Engie last week made official its agreement to acquire a majority stake in Electro Power Systems, a French-based energy storage and microgrid company with projects in the Americas, Europe, Asia and Africa.

The acquisition aligns with a strategy Engie announced in 2016 “to become leader of the world energy transition.” The EPS deal, originally announced in January, kicks off the last leg of Engie's three-year, $12.5 billion investment plan.

"It's a full '3-D' vision. D as in 'decarbonization.' D as in 'decentralization.' And D as in ‘digitalization,’” Thierry Lepercq, executive vice president at Engie in charge of research, technology and innovation, told Greentech Media in early 2017. The EPS investment is the latest indication of this vision becoming a reality.

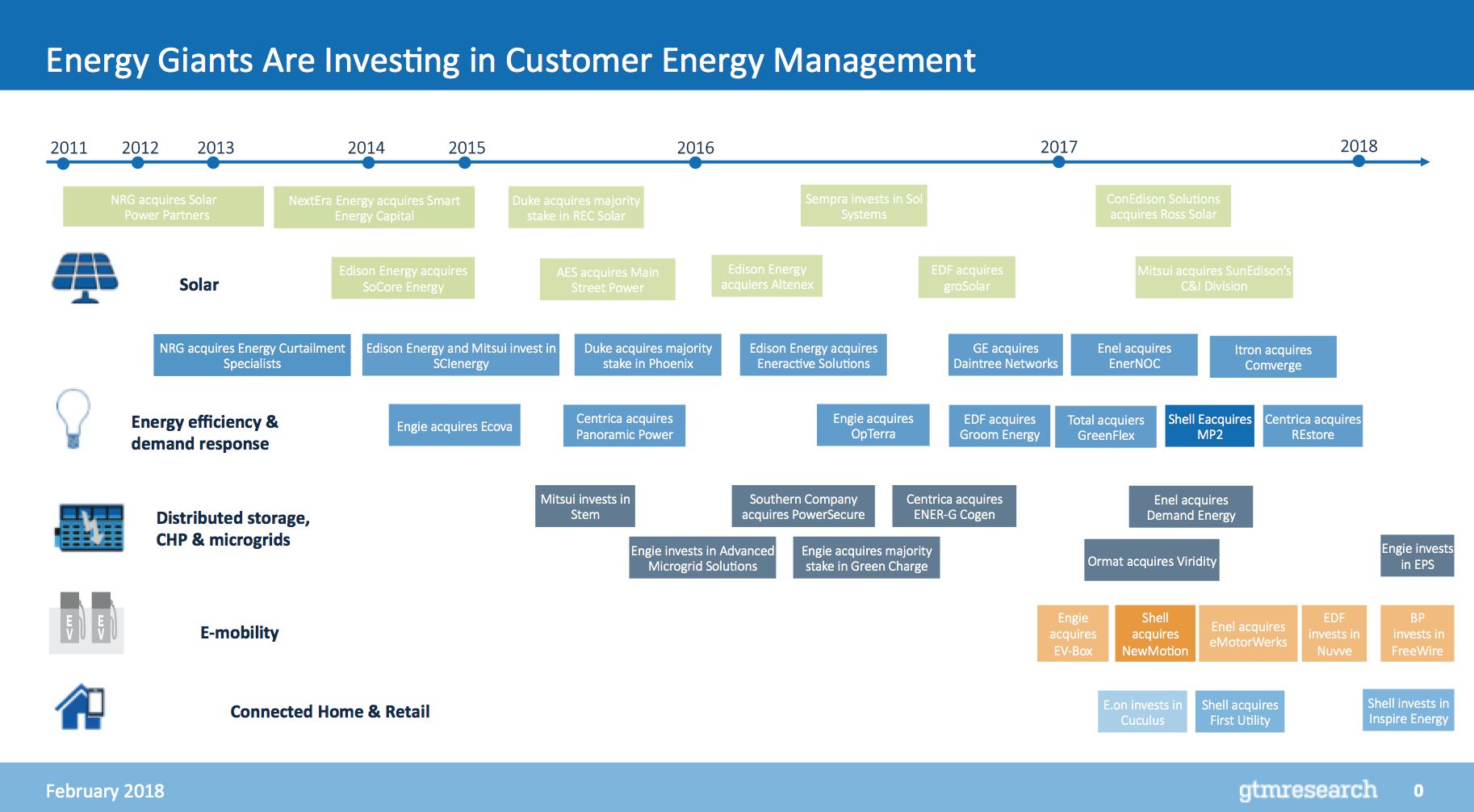

The purchase also reaffirms a several-year trend of large energy companies, especially in Europe, pouring money into customer energy management.

