This is the second piece in a three-part series offering insights and perspectives from GTM Research’s latest smart grid report, Distribution Automation 2012-2016, Technologies and Strategies for Grid Optimization. To read part one, click here.

The Competitive Landscape

Distribution automation (DA) saw a surge of venture capital investment between 2008 and 2010, leading to lots of startups competing in sectors traditionally dominated by giants like ABB, General Electric, Siemens and Schneider Electric. Now it's time for those larger companies to start snapping up the competition -- and to clarify what the DA business will end up looking like over the long term.

The DA industry's taxonomy will develop through acquisition, strategic partnerships and utility relationships over the coming years. Within the DA market, there are three tiers of vendors, each of which are largely determined by revenue size, financial strength and competitive strategy. The first tier is made up of mature, diversified companies seeking strong growth verticals to invest in -- the previously mentioned Four Horseman of the Grid.

The second tier is more specialized and often offers less-integrated solutions, but promises technology innovation. These firms often have the capital available for acquisitions, and tend to focus their attention on targets that can have a more immediate impact and can be integrated effectively into existing business units.

The third tier often focuses on a specific technology or set of technologies to provide a value-added solution to a particular product or service.

Tier One includes:

- ABB

- GE

- Schneider Electric

- Siemens

This first tier consists of the largest, most diversified firms in the market. All of these firms have annual revenues over $20 billion, products in almost every DA vertical, and profitable non-DA business units from which to potentially draw resources.

These companies are ramping up internal and external investment in the space. Internal R&D at ABB, Siemens and Schneider increased 5.1 percent per year from 2006 to 2010. Acquisitions from these firms, however, have made for some of the biggest news stories in the space over the last three years.

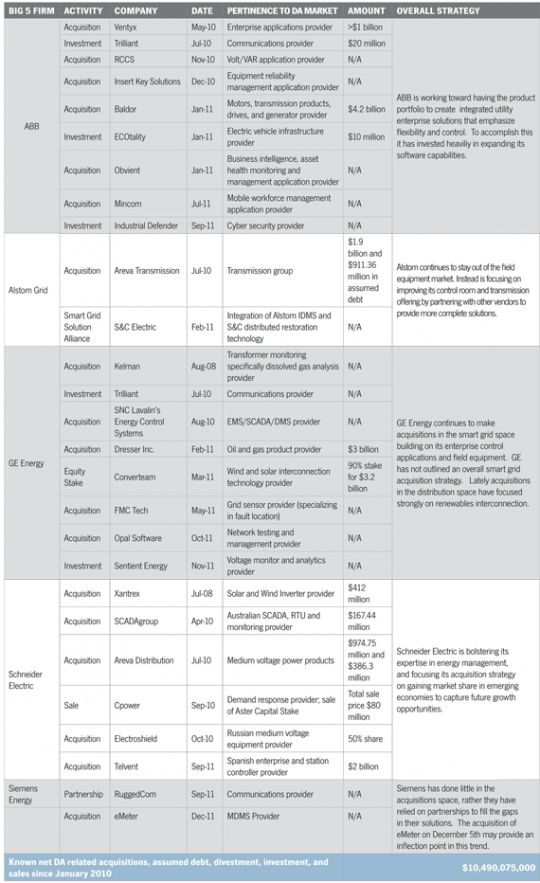

FIGURE: Overall Smart Grid Strategic Activity of the Big 5 Firms

Click on image above for link to larger version / Source: GTM Research

ABB and Schneider Electric have been the most active of the "Four Horseman of the Smart Grid," working toward a vision of integrated hardware and software solutions. The acquisitions of Ventyx and Telvent, respectively, provided the centerpiece for both firms' enhanced software divisions.

GE and Siemens have made more disparate efforts to achieve their smart grid goals. Although GE has aggressively acquired companies with promising products, GE has yet to explain an overall strategy for addressing the smart grid market. Siemens took the first steps toward a more coherent approach by reorganizing smart grid products under its new Infrastructure & Cities sector and recently acquired smart grid leaders eMeter and RuggedCom.

Tier Two includes:

- Alstom Grid

- Cooper Power Systems

- Efacec ACS

- S&C Electric

- Schweitzer Engineering Laboratories (SEL)

The majority of companies in the second tier of DA have far smaller revenue bases and more specialized product offerings. Technological capabilities of these firms often equal or exceed those of their larger counterparts. Outside of Cooper Power Systems, these firms specialize in particular areas within the DA product ecosystem.

Alstom Grid and Cooper Power Systems are the two anomalies in this tier. Alstom has revenues greater than $20 billion, placing it in the first tier, but a product portfolio that limits it to the utility control center. Its recent solution alliance with S&C to enable layered intelligence does provide Alstom with strong links to at least one hardware provider. Cooper Power's broad product portfolio rivals the most diversified companies in the space, but it’s much smaller than the big four with revenues for its parent company at $4.76 billion. Cooper also is focusing more effort than its larger counterparts on the faster-moving municipal and co-op utility market.

Efacec ACS has been mostly quiet in the DA market, with little external involvement outside of its SCADA partnership with the National Rural Telecommunications Cooperative (NRTC).

S&C and SEL have focused much of their efforts internally. S&C’s acquisition of Current Group’s grid optimization wing in 2011 was a bit of an anomaly for these two, but the ease of integration provided immediate value. These firms primarily develop their own technology and pursue partnerships that can expand the use of flagship technologies. Examples include S&C’s solution alliance with Alstom Grid and G&W Electric’s integration with SEL's automation technologies. Both of these firms have made bets on the market potential of innovative products including synchrophasors and community energy storage units, respectively.

Tier Three includes:

- GridSense

- PCS Utilidata

- PowerSense

- Power Tagging

- Survalent

- Tollgrade

Third-tier players have limited product offerings and much lower revenues. Many of these firms were formed during the venture capital explosion that occurred between 2008 and 2010 in the smart grid sector. Some are newcomers to the sector, while others are legacy firms with a strong specialization in a particular technology, utility market segment, or area of interoperability. Small market caps, innovative technology, product market potential, and investors that are often itching to realize returns make many of these firms great targets for acquisition.

Looking Forward

Consolidation will continue to be the major theme of the DA market. Currently, there are more vendors than the market can support in the long term. Market entry by global industrial or software conglomerates is not impossible, but these firms are likely to mirror the strategies of their counterparts already in the market: buying up smaller firms to gain a brand name, an immediate customer base, and some local manufacturing facilities.

For more information on Distribution Automation 2012-2016: Technologies and Strategies for a Digital Grid, visit http://www.greentechmedia.com/research/report/distribution-automation-2012-2016.