Twenty-five years after economic liberalization, Vietnam’s urban centers are populated by world-class buildings and skylines rife with modern high-rises. The country’s fast expansion, however, has been prioritized over sustainable development, drawing on the country’s non-renewable resources and encouraging a looming energy deficit.

The application of energy-saving technologies in commercial buildings is still very limited in Vietnam. Energy-saving technologies are used in systems that actively consume electricity to help them consume less than they traditionally would. Some examples of these systems include lighting, air-conditioning, and elevators. Energy-saving technologies are different from preventive technologies used in solar panels and insulating window glass that allows energy-consuming systems to work less.

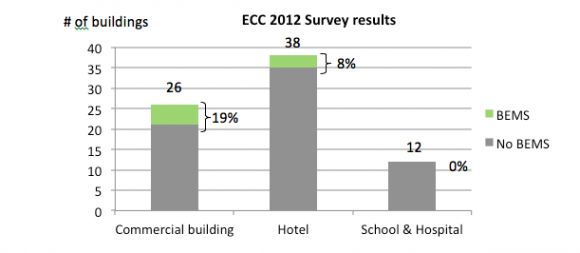

Most buildings in Vietnam that have implemented energy-saving solutions stop at replacing fluorescent lamps with compact fluorescent lamps (CFLs). Advanced technologies for heating, ventilation and air-conditioning or for building energy management systems have not made significant inroads in the country. For example, in a 2012 survey of 76 buildings in Ho Chi Minh City conducted by the Energy Conservation Center, it was found that only 10 percent have BEMS installed.

In addition, according to a recent paper published by Solidiance, an Asia-focused consulting firm, green lighting and green HVAC have very few suppliers in Vietnam, though they represent two of the most attractive markets and have the highest growth potentials in Vietnam for green building materials and technology.

From the government’s perspective

Limited application of energy-saving technologies in commercial buildings is putting pressure on Vietnam’s energy infrastructure. According to experts at the Energy Technology International Exhibition Hanoi 2013 conference, the rate of energy consumed by buildings in Vietnam is on average higher than that of factories. In 2012, the building sector (excluding residential) accounted for roughly 30 percent of the country’s total energy consumption, ranking second only to manufacturing at 50 percent.

Currently, Vietnam, a country that once exported electricity, is predicted to run a 10 percent power deficit by 2015, increasing to a deficit of 70 percent by 2025.

Recognizing the threat, Vietnam has developed several programs to encourage the application of energy-saving technologies in buildings. In June 2010, the central government updated the Construction Law, adding the provision that new commercial buildings must use highly energy-efficient equipment, as well as install automatic energy management systems, including BEMS. The goal of the regulation is to save 11 to 17 tons of oil equivalent from 2012 to 2015.

Despite the government’s efforts, however, the consumption level of green products continues to see little change in the country.

What are the barriers for development?

Macro level: There are two main hindrances to green building technologies in Vietnam -- the relatively low price of electricity and the lack of tax incentives from the government. As of 2013, the average cost of electricity in Vietnam is $0.07 cents per kilowatt-hour, 20 percent lower than Thailand ($0.09 cents per kilowatt-hour) and 70 percent lower than the Philippines ($0.27 cents per kilowatt-hour). Even with high power usage, operational cost for buildings in Vietnam is still relatively small. Additionally, although the government has implemented regulations to encourage buildings to go green, there are no financial incentives and rewards for companies that follow them. This stands in contrast to the situation in the U.S., for example, where both owners and developers of certified green buildings are entitled to tax reduction benefits. The lack of financial incentives in Vietnam has eclipsed the social benefits of investing in energy-efficient technologies.

From a logistics perspective, high initial costs and a skewed supply chain are some of the key obstacles for green development. Often, leading suppliers of green building technologies are multinational corporations that work primarily with international developers and price their products at a level appropriate to this premium market. The lack of budget options for green products has left out a large pool of smaller developers, such as those who focus on schools and hospitals. Furthermore, architects and developers want to save costs to maximize their profits, but doing so also sacrifices the long-term savings of building owners.

From the consumer’s point of view, the existence of low-quality products in the market has fomented doubt around the cost-benefit of green technologies. Take the LED lighting market, for example. In Vietnam, 80 percent of LED lamps carried in retail stores are made in China. In a random test by the Center for Energy Conservation Lamp and Electronic Solution, many Chinese 3-watt LEDs are only measured at 1.5 watts, and only last about two months, which is significantly shorter than the usual life expectancy of 50,000 hours. Chinese LEDs, although priced at 60 percent of similar Philips-branded items, are still much more expensive than the popular fluorescent lamps. Many consumers have stated that they prefer buying the cheaper product, because they expect both products to have similar life expectancy of around two months.

Can the market take off?

Despite these challenges, Vietnam’s green building sector has recently seen some pioneers that have set high standards for both quality and affordability, which will in turn help generate healthy competition in the market. In early 2013, the estate management company Savills launched President Place, the first LEED Gold-certified building in Vietnam. On average, the rental cost at Presidential Place is $35 per square meter, plus a management fee of $6 per square meter. This is, in fact, cheaper than other grade-A buildings in the same area whose management fee is about $8 per square meter on average. These competitive prices have made President Place a great success -- the property boasts a 75 percent occupancy rate after only three months.

According to Alex Crane, leasing manager of the project, the management fee is lower for President Place because a big part of the management fee is used to cover the cost of air-conditioning during office hours. This building, by virtue of its green features, consumes far less power. In addition to cutting electricity by using automatic zoning control for air conditioners, the building’s Schindler lift system also has generative motors that convert gravitational forces to electricity and feed it back into the electrical grid of the building.

The lesson of this story is that although green certificates and corporate social responsibility efforts remain secondary priorities for companies seeking offices, green buildings with lower operating costs have advantages that can be partially transferred to tenants, attracting more business.

Electricity prices in Vietnam have increased by 5 percent since 2011, and are set to increase an additional 45 percent by 2015. When cheap electricity is no longer available, buildings with high levels of energy efficiency are well positioned to win.

How can multinational manufactures help drive demand?

Multinational manufacturers need to generate demand by demonstrating returns on investment and promoting showcase projects. Players could also cooperate with each other to offer integrated green buildings solutions and to eliminate duplicated logistics costs for customers. In Vietnam’s cost-sensitive environment, commercial benefits are the most convincing argument to be used to win projects.

Multinational corporations' products should be more adapted to Vietnam’s market. This includes developing a middle market segment for energy-saving technologies that appeal to the majority, which are smaller/local estate developers. Additionally, in order to prevent counterfeit or low-quality products, it is necessary to establish quality assurance standards and advocate for differentiating features to help consumers navigate the market.

To gain access to the wide open market of public buildings such as schools, hospitals and government offices, companies could support the government in preparing feasibility studies and regulatory reforms that help the country to achieve its energy savings targets. One of the pioneers that is doing so is General Electric. In 2011, GE invested in the government’s wind energy studies for Vietnam.

Last but not least, in order to spread product knowledge and spur brand recognition, companies should work with local universities on the development of a green building curriculum, as well as offer internships to students to give them practical experience in the industry. Some large international firms already have a few programs in place. For example, Schneider Electric Vietnam has established three automation training centers in Hanoi, Ho Chi Minh City and Phnom Penh (Cambodia), as well as offering customized courses at customers’ sites, to allow more people to gain experience with their products and solutions.

The bottom line

As the country continues to develop, Vietnam offers a large market for green building technologies. Many new communities that are satellites of major metropolitan areas are being built, calling for the development of commercial areas, residential housing, hospitals, schools, retail, and more. These new construction projects offer opportunities for multinational manufacturers with experience in mature markets to help guide project development to meet the higher environmental standards set by the government.

In addition to new projects, existing buildings also need to be upgraded with energy-saving technology, because as many as 95 percent of these existing units do not have any power-saving functions. Companies that are trend-setters in this emerging stage of the market will gain advantages in the long term.

***

Patricia Hong-Phuc Le is a consultant in Solidiance’s Vietnam office who has advised multinationals on market growth projects across the healthcare, automotive and building materials sectors. The company recently released a comprehensive white paper outlining the green building industry in Vietnam, which is accessible and free to download here.