Last month First Solar (FSLR) provided the market with some decent surprises including another efficiency record, an acquisition, and a strong 2013 guidance.

This month's earnings call didn't hold too many surprises.

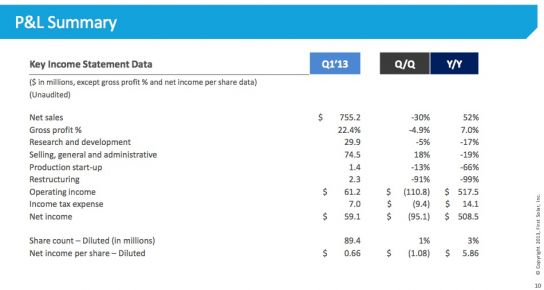

- Net sales were $755 million (up year-over-year but down from Q4)

- Cash and marketable securities were steady at $1 billion

- Full-year 2013 guidance maintained

- Net income of $59.1 million and 22.4 percent gross profit

Other takeaways from today's call:

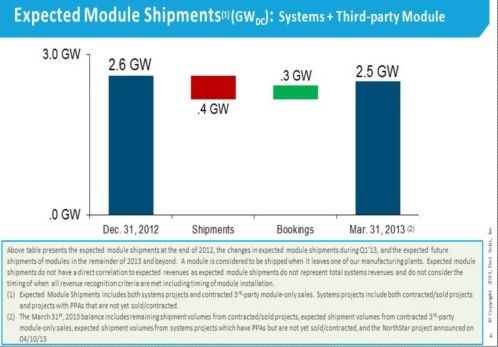

- Book-to-bill ratio improved to 1.0, up from 0.8 in 2012

- Increase in third-party (presumably c-Si) module sales

- The CEO noted that First Solar is "sold out" until late Q3 of this year

- A layoff (OK, a "reduction in force") will occur this quarter -- it will impact 150 people

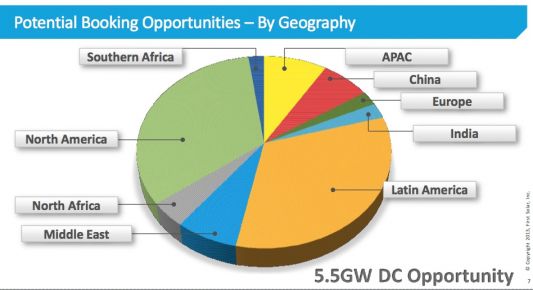

The firm has potential bookings availability of 5.5 gigawatts (DC) under varying stages of development, 700 megawatts of which are classified as late- and medium-stage.

The CEO noted that the firm's big Chinese development deal has moved forward to an MOU on Phase 2, a 300-megawatt to 500-megawatt project. Phase 1 of that project is a 30-megawatt demo plant to be built upon regulatory approval.

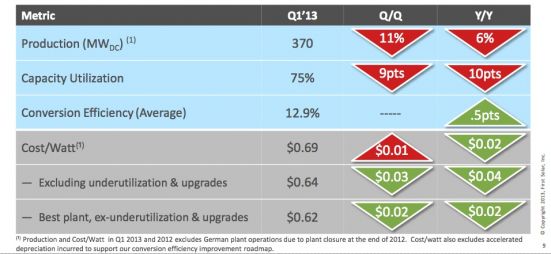

The CFO noted that First Solar shipped 370 megawatts in Q1, down sequentially and year-to-year and amounting to a 75 percent factory utilization. Best cost was $0.62 per watt, but the company average was $0.69 per watt. The best line is running at 13.3 percent efficiency, and the company claimed that the best line would be at 14 percent by year-end after incorporating improved back-contact technology.

Completion of the AVSR project has been delayed until Q4.

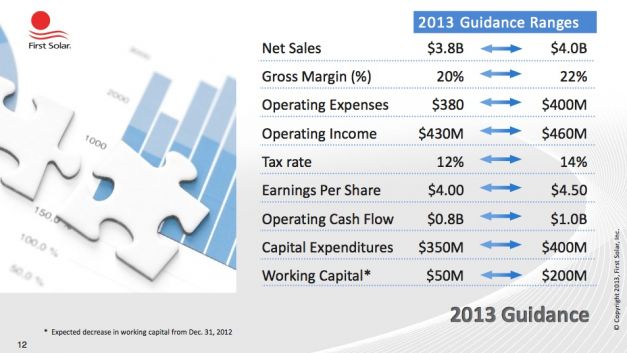

Full-year 2013 guidance was maintained. At its recent 2013 analyst day in New York, First Solar came in with a revenue guidance of $3.8 billion to $4.0 billion on shipments between 1.6 gigawatts and 1.8 gigawatts. First Solar expects gross margin to be between 20 percent and 22 percent.

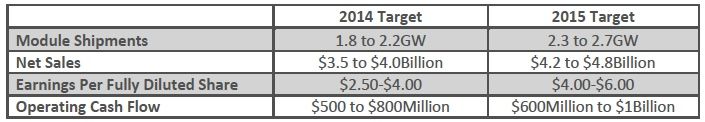

The company also announced that its manufacturing cost will be $0.63 to $0.66 per watt in 2013 and will plunge to $0.40 per watt by 2017. First Solar furnished its outlook for 2014 and 2015:

As always, recognizing revenue timing on First Solar's enormous solar projects is for GAAP and non-GAAP accounting black belts and influences the lumpiness of the firm's sales figures.

First Solar's technical team is scrubbing off cost and keeping pace on technology improvements. Now all of its business development people have to do is close on a 5.5-gigawatt pipeline of utility-scale solar.