REstore, the Belgian startup that’s taken a leading role in Europe’s emerging demand response markets, has been acquired by U.K.-based utility and energy provider Centrica for €70 million ($81.4 million) in cash. It’s the latest acquisition in a year busy with European utilities shopping for startups to help them compete in a distributed energy future.

Friday’s deal will give Centrica control of REstore’s portfolio of 1.7 gigawatts and counting of peak load across the U.K., France, Belgium and Germany. Since its 2010 founding, REstore has grown from a few megawatts of industrial load to more than 150 industrial and commercial customers including ArcelorMittal, Praxair, Sappi and Barclays.

Centrica will integrate REstore into the Distributed Energy & Power unit of its Centrica Business Solutions business, one of many utility-owned energy services companies competing for commercial and industrial market share in deregulated energy markets in Europe and around the globe.

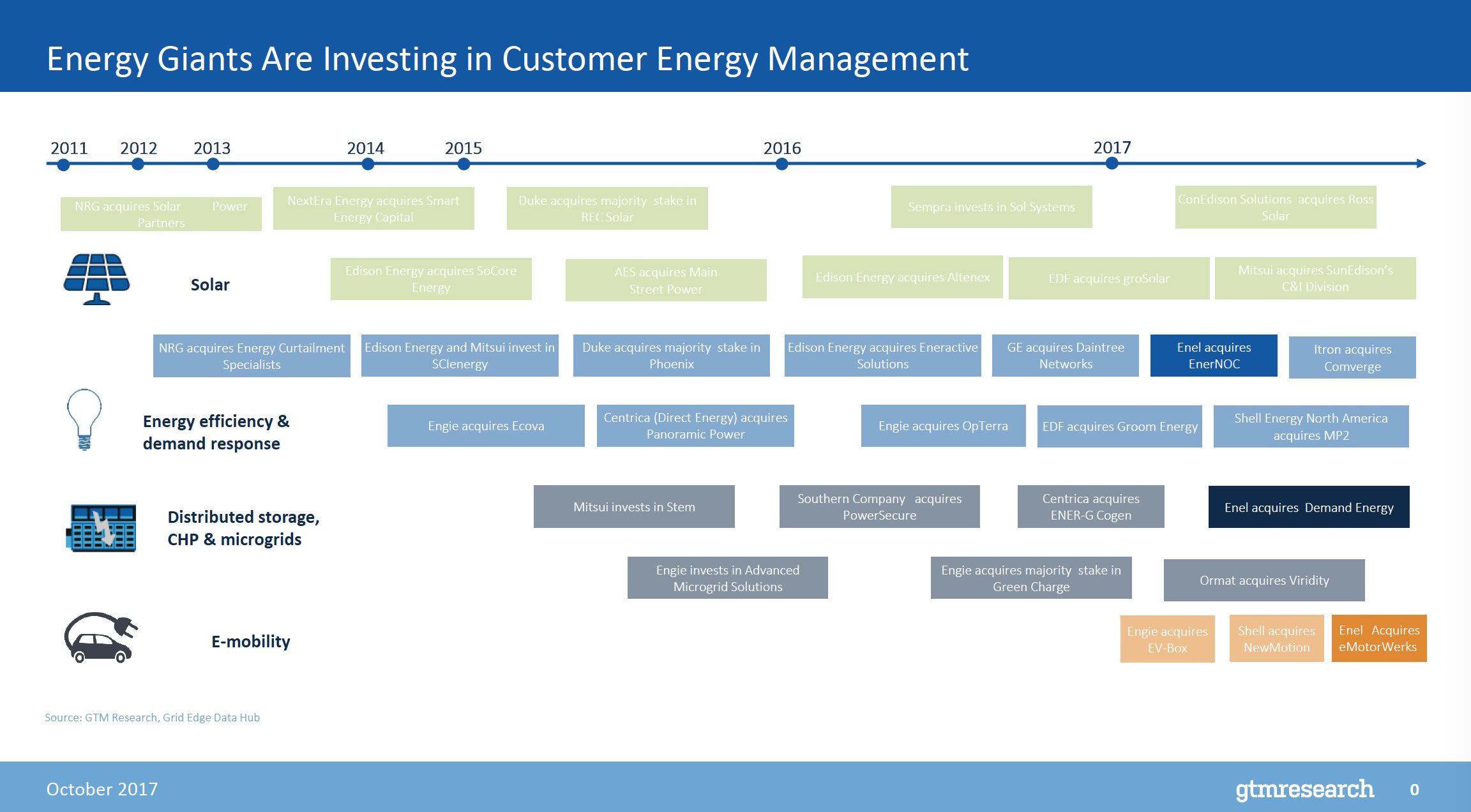

Centrica has centered its acquisition strategy around these opportunities, ranging from its purchase of building sensor startup Panoramic Power for $60 million in 2015, to buying Danish energy trading platform Neas Energy for $249 million and combined heat and power provider ENER-G Cogen for $212 million last year.