"As of right now, building out a distributed practice for these European energy giants will not result into a multibillion-dollar business in the near term," said GTM Research grid edge analyst Elta Kolo. "Rather, acquisitions and large investments are expected to continue throughout 2018 as these energy giants seek to remain on top of emerging activity at the grid edge and in tune with where competitors are concentrating."

EPS joins the Engie portfolio at €9,5 ($11.70) per share and joins recent solar additions Fenix International and SoCore and 2016 acquisitions including OpTerra, Ecova and Green Charge, which have been rebranded under Engie. The French utility said it will continue to list EPS shares.

Kolo said that after a spate of acquisitions and investments, 2018 will be a big year for consolidation. Companies are also likely to continue eyeing investments and acquisitions in energy storage, e-mobility, demand response, energy efficiency, smart home and residential retail spaces.

In speaking with Greentech Media in 2017, Lepercq noted that incorporating already-established companies into the fold allows Engie to innovate while maintaining a conservative, utility-minded approach to change.

“If you're working with existing companies, you're working with established teams that have established businesses. […] It’s fundamentally different than taking pure technology players and starting from scratch,” he said. “We're combining a bold move with a solid approach to business.”

Engie's recent investments fit concretely within its mission to provide global energy solutions in its verticals of sustainable mobility, decentralized energy communities, smart buildings, 100 percent clean energy “territories,” hydrogen and energy storage. The utility has also outlined increased interest in investing in projects outside Europe.

Buying into EPS helps Engie with both of those goals.

“By targeting a company that is focused on the low-hanging fruit of replacing expensive diesel with clean energy in remote areas, you can get more carbon bang for your investment buck,” said Colleen Metelitsa, a GTM Research grid edge analyst. “Engie also seems to be targeting a diverse range of technologies across storage, microgrids, EV charging, energy billing and more. This diversified portfolio allows it to hedge its bets on where it thinks the biggest growth in green energy might be.”

EPS specializes in transitioning intermittent renewable and fossil-fuel systems to more permanent and sustainable solutions. Of the 36 megawatts of microgrid generation capacity in EPS’ portfolio, 70 percent is in the Asia-Pacific region and 23 percent is in Africa. Its major projects include a 12-megawatt microgrid installation in Australia -- including 3 megawatts-peak of solar PV, 2 megawatts of wind, and 1 megawatt of battery storage -- and a “Hybrid Energy Storage System” in Bosnia that provides fast-charging for electric vehicles.

“We share Engie’s strategic vision of a paradigm shift in the energy system toward decentralized energy solutions: in advanced economies renewables are displacing conventional centralized power plants, calling for distributed energy storage to secure flexibility and capacity. [...] In parallel, in emerging economies, storage-enabled renewables open a market of 2.4 billion people reliant on diesel generation,” said Carlalberto Guglielminotti, EPS’ CEO and general manager, in a statement. “Our unique technological platform combined with Engie’s global reach, establishes a driving force of the energy transition.”

According to Metelitsa, large energy companies throwing money into the microgrid world could also be a big help in a landscape where funding has at times proved elusive because of the difficulty of scaling the technology. Kolo, too, said she expects acquisitions and consolidations to allow companies to expand their business using the platforms of the large energy companies that buy in.

“What Engie and all these energy giants bring are large balance sheets, which can be critically important in helping project developers scale,” said Metelitsa. “Financing for remote and island microgrids can be more difficult than campus-level financing because there is more counterparty risk. If Engie can help provide capital for construction costs, you can really lower the cost of capital in building and be more cost-competitive.”