Suntech (NYSE: STP) was the world's number-one solar manufacturer in 2010 and rode a subsidy-led boom to the top. Its suddenly super wealthy Founder and CEO, Dr. Zhengrong Shi, was hailed as an entrepreneurial beacon in China's manufacturing sector.

Now, amidst a difficult debt situation and allegations of financial impropriety, Dr. Shi is stepping down as CEO and being replaced by David King, who has served as CFO of the firm. Anlin Ting-Mason, now CFO of Suntech America, will fill the role of interim CFO.

Dr. Shi will serve as Executive Chairman and Chief Strategy Officer.

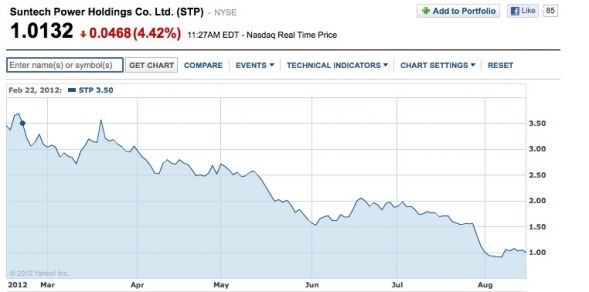

Suntech's stock is trading near historic lows and the once highly valued PV firm has a market cap of $182 million.

In July, Suntech revealed that a business partner, Global Solar Fund (GSF), faked $680 million in collateral for a loan backed by Suntech. According to a Suntech spokesman, "There is no indication to date that any Suntech employee or member of management was involved. We believe that the suspected fraud was committed by a third party."

According to a Reuters article, Suntech "said it won court orders freezing the worldwide assets of its partner in a solar development fund, GSF Capital, and GSF owner Javier Romero," adding that GSF appeared to have defrauded Suntech by falsely claiming it had posted $691.68 million in German bonds as collateral for solar power plant projects built by Suntech's Global Solar Fund subsidiary in Italy. The article continued, "Suntech, which has been seeking to sell its 80 percent stake in Global Solar Fund to raise money to cover debt payments, said the bonds pledged as collateral appear to never have been posted as collateral."

“Suntech is done as a U.S. investment,” said Mark Bachman, an analyst at Boston-based Avian Securities. “Shi is stepping down in the midst of all these fraud allegations and as the company struggles under a mound of debt. I wouldn’t be surprised if Suntech is the first to delist its shares in the U.S.”

Aaron Chew of Maxim Group writes, "Even with a White Knight Savior, STP’s debt load leaves equity at risk: Burdened by $2.2 billion in debt, STP’s net debt-to-equity has reached 2.0x, while its equity is likely to remain pressured from further losses and writedowns as we estimate unsubsidized solar pricing yields best-case normalized gross margins of 5 percent to 10 percent and annual free cash flow losses of $150 million. Even as CFO David King has tightened the ship to focus on cash, working capital can only go so far. With cash to cover three years of losses and $541 million due March 2013, we believe STP is under pressure to recapitalize or find a white knight with deep pockets. Still, with capacity replacement value at $1.1 billion, we estimate this implies equity value of only $52 million, half its market cap. We maintain our Sell rating; as we expect continued destruction in equity value, we maintain our $0.50 price target."

We are in an era of seismic shifts in the solar industry where even the once-stable incumbent firms like Suntech and Trina are fighting for survival in a destructively dynamic market. The only sure thing about the solar industry over the next few years is that there is more change to come.