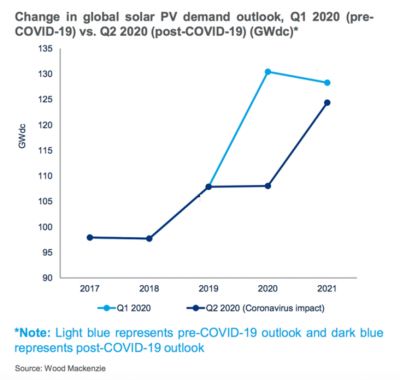

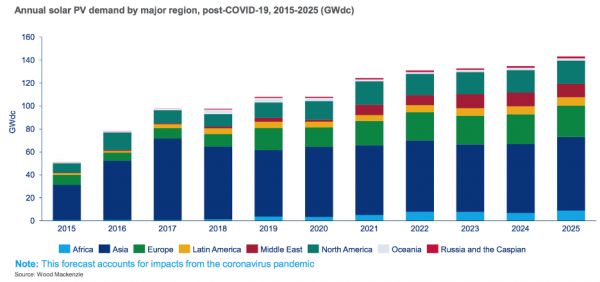

The global solar market is expected to stay nearly flat between 2019 and 2020 as a result of the coronavirus pandemic and its economic impacts, according to Wood Mackenzie. But a significant increase in demand is now expected between 2020 and 2021 as the industry rebounds.

The future is bright(er)

Long-term fundamentals for global PV remain strong despite the pandemic, primarily driven by improving cost-competitiveness and sustained investor interest, and Wood Mackenzie has increased its outlook for the 2021-2025 period by 5 gigawatts (DC).

Excess capacity issues

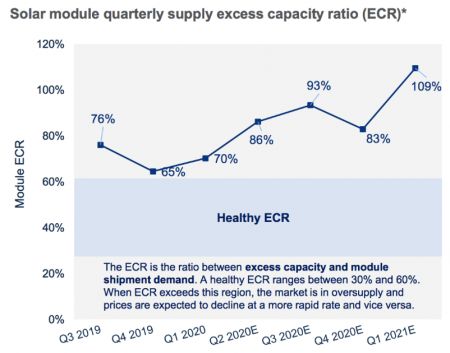

Solar cell supply is in balance in 2020, but the risk of oversupply will rise in 2021. This year, global module production capacity will exceed total expected shipments by 70 percent or higher, making oversupply a very real short-term possibility. Accelerated price declines and supply chain consolidation have marked excess capacity periods in the past.

This cycle will likely produce similar results, further strengthening the position of leading cell and module suppliers.

The coronavirus outbreak threw a wrench in the global solar supply chain this year. After a pause in Q1, by the end of March, cell and module production capacity in China recovered to near pre-COVID-19 levels.

Inverter and module production in Europe and India experienced a severe interruption in March, which is now beginning to resolve.

Overall, major solar markets have experienced various levels of module, inverter and other solar components delivery delays rather than cancellations.

***

Ravi Manghani is head of solar research at Wood Mackenzie.

Wood Mackenzie's Solar Executive Briefing quarterly update and brochure can be found here.