There’s a real minute-to-minute cost to the grid when it comