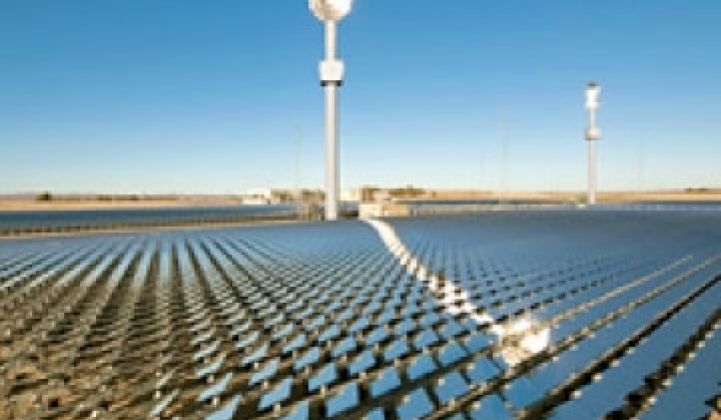

Concentrated solar power (CSP) has been hot lately (pardon the pun). [Not pardoned -- ed.]

This weekend, President Obama doled out $1.45 billion in loan guarantees for Abengoa's 250-megawatt solar thermal plant with molten salt storage in Gila Bend, Arizona. Two months earlier, the Department of Energy dispatched $62 million for CSP technology development and component design. And CSP player Brightsource Energy received a massive loan guarantee in February.

The beneficiaries of the DOE's recent CSP largesse include Pratt & Whitney's Rocketdyne, Abengoa and eSolar.

ESolar finally elaborated on the project it has underway with Babcock & Wilcox. The two companies will use $10.8 million in funding to build and test modular plant components, including a molten salt receiver, a molten salt-to-steam heat exchanger and a molten salt storage system.

The move to molten salt is new direction for eSolar, which up until now has relied on a methodology that involves directly heating water to produce steam. The funding will "accelerate the research and development of (the) economic storage" of solar thermal power generation capacity to extend the operating range of plants, says eSolar CEO John Van Scoter.

But despite the new funding, all is not well in the industry. Falling photovoltaic prices are putting pressure on plant development at a time when vendors are struggling to find financing for a new generation of tower-oriented farms.

These pressures have already resulted in the cancellation of two eSolar projects, according to published reports, including one on Green Wombat. PG&E has decided to scale back the Alpine SunTower farm in California and replace eSolar's field of heliostats with PV panels.

A second New Mexico facility where El Paso Electric is to receive power is also switching to photovoltaics.

ESolar and partner NRG Energy said in a statement that the decision to downsize the California plant from 92 megawatts to 66 megawatts was the result of limited transmission capacity at the site.

But more than transmission, the challenge for solar-thermal developers is low-cost solar panels. Photovoltaic panel prices fell sharply last year, and plant financing has become easier. Perhaps the DOE recognized this with its May funding awards urging the development of lower cost solar thermal technology. According to eSolar, the goal of its work with Babcock and Wilcox will be to achieve the lowest levelized electricity cost of any utility-scale solar thermal plant.

That means allowing plant components to be built in a factory and shipped fully assembled to a site. This could vastly simplify the permitting and construction processes.

The completion of the work with Babcock & Wilcox is two and a half years away. It seems as if there is no time to waste.