With the REstore acquisition, “demand response aggregation will become a core part of the offer to customers and is expected to represent a significant growth opportunity for Centrica as global electricity markets evolve,” the company wrote.

The deal would appear to provide a comfortable return to REstore investors, which include LRM, Axe Investments and Ark-Angels Fund and “prominent industrial families and entrepreneurs,” according to the company’s website. The company, founded in 2010, has raised about €11 million ($12.5 million) in three rounds of venture capital investment, most recently with a €7 million ($7.5 million) Series C round in 2015.

REstore’s growth from megawatt- to gigawatt-scale somewhat matches the rate of growth for European demand response, a term that means something quite different from what it has traditionally meant in the United States. Here, demand response has meant turning down large energy-using loads and industrial processes to help reduce demand during summer days when air conditioner energy use is peaking, or perhaps, doing the same thing in winter to deal with heating energy use.

But in Europe, the bigger drivers for demand-side peak load management are the systemwide effects of the continent’s growing share of intermittent wind and solar power, combined with the closure of large coal and nuclear power plants, as REstore co-founder Pieter-Jan Mermans explained back in 2015. This makes for a demand-supply balancing equation that’s a lot more complex than shaving a single, predictable peak, and requires careful balancing of multiple economic drivers to ensure a return for both customers and aggregators, he said.

These needs have pushed the continent’s grid operators to create ways for demand-side control technologies to participate alongside generators, both in capacity markets and in real-time ancillary services markets, or as they’re known in Europe, primary and secondary reserves markets. We’ve been tracking the developments in these markets, as has the Smart Energy Demand Coalition industry group, which tracks regulatory progress from country to country.

REstore’s solution is a software suite, called FlexPond, for both big industrial and commercial customers, and the utilities that are controlling them for their grid needs. In simple terms, it’s a combination of on-site sensors and controls and a cloud-based software stack to manage their capabilities to serve both market and customer-side needs, all in real time.

GTM Research grid edge analyst Elta Kolo noted that REstore’s technology differs slightly from the majority of demand-side management vendors. “REstore has a hybrid patented approach to demand response, putting its intelligence centrally and locally, whereas most vendors just choose one,” she said. This allows it to participate not only in capacity markets, but in high-value reserve markets requiring fast response: “REstore has the capability to provide sub-second response,” she noted.

The startup is also one of the few demand response aggregators participating in the markets of multiple European transmission system operators, including Amprion in Germany, Elia in Belgium, National Grid in the U.K. and RTE in France.

While the startup has been exclusively focused on commercial and industrial customers for most of its life, it’s starting to make headway in the residential sector as well, Kolo noted. That has been helped along by a partnership with a European heat-pump and boiler manufacturer that’s installing REstore’s control chip in their products, she said.

Other companies with this kind of approach to demand response include Enbala Power Networks, a Vancouver, Canada-based startup with customers serving flexible load into frequency regulation and ancillary services markets, as well as utility and energy services partners putting its software to use. AutoGrid, a Silicon Valley startup, also has demand response optimization software being used by utilities in North America, and in Europe, by Dutch energy company Eneco to create a virtual power plant from aggregations of customer-sited energy generation and flexible loads. Many others are out there.

Buildings represent a huge untapped opportunity not just for saving wasted energy, but for shaping and shifting energy use to help manage an increasingly unpredictable grid. Controlling energy use in offices, factories, warehouses and other buildings is a complicated task, with each site and each customer requiring a tailored approach. But technology advances are driving down the cost and complexity of networking and controlling HVAC systems, lighting, pumps, freezers, and other key energy loads, giving energy companies more inroads into controlling them.

Centrica’s push to create a distributed energy services arm matches the efforts underway by other European utilities to diversify outside the challenging power generation and transmission sectors. German utilities RWE and E.ON have both spun out their distributed energy and retail energy businesses from their struggling core businesses. RWE has bought solar developer Belectric, rolled out home energy services from Silicon Valley startup Bidgely, and created a $144 million venture capital fund.

Italy’s Enel acquired New York-based distributed energy systems aggregator Demand Energy in January, U.S. demand response giant EnerNOC in June, and Silicon Valley electric-vehicle charging management startup eMotorWerks last month. Engie, the services arm of GDF Suez, has bought an 80 percent stake in U.S. behind-the-meter battery startup Green Charge Networks, and has acquired Dutch startup EV-Box and the European solar business of bankrupt Sungevity. French mega-utility EDF bought Groom Energy Solutions through a subsidiary last year, and launched a C&I distributed energy business in January.