It's hard to find a fuel cell company that's in the black.

In GTM's fuel cell summer update, "Wesoff’s Wall" was introduced as a metaphor for the barriers standing between fuel cell companies and profitability. In the weeks since, the wall has claimed yet another victim.

Last month, British fuel cell developer Intelligent Energy was sold to its largest shareholder, owing to a bleak business outlook. The only publicly traded fuel cell company to ever turn a profit (once, in 2012), the company had variously developed fuel cells for motorcycles with Suzuki, and for portable devices with Apple, two blue-chip collaborations that seemed to position it for success. More recently the company had pivoted into the telecom backup-power market in India, and drones, or unmanned aerial vehicles.

The continuing struggles of fuel cell companies -- including former sector-leading fuel cell companies such as Intelligent Energy -- has no doubt contributed to the drop-off in investor interest in recent years. As a result, diversified multinationals such as Toyota and Hyundai have been largely maintaining the sector’s momentum -- but they aren't the only ones.

On Wednesday, Ballard Power Systems released its third-quarter earnings report, showing a 54 percent increase in revenue over the same period last year and a positive adjusted EBITDA of $900,000. Ballard also posted a net loss of $1 million, which isn't great, but it's an improvement from the $4.2 million in losses reported in the third quarter of last year.

The company sees fuel cell electric vehicles as a promising new market. But Ballard, and others, are also finding new market opportunities in everything from drones to cruise ships.

Fuel cells for drones

Unmanned aerial vehicles happen to be one of the markets Ballard Power Systems is targeting with its September announcement of the world’s first proton exchange membrane (PEM) fuel cell product incorporating a non-precious metals catalyst, or NPMC. Operating at temperatures below the boiling point of water, PEM fuel cells have, until now, required platinum catalysts. Higher-temperature technologies, such as the solid-oxide fuel cells used by Bloom Energy, do not require precious metal catalysts, but require more heat-tolerant materials, and can only ramp their power production slowly.

The 30-watt FCgen-1040 fuel cell stack uses a carbon “nanoshell”-based cathode catalyst developed by Japanese conglomerate Nisshinbo Holdings, which holds a 1.9 percent stake in the fuel cell developer. PEM fuel cells commonly have a 4:1 ratio of platinum on the cathode to the anode, so replacing the cathode platinum would be consistent with the claim of an 80 percent reduction in platinum.

Japanese media reports indicate that the product is due to launch in December. While an NPMC-based fuel cell is expected to be cheaper than one using platinum catalysts, it would probably have a shorter warranty life, given the high electrochemical potentials on the cathode. Ballard’s mid-September corporate presentation claimed the company had helped improve NPMC durability 100-fold over earlier incarnations, so we will see in December how durable the carbon catalyst has now become.

If nothing else, manufacturing emissions for the NPMC fuel cell stack should be significantly lower than for a platinum-based counterpart. Much of the world’s platinum is being mined in South Africa at parts-per-million concentrations and processed on a coal-heavy grid.

Given how small these UAV-targeted fuel cell stacks are -- it would take 3,800 FCgen-1040s to match the output of one Toyota Mirai -- the non-precious metals catalyst technology will need to be deployed in larger markets to realize truly commercial potential. Unsurprisingly, shortly after the micro-fuel cell product announcement, Ballard and Nisshinbo signed a contract to develop the NPMC further for forklift applications. Ballard currently supplies fuel cell forklift market leader Plug Power with a small percentage of its fuel-cell stacks.

Fuel cells for cruise ships

At the other end of the size spectrum, Norwegian cruise ship operator Viking Cruises has announced plans to commission a fuel-cell-powered zero-emissions cruise ship based on an existing ship design, which would minimize re-engineering costs. The company is in discussions with Statoil to source liquid hydrogen, which would be required as compressed hydrogen lacks the energy density a cruise ship would require.

The fuel-cell-powered tractor trailer Toyota will put into service on October 23 is a short-range, or “drayage,” truck that also uses compressed hydrogen. Liquid hydrogen tanks would almost certainly be required to serve long-haul trucking routes.

As in the passenger vehicle market, lithium-ion batteries have taken an early lead on fuel cells in the marine sector. Owing to marine vessels’ tremendous energy requirements, while all-electric ferries have found a foothold, most electrification has focused on hybridization.

The marine electrification market leader appears to be Canadian firm Corvus Energy, with marine deployments of more than 50 megawatt-hours of lithium-ion battery Energy Storage Systems across 90 installations; the company claims more than 90 percent of large commercial hybridized vessels use its ESS. While these volumes are modest, the pollution-reduction impact impact is far greater, as the maritime industry runs on heavy, low-grade bunker fuel.

While focused on the batteries, Corvus Energy has fuel cell ties of its own, with a number of staff having come from the Canadian fuel cell cluster in Vancouver during its long period of retrenchment.

Low-carbon fossil electricity?

Perhaps the most transformative fuel cell development in the past year has been the deepening collaboration between molten carbonate fuel cell developer Fuel Cell Energy and ExxonMobil to explore carbon capture opportunities.

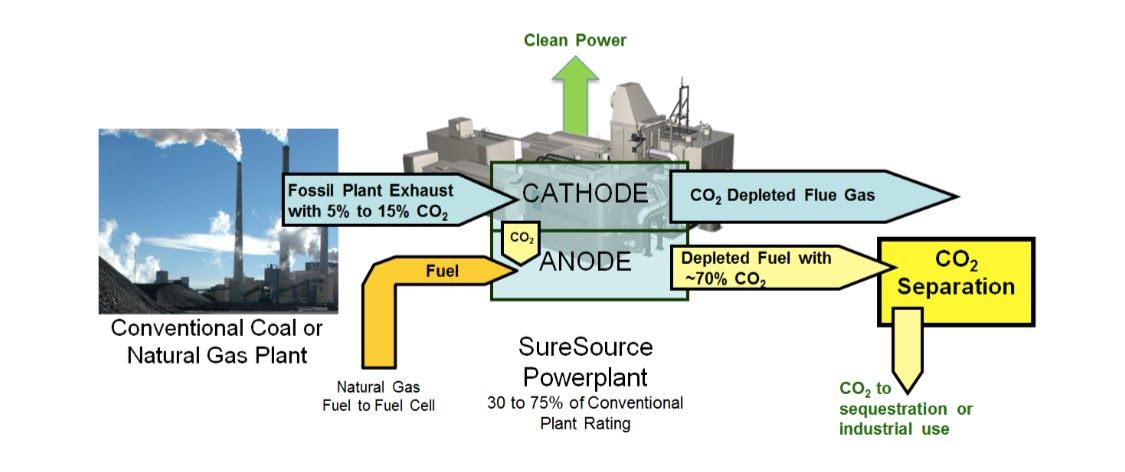

In a molten carbonate fuel cell, a CO2-enriched cathode inlet gas reacts with oxygen in the air to form carbonate ions, which migrate to the anode, where they react with methane. The anode exhaust consists primarily of CO2 and H2O, along with smaller amounts of hydrogen and carbon monoxide; in a standalone application, some of the anode exhaust would be piped back to the cathode inlet to enrich the latter with CO2. The cathode exhaust is depleted of most of its CO2 while electrons flow around an external circuit, generating electricity.

Working with the anode exhaust, a straightforward water gas shift reaction can convert the remaining carbon monoxide into CO2 and the water vapor can be condensed with cooling. The result is gas suitable for enhanced oil recovery, the dominant form of carbon sequestration today.

Sequestering CO2 to increase hydrocarbon production is, admittedly, an imperfect solution if the aim is to mitigate greenhouse gas emissions. But the technology is noteworthy, nonetheless. The CO2 from this application can also be separated from the hydrogen and provided to industrial gas companies. Fuel Cell Energy, for instance, has built a pilot facility to do this in Alabama with a capacity of 60 tons of CO2 per day.

