The economics of storage aren't easy to model.

The technology can be used for so many applications -- frequency regulation, equipment upgrade deferral, backup power, renewable energy integration, or peaking power -- that it can be hard to compare storage to conventional generation. The technologies themselves are just as diverse.

But the analysts at the financial advisory firm Lazard just did it. And their work yielded some promising results.

This week, Lazard released its first-ever analysis of the levelized cost of storage. The study is a reproduction of Lazard's earlier work on the levelized cost of renewables, which has documented the steady improvement in the economics of renewables compared to fossil fuels and nuclear on an unsubsidized basis.

There's a lot of debate about whether megawatt-hour costs are the most helpful way to measure competitiveness, since they leave out dispatchability characteristics and specific use cases for technologies. But they do provide a helpful guide for where technology costs are today, and where they're headed in the future.

When calculating megawatt-hour costs, storage doesn't rival renewable generation in its competitiveness with conventional alternatives. But some of the leading technologies are showing the same "rapid declines" in cost, concluded Lazard. And the downward trend isn't likely to slow any time soon.

“Although in its formative stages, the energy storage industry appears to be at an inflection point, much like that experienced by the renewable energy industry around the time we created the LCOE study eight years ago,” said George Bilicic, the head of Lazard's energy and infrastructure group, in a release about the report.

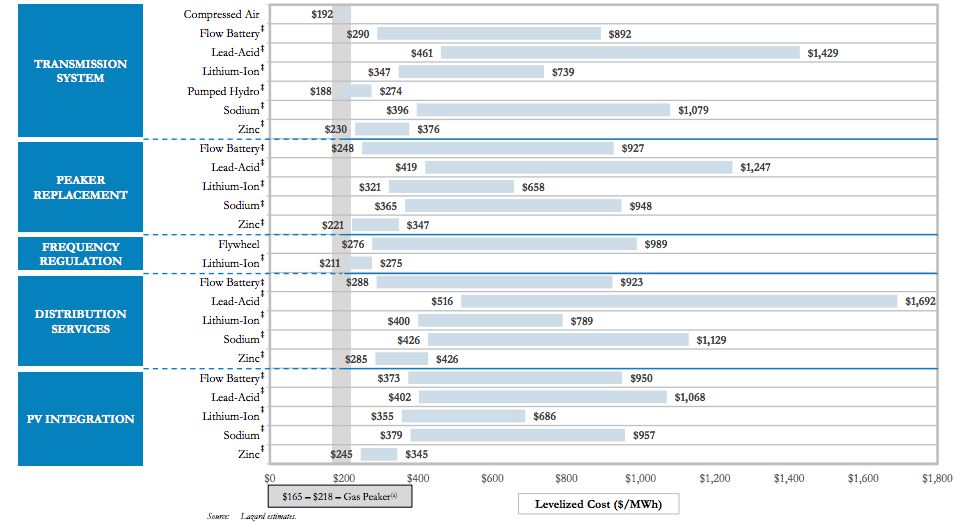

Lazard modeled a bunch of different use cases for storage in front of the meter (replacing peaker plants, grid balancing, and equipment upgrade deferrals) and behind the meter (demand charge reduction, microgrid support, solar integration). It also modeled eight different technologies, ranging from compressed-air energy storage to lithium-ion batteries.

"As a first iteration, Lazard has captured the complexity of valuating storage costs pretty well. Unlike with solar or other generation technologies, storage cost analysis needs to account for not just different technologies, but also location and application, essentially creating a three-dimensional grid," said Ravi Manghani, GTM Research's senior storage analyst.

In select cases, assuming best-case capital costs and performance, a handful of storage technologies rival conventional alternatives on an unsubsidized basis in front of the meter. Using lithium-ion batteries for frequency regulation is one example. Deploying pumped hydro to integrate renewables into the transmission system is another.

The front-of-meter applications are modeled below. (Click the chart to enlarge.)

Source: Lazard's levelized cost of storage analysis 1.0

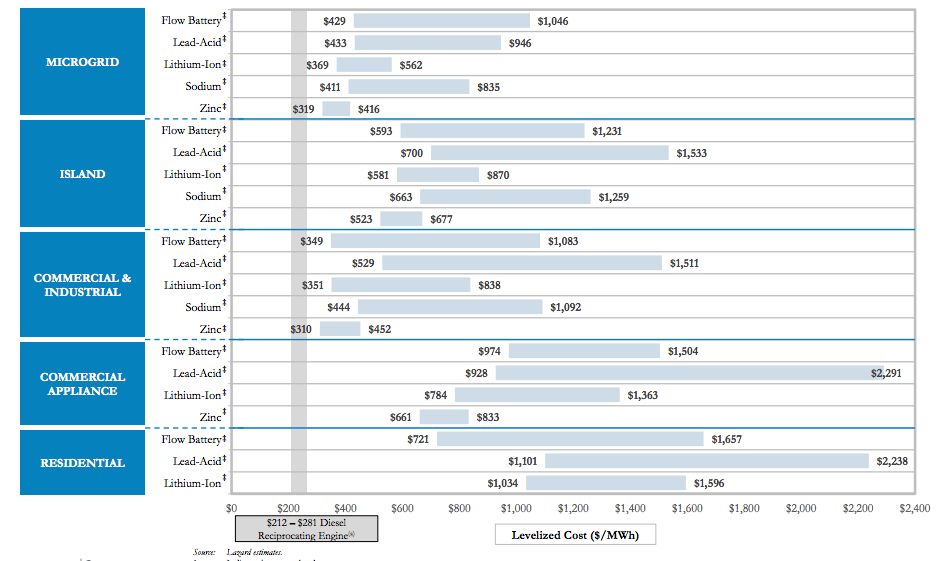

Storage in front of the meter is encroaching on conventional resources, but there's still a lot of room for cost improvements. The economics of storage installed on the customer's side of the meter are less favorable. On an unsubsidized basis, no storage technology modeled beat out its conventional rival.

Lazard did, however, find that stacking value streams can make storage a much more viable option for on-site applications. For example, this could mean using batteries to time-shift solar consumption, while also using them to provide frequency regulation services.

"While no 'behind-the-meter' technology and use-case combination is strictly 'in the money' from a cost perspective as compared to an illustrative conventional alternative, a number of combinations are within striking distance and, when paired with certain streams of value, may currently be economic for certain system owners in some scenarios," concluded the report.

This is backed up by other modeling. In a recent report on solar-plus-storage for affordable housing, the Clean Energy Group showed that stacking solar with batteries for grid support could accelerate the payback of a PV system considerably in certain markets.

Lazard's behind-the-meter applications are modeled below. (Click the chart to enlarge.)

Source: Lazard's levelized cost of storage analysis 1.0

None of Lazard's modeling factored in subsidies. State-level rebates and federal tax incentives help the economics of storage considerably. Storage is quickly becoming competitive with conventional resources in California -- but only because the industry was spurred by the Self-Generation Incentive Program and a state mandate.

More states and regional power markets are looking to promote energy storage as a way to balance the grid and help integrate renewables. And more commercial and industrial customers are looking to use batteries to shave their power bills and backup onsite generation. The result: GTM Research expects the American storage market to double this year. The U.S. could see more than 850 megawatts installed by 2019 -- four times more than what will be installed this year.