Did you know that Latin America is the fastest-growing regional market in the history of the solar industry? Or that the region is home to the largest merchant solar plant in the entire world? Do you know which companies and financiers are leading that growth?

Latin America has been the bright spot of 2014, breaking several global PV records and setting a few regional ones of its own. This post draws on the most comprehensive research available from GTM Research’s Latin America PV Playbook to provide you with a data-packed guide to putting Latin America’s solar growth in context.

Latin America is the fastest-growing market for solar PV in history

The Latin American solar market is growing faster than any other regional market in history. Here are a few ways to put that in perspective.

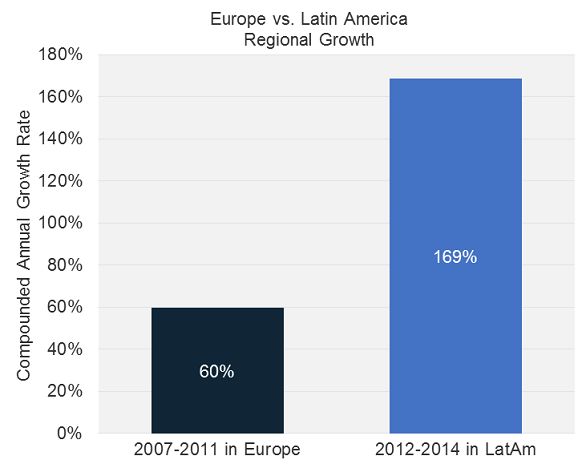

Latin America is growing more than twice as fast as the European market did in the 2007-2011 boom. In other words, the time that most folks in the solar industry associate with rapid downstream expansion pales in comparison to the growth we are seeing in Latin America today. Keep in mind that those European markets were subsidized, and Latin America is not.

Source: Latin America PV Playbook

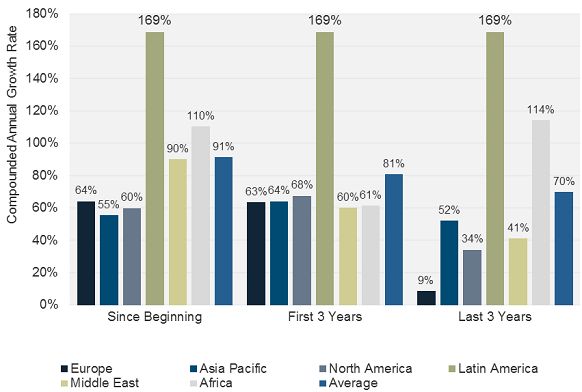

There are a number of ways to put Latin America's growth rates in context. The chart below shows rates since the market began in that region, the first three years of growth, and the last three years to the present day.

Source: Latin America PV Playbook

Looking across all regions, and taking their growth up to today, Latin America has grown at 1.8 times the regional average -- and 1.5 times faster than the second-fastest-growing market. Adjusting for the start year to look at how the market grew in its first three years, Latin America rate of growth has been twice as fast as the regional average -- and 2.5 times faster than the second-ranked market. Latin America has also been the fastest-growing market over the last three years, despite the massive growth in the Asia-Pacific region led by China and Japan.

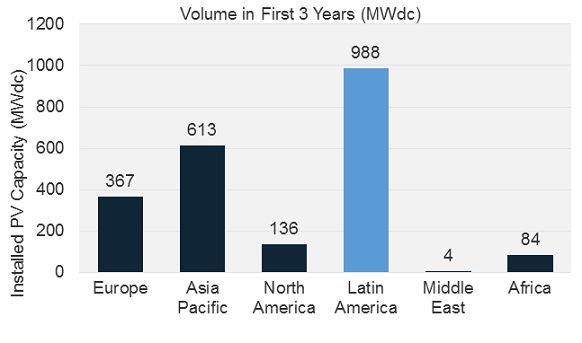

But what about volume? Of course, real volume matters too. While Latin America is still small in volumetric terms, compared to Europe, Asia-Pacific, and North America, it is notable that at 988 megawatts, it has installed more volume in its first three years than any other regional market has in the past. The second-best market in this regard was Asia Pacific, which installed 613 megawatts in its first three years.

Source: Latin America PV Playbook

Chile dominates the Latin American solar landscape

With a record-setting 2014, Chile has surpassed both Peru and Mexico as the regional leader in PV installations. The volume of installations in Chile is eclipsing the total cumulative market for the region in previous years. In 2012, only 51 megawatts of on-grid PV capacity was on-line. In the first quarter of this year, Chile installed 150 megawatts. This is consistent with a trend seen in the top three markets -- Chile, Mexico, and Brazil -- which are responsible for 50 percent of all cumulative market growth through 2014. But even among the three, Chile currently rules supreme, installing 40 percent of the region's volume in 2014. In 2015, Chile is expected to be Latin America’s first market to install 1 gigawatt in a single year.

Chile is home to the largest merchant solar plant in the world

In fact, Chile is home to two of the largest merchant solar plants. The 50-megawatt Maria Elena project from SunEdison was the first large-scale solar plant to rely on the merchant spot market for its revenue. It held the distinction of the largest merchant solar plant in the world until a few weeks ago -- when SunPower’s Salvador Project, clocking in at 70 megawatts, stole the title. The region is able to sustain merchant solar plants due to a combination of high spot prices in parts of the grid and having the highest insolation rates in the entire world. That these plants were able to be developed without subsidies and be cost-competitive against every other resource on the market is a huge testament to how far solar has come in the region -- and where it is going.

The Overseas Private Investment Corporation is the biggest solar investor in Chile

OPIC is the region’s largest debt investor, with more than $650 million invested in five solar projects, representing 432 megawatts in Chile. The organization is beating the nearest competitor three times over -- the International Finance Corporation with $190 million in four projects in Chile, representing 318 megawatts. The International Finance Corporation can also lay claim to financing the 40-megawatt Aura project in Mexico, adding more to its regional portfolio. The Inter-American Development Bank, currently ranking third, has been very active and could surpass both IFC and OPIC in 2015.

SunEdison is the region’s top developer

Last, but certainly not least, is the company that is leading the way on the massive growth in the region. SunEdison is the top-ranked developer in Latin America, based on a combination of megawatts installed and late-stage pipeline. With 155 megawatts operational and another 163 megawatts on the way, SunEdison is well ahead of the competition for 2014. Several companies will challenge it for the top ranking in 2015, including First Solar with its 141-megawatt plant in Chile and Enel Green Power with 169 megawatts in its late-stage pipeline -- not to mention some very savvy competitive positioning by Enel in markets like Peru and Panama.

***

For more information on the Latin America PV Playbook, visit http://www.greentechmedia.com/research/report/latin-america-pv-playbook.