The overarching significance is that while other carbon capture approaches consume considerable energy, molten carbonate fuel cells (and their higher-temperature cousins, solid-oxide fuel cells) can concentrate CO2 while generating electricity.

Gas Flows for Molten Carbonate Fuel Cell Paired to Thermal Power Plant

Source: Fuel Cell Energy

ExxonMobil’s specific interest in molten carbonate fuel cells may stem from its recent move into natural gas; it competes with Royal Dutch Shell for the title of the world’s biggest private-sector natural gas producer. What’s more, the flue gas from thermal power plants such as combined cycle gas turbines (CCGTs) has enough CO2 that it can be used as the cathode inlet gas for Fuel Cell Energy’s molten carbonate fuel cells.

If the flue gas from a CCGT was fed into the cathode of a molten carbonate fuel cell, the fuel cell would migrate most of the CO2 into the anode exhaust, where it could eventually be used for sequestration. In effect, the fuel cell would serve as a CO2 pump, and an energy-generating one at that. The carbon intensity of gas turbines coupled with molten carbonate fuel cells would be greatly reduced as a result, ensuring a market for ExxonMobil’s natural gas, even in a carbon-constrained world.

Fuel Cell Energy estimates that adding a 400-megawatt molten carbonate fuel cell to a 500-megawatt coal plant would allow capture of 90 percent of the CO2 and only increase the cost of electricity by 2 cents per kilowatt-hour. This represents a carbon-capture cost already below the U.S. DOE target of $40 per ton of CO2 for the 2020-2025 timeframe.

Put differently, if there were large, depleted oil or gas fields nearby, a carbon price of $40 per ton of CO2 could cause utilities to deploy molten carbonate fuel cells to reduce their power plants’ carbon intensity. The economics should be better still for a 500-megawatt combined-cycle gas turbine, which the company believes would only require a 150-megawatt molten carbonate fuel cell.

Capturing 90 percent of the CO2 from a 500-megawatt CCGT with carbon intensity of roughly 400 grams of CO2 per kilowatt-hour, while increasing generation capacity by 150 megawatts through the molten carbonate fuel cell, would result in a lifecycle carbon intensity in the 30 grams of CO2 per kilowatt-hour level range.

Even boosting this to 50 grams of CO2 per kilowatt-hour (bearing in mind that real-life deployments seldom achieve on-paper estimates), the installation would be roughly on par with the IPCC’s 2014 mid-range estimates for lifecycle photovoltaics emissions. That said, photovoltaics continue to see dramatic improvements, and the carbon dioxide from the molten carbonate fuel cell would still need to be sequestered nearby.

Fuel Cell Energy and its South Korean partner have a combined 200 megawatts of production capacity that's not fully utilized. Production capacity would have to increase for deployments to begin in earnest. On a more positive note, this sort of production ramp should unlock learning-curve effects, which could reduce the cost per kilowatt-hour premium for thermal plant operators interested in adding molten carbonate fuel cells to their fleets, increasing the addressable market for further deployment.

Looking to 2018

For these reasons and more, after more than 15 (admittedly deserved) years in the hype cycle's trough of disillusionment, fuel cell technologies appear to be finding their footing. While wind, solar, efficiency and storage form the top of the batting order for our energy transition, fuel cells and other technologies still have their smaller contributions to make, much like the role players on a baseball team.

With fuel cell shipments in 2017 expected to more than double over 2015 and quadruple 2014’s levels, the industry appears to have finally found pathways to growth, readying it to come off the bench when called upon.

***

Matthew Klippenstein, P.Eng., heads Electron Communications, a cleantech-centric consultancy. He chronicles the Canadian electric car market for GreenCarReports and co-hosts the CleanTech Talk podcast. He does not own shares or conduct business with any of the companies listed above, but previously worked for Ballard Power Systems.