Leading investment house Deutsche Bank has dramatically lifted its demand forecasts for the global solar industry -- predicting that 46 gigawatts of solar PV will be installed across the world in 2014, before jumping by another 25 percent to 56 gigawatts in 2015.

It notes that the world’s three biggest solar markets -- coincidentally located in the world’s three biggest economies, the U.S., China and Japan -- are currently booming and are likely to deliver what market analysts describe as more “upside demand surprises.”

But it also points to other countries such as India, Australia, South Africa, and Mexico, as well as regions in the Middle East, South America and Southeast Asia, as being likely to act as strong growth contributors.

“The majority of these markets are at grid parity and as such [are] sustainable,” the analysts state. “Moreover, we believe some of the grid and financing constraints that have inhibited growth so far are set to improve in 2014.”

Deutsche Bank cited five principal factors that explain why it forecasts the global solar PV market will nearly double from 2012 to 2015.

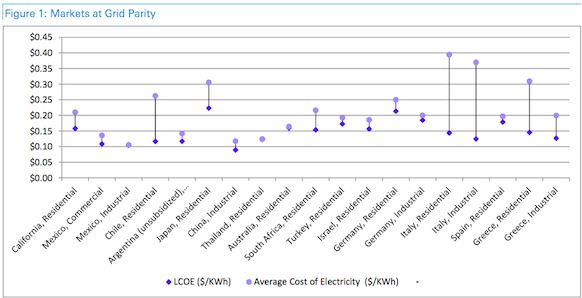

The first is the spread of grid parity, which is said to occur when the cost of solar is equal to or cheaper than retail rates of electricity. Deutsche Bank says solar is currently competitive without subsidies in at least nineteen markets globally, and it expects more markets to reach grid parity in 2014 as solar system prices decline further.

Here’s a graph to illustrate that grid parity claim.

Source: Deutsche Bank

The other variables cited by Deutsche Bank are:

- U.S.-based distributed generation business models are set to become more pervasive in international markets and act as a significant growth catalyst in European markets that have significantly scaled back subsidies.

- Financing costs and availability for the solar sector are set to improve from 2014. The report noted that sufficient access to low-cost financing has been a significant constraint inhibiting the growth of global solar sector so far.

- It expects downstream solar companies to participate in the “'gold rush' to acquire solar customers at an accelerated pace.“ Just as upstream/midstream solar companies participated in the gold rush to add manufacturing capacity during the 2005-2007 timeframe, the analysts expect another gold rush to add megawatts over the next two to three years “until [the U.S. federal investment tax credit] expires around 2016.

- While the past five years were about module cost reduction, the next three years are likely to be about reductions in the balance-of-systems costs. This includes the cost of inverters, hardware, customer acquisition and financing costs.

Deutsche Bank says its base-case demand estimate assumes the Japanese market will increase from around 7 gigawatts in 2013 to around 8 gigawatts in 2014. It also forecasts that the U.S. market increases from 6 gigawatts in 2013 to 8 gigawatts in 2014 and the China market increases from 8 gigawatts to around 12 gigawatts.

Europe is expected to account for 7 to 8 gigawatts of installations, and international markets are likely to account for around 12 to 17 gigawatts of demand.

“Within international markets, we expect India, South Africa, South America, Southeast Asia, Australia and other emerging markets to each contribute to over 1 gigawatt per market."

Deutsche Bank cited system prices, financing costs and the policy outlook as factors likely to act as increasing tailwinds for the solar sector over the next twelve to eighteen months.

“Solar module prices are likely to remain at record-low levels for the next eighteen months, and beyond that timeframe, we see some inflationary pressures driving prices higher,” the report states.

“While balance-of-system costs have room to decline further, we expect a rapid decline in these costs over the next eighteen months and then expect inflationary wage pressures on overall costs.

“Along the same lines, while overall financing costs have room to decline as solar moves down the risk curve and innovative financing structures drive down costs, we expect the rising global interest rate environment from the 2015 timeframe to drive upward pressure on overall financing costs.

“Bottom line: we expect solar LCOE to reach a cash bottom over the next eighteen to twenty-four months and expect a rush for installations during the corresponding period.”

***

Editor's note: This article is reposted from RenewEconomy. Author credit goes to Giles Parkinson.