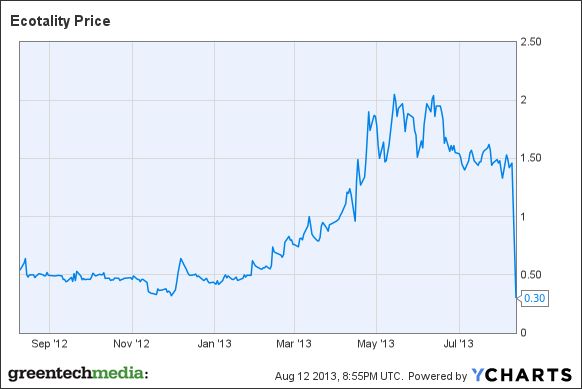

ECOtality (NASDAQ: ECTY), which has won more than $100 million in federal grants to support a nationwide EV charging rollout, has warned investors that it is exploring strategic alternatives, including potential bankruptcy, amidst stagnant sales and technical problems, sending the company’s shares plummeting in Monday trading.

The San Francisco-based company announced Monday that it has failed to transition from installing charging infrastructure under the Department of Energy’s EV Project to commercial sales of its electric vehicle service equipment (EVSE). As we reported earlier this year, moving from EV Project sales to real-world sales was critical in order for the company to remain a going concern.

ECOtality’s Monday filing with the U.S. Securities and Exchange Commission states, “At this time, neither the Company's direct sales force nor the independent dealers have generated sales volumes of its commercial EVSE products sufficient, in combination with other sources of revenue, to support the Company's operations in the second half of 2013.”

Monday’s announcement also said that the company’s Minit Charger product, meant to go on sale this year, “exhibited unacceptable performance shortfalls during prototype verification testing,” and thus won’t be introduced in 2013. ECOtality acquired the Minit Charger business, which is used to charge airport tractors and other industrial EVs, from Edison International for $3 million in 2007, and had launched a $12.5 million joint venture last year with Changchun Eco-Power Technology Co. to spread the technology to China.

On top of that, ECOtality said it has been unable to raise additional financing, and notified the DOE last week that without more money, it may not be able to keep up its EV Project work -- a move that led DOE to freeze further payments of its grants to the company. ECOtality has already drawn about $96 million of the $100 million grant it received for the EV Project, so it’s not clear that keeping that spending channel open would have helped it out of its current problems.

ECOtality said it was exploring options for a restructuring, including a sale, and had retained FTI Consulting as an adviser. The company’s stock had fallen 77 percent to 33 cents per share in midday Monday trading.

Monday’s news has prompted a flurry of news stories comparing ECOtality to Solyndra, the solar panel maker which filed for bankruptcy in 2011 after receiving a $535 million DOE loan guarantee, one it was unable to pay back. Other green technology companies backed by federal grants or loan guarantees that have since gone under include A123 Systems, Abound Solar and Beacon Power.

But ECOtality is far different from Solyndra, which found its unique thin-film solar panels unable to compete on a cost, performance or bankability basis in a burgeoning solar market. ECOtality, by contrast, has essentially been given more than $100 million in taxpayer funds to build an electric vehicle charging network for a market of EV drivers that, as of yet, doesn’t exist anywhere in large enough numbers to support it.

The $100 million grant from the DOE was meant to fund the rollout of some 15,000 car-charging stations across key U.S. cities. It also won a $26.4 million grant under DOE’s Advanced Vehicle Testing and Evaluation project, and subsidiary companies had received about $35 million in DOE funds from 2005 to 2011.

But a July report from the DOE Office of Inspector General found several problems with the way DOE has managed its financial relationship with ECOtality:

We noted that the Department had not adequately documented its consideration of alternatives before making significant changes to ECOtality's Recovery Act project. Additionally, the Department had not ensured that the selection of commercial charging station locations was based on a process that advanced the goals of the project. Further, the Department had not ensured that ECOtality's awards were finalized in a timely manner. We did not find that the cost-share concept for this project was prohibited under Federal regulations; however, we concluded that the cost-share arrangement was unusual and provided ECOtality with a very generous cost-share credit.

About 72 percent of ECOtality’s 2012 revenue was attributable to continued rollout of the Blink network of charging stations for the EV Project, company CFO Susie Herrmann said in an April conference call. Of the company’s $100.2 million total grant award, some $84.8 million had been received as of December 31, 2012, with $63.7 million recognized in revenues, up from $24.2 million recognized as of the end of 2011.

To move from a government-funded enterprise to a commercially viable company, ECOtality was focused on “literally building another company on the foundation of the EV Project,” CEO Ravi Brar, who replaced former CEO Jonathan Read in September 2012, told investors in April. But the company's first-quarter 2013 report in May noted that an even larger share of revenues -- 77 percent, or $12.2 million of total revenues of $15.9 million -- was still attributed to the EV Project.

Other EV charging companies include ChargePoint America (formerly Coulomb Technologies), which received a $15 million DOE grant and $3.4 million in California Energy Commission funding, and has installed about 5,000 charging stations in nine U.S. regions, and AeroVironment (NASDAQ:AVAV), which is working with such partners as NRG Energy for its eVgo car charging business, as well as Nissan (NASDAQ:NSANY) to bundle its chargers with sales of the Leaf EV at the point of purchase. ECOtality, by contrast, has not made any deals with automakers, and appears to have installed far fewer chargers per federal dollar received than ChargePoint America has managed.