First Solar (Nasdaq:FSLR) is by far the leading producer of cadmium telluride (CdTe) solar panels (and the leading producer of thin-film solar panels, for that matter). The firm is the largest solar company by market capitalization at $10.37 billion.

First Solar plans on a capacity expansion to 2.9 gigawatts by 2012. That's a lot of solar panels, a lot of CdTe photovoltaic materials, and a lot of CdTe constituent materials -- cadmium and tellurium.

Tellurium is a byproduct of copper mining and there is an ongoing debate over whether the global tellurium supply can support the growing needs of the solar industry. Tellurium is also used to improve the machinability of steel and copper, as a component in CD-RW disks and for other semiconductor applications.

Prices for tellurium surged from under $100 per kilogram in 2007 to over $200 per kilogram in 2008, according to Lita Shon-Roy of market research firm Techcet Group. Tellurium prices rose to $235 to $295 per kilogram early this year according to MetalBulletin. It is estimated that thirty percent of the global tellurium supply goes to First Solar -- and that proportion is increasing. Rising tellurium prices might spur companies to consider a more active exploration and mining operation, rather than depending on tellurium as a metallurgical byproduct.

So, where is First Solar going to get a predictable source of tellurium?

Answer: From the gold mine in Mexico it appears to own. A 10K SEC document filed by California Gold Corp (CLGL:OTC BB) says, "Minera Teloro, S.A. de C.V.," which, to our knowledge, is a subsidiary of First Solar.

The 10K continues,

"The La Bambolla Concession is owned by Minera Teloro, S.A. de C.V., a Mexican company reported in the past to be a subsidiary of First Solar, Inc. (“First Solar”). ... A report in the Sonora Geological-Mining Monograph published by the Consejo de Recursos Minerales ("CRM") describes the La Bambolla vein system as being a 2-meter thick quartz-pyrite-hematite-gold system that averages 4.0 g/ton gold and 5 g/ton silver, respectively. ... More than 500 channel samples taken in the underground workings of the La Bambolla mine show the presence of gold and tellurium. The gold grades are in the 0.03 to 4.90 oz/ton range, and average about 0.46 oz/ton Au. The tellurium grades range from 0.01 to 3.26 %, and average 0.25 % Te. The tellurium content of these samples in parts per million (ppm) ranges from 100 to 32,600 ppm, and averages 2,500 ppm. ... Reportedly, the La Bambolla mine dumps also contain visible native tellurium as well as tellurite and sonoraite, which are secondary tellurium minerals."

First Solar has been looking for suppliers who would focus on mining tellurium. Capital Mining in Australia announced in May 2008 that First Solar was sending a geologist to check out a newly discovered tellurium deposit.

"There's a limited amount of tellurium in the world and First Solar needs a significant portion of it. It would make sense for them to try to lock up supply and increase their security," said National Bank Financial analyst Rupert Merer in a Reuters article.

Estimates vary, but annual global tellurium production is about 160 tons to 260 tons, with demand potentially reaching 800 tons by 2013. At 8 grams of tellurium per 2 foot by 4 foot panel, that's roughly 100 metric tons of tellurium for each gigawatt of PV production.

Although First Solar is the largest cadmium telluride PV manufacturer, there are a few startups looking to replicate its success. The leading aspirants in the CdTe materials system for photovoltaics are Abound Solar, which recently received a $400 million loan guarantee, PrimeStar Solar, which is now majority owned by GE, Calyxo/Q-Cells and Solexant. Abound Solar has a materials supply agreement with 5N Plus, as does First Solar. In addition to 5N Plus, other tellurium suppliers include China-based Apollo Solar Energy and Vital Chemicals.

On Nov. 8, 2007, First Solar's CFO spoke at an investment conference and publicly commented that "We [FSLR] have identified "terawatt levels of tellurium availability." That's a lot more tellurium than currently identified -- perhaps First Solar has some undisclosed sources or processes or perhaps First Solar owns the mine we've discussed here.

Damoder Reddy, the recently former CEO of solar panel startup Solexant, had this to say: "More-than-adequate amounts of tellurium are extracted to meet photovoltaic demand for several years to come. The amount of tellurium used per watt decreases as CdTe module efficiency increases and CdTe layer thickness decreases."

Here's a question for First Solar: When the firm boasts of an energy payback time of less than a year -- does that include the mining operation?

Dustin Mulvaney, a UC Berkeley postdoctoral researcher working on an NSF-funded project on PV life cycle metrics, had this to say: "Energy payback times for CdTe PV do not account for any emissions from mining tellurium because it is a by-product of copper mining and refining. The ISO Life Cycle Analysis standards typically aim to avoid allocations to by-products, but do allow emissions to be allocated based on the economic value of each of the products. Currently the copper ores have significantly higher concentrations of copper than tellurium so it justifies allocating zero to tellurium. However, if the mine development is driven by tellurium extraction, that could make ore processing and land use change an important part of the GHG accounting."

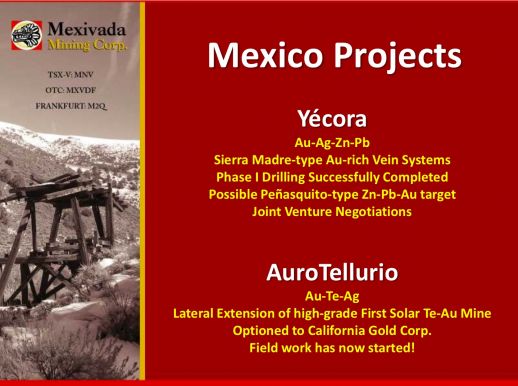

Here are some more references to the First Solar mine in a presentation from Mexivada Mining Corp. First Solar declined to comment on the mine ownership.

Price rise of Tellurium, according to Metal Pages.