President Barack Obama’s clean power policy rollout in Las Vegas this week included a big regulatory win for PACE financing, hundred-million-dollar federal energy-efficiency and solar commitments, and big-picture goals on clean energy and emissions reductions, among other highlights. So it’s easy to see how a little thing like a $1 billion commitment to backing loans for distributed energy projects could have gotten lost in the mix.

But tucked inside this relatively small upward adjustment to the billions to come from the Department of Energy’s reinvigorated 1703 loan guarantee program, there’s a radical effort underway to define a new breed of government-backable grid-edge technologies.

In a series of guidance documents released this week, DOE has described a first-ever move to open its loan guarantees to projects that aggregate lots of distributed energy resources (DERs) -- solar, batteries, smart thermostats, EV chargers, fuel cells or standard on-site generators, to name a few options -- in new and cost-effective ways.

Two loan programs are taking applications: one centered on advanced fossil fuels (PDF), and the Renewable Energy and Energy Efficiency (REEE) program (PDF), which is more focused on technologies like solar and software.

Proven commercial technologies, like straight rooftop solar or efficiency upgrades, won’t fit the bill, the DOE’s loan programs office said in its “supplemental solicitation” document. Nor will “multiple, unrelated projects,” meaning that DER owners can’t just throw together what they’ve got to pass the program’s “innovation” requirements.

But for companies or partnerships that can meet the strict financing and technology requirements, there’s a bewildering array of applications to work on. REEE supplies a list of potential projects for utilities and DER providers/aggregators, ranging from grid infrastructure and communications, utility software and analytics (think DERMS), and behind-the-meter smart inverters, to distributed storage and “active demand management systems.”

Buildings can also seek out zero-energy or low-carbon installations, passive heating and district cooling, and DER integrations for “solar photovoltaic installations such as solar gardens, rooftop solar or building integrated solar; wind; geothermal; modular low head hydropower systems along a single structure or body of water,” or more traditional co-gen and CHP systems -- all with or without energy storage.

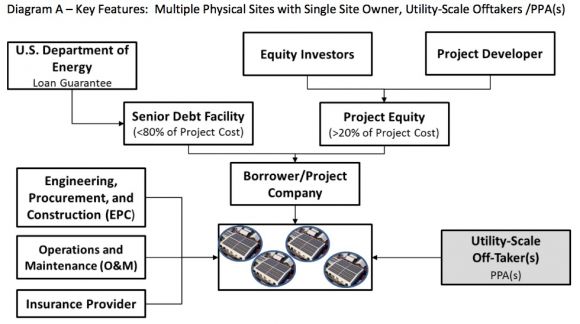

Perhaps more important are the three models DOE has laid out for how projects will be organized to meet its loan terms. The first involves the “Borrower/Project Company” agreeing to “develop, construct, operate and own, directly or through one or more Project Company subsidiaries, revenue-generating assets consisting of multiple installations of Distributed Technology at multiple sites.”

There’s a pretty clear emphasis on direct control with this “Example A” model: “Either the host sites are owned by a single, credit-worthy party, or the Borrower/Project Company or its subsidiary, as applicable, will secure control of diversely owned sites in a manner that is 1) highly standardized, and 2) structured to mitigate against the risk of unrated credit.”

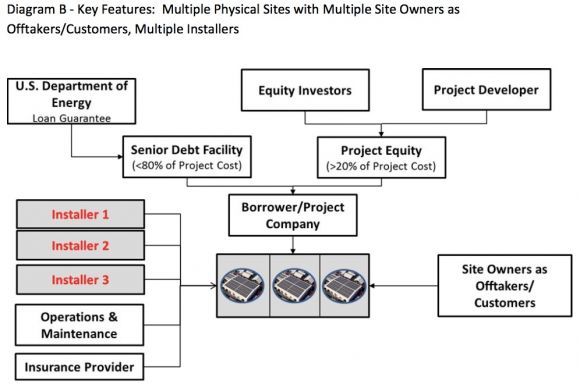

The second model, “Example B,” offers an alternative to ownership: “standardized contracts, such as equipment leases or power purchase agreements with multiple host site-owners,” provided they meet credit criteria. That could open up much more flexibility for the distributed solar companies like SolarCity, SunPower, Sungevity and Vivint Solar, smart thermostat and connected-home providers like Nest and Honeywell, and other customer-facing DER aggregators to play a role.

DOE expects to see a lot of a would-be project’s business plan beforehand, however. “In such a project, LPO would also anticipate looking through a Distributed Energy Project’s lease, power purchase agreement or other revenue contract structure to ensure that the Borrower/Project Company is not merely re-lending DOE-guaranteed loan proceeds to project hosts for unreasonable profit."

The third model envisions mobile technology “deriving revenues from its temporary set up and operation of such technology at multiple customer sites.” This is the least clearly defined option, though it largely sticks to the direct ownership structures of Example A.

As for why DOE needs to do this, here’s REEE:

Typically, each installation or facility in a Distributed Energy Project would be too small, if individually financed, to benefit from a DOE-guaranteed loan due to the transaction costs associated with the financing and DOE’s participation. However, under certain circumstances, DOE may issue loan guarantees to support the financing of an aggregation of such installations and facilities, permitting the borrower to access financing under a single arrangement for the multiple installations of the applicable facilities. A Distributed Energy Project using Distributed Technology will constitute a single Project under Title XVII and the 1703 Regulations because the aggregation of installations and facilities at multiple locations are integral components of a master business plan, necessary to the viability of the Project.

DOE has been preparing for its push into distributed energy integration and innovation for some time. Peter Davidson, former executive director of the loan programs office, said last year that the 1703 program was seeking between $3 billion and $4 billion to direct not to its previous utility-scale projects, but to to “grid connectivity and integration.”

At our Grid Edge Live event in June, David Danielson, assistant secretary for the office of energy efficiency and renewable energy, said that a soon-to-be announced opportunity was looking to fund "advanced technologies that drive innovation on the grid edge,” including power electronics, sensors and grid modeling tools. This spending is to be a small piece of a 10-year, $3.5 billion spending plan outlined by the DOE Quadrennial Energy Review, and it is distinct from the 1703 program, he said.