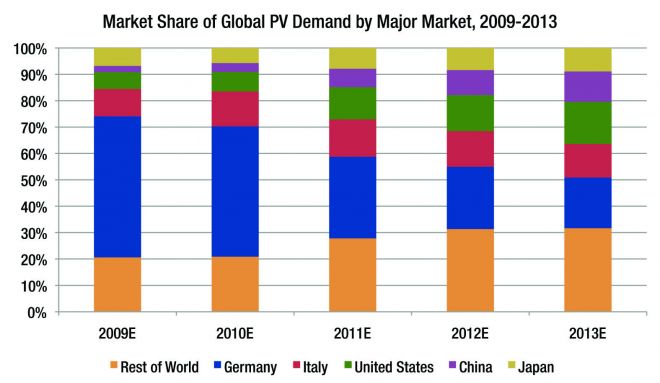

"...2010 will mark the beginning of a global PV market diffusion. Over the past few years, PV demand has been characterized by a series of gold rushes in which the majority of production flows into a single uncapped feed-in tariff market (e.g., Spain in 2008, Germany in 2009). But the gold rush is necessarily followed by the government reducing, and often capping, incentives in order to constrain market growth. This leads manufacturers and developers to seek the next gold rush, and new markets are suddenly flooded with additional inventory. But as Germany's star begins to fade in the second half of 2010, no individual market will emerge to soak up excess inventory in sufficient volume to become the singular focus of global demand. Instead, demand will become increasingly spread amongst a growing class of markets around the world."

Here are some of the insights from the report:

- Global PV demand will grow 58 percent in 2010: Overcoming the final throes of the financial crisis, global PV demand will grow 58 percent in 2010 to 11,218 MW.

- German PV demand will peak in 2010: Germany will remain the market of last resort in 2010, installing 5,541 MW, most of which will come in the first half of the year. Feed-in tariff cuts in the second half of 2010, combined with annual digression in 2011, will force module ASPs down severely, and only low-cost producers will be able to compete in the German market.

- Italy will remain the second-largest PV market in 2010: Italian demand will spike to 1,487 MW in 2010, maintaining its position as the second-largest national market. Italian demand will be spurred by forthcoming feed-in tariff reductions in 2011 as well as fallout from the German market’s second half demand loss.

- 2010 will mark the beginning of a global diffusion of demand: Whereas the past few years have been characterized by a single “savior” country essentially keeping the global market afloat, 2010 will mark the beginning of a global diffusion of demand across a class of growing markets.

The report also analyzes the global markets, country by country, based on the three factors that truly determine demand -- technology, policy and financing.

The new solar PV climate is one of an industry taking big steps from erratic exuberance to mature consistency in growth and policy.

More details on the report and ordering information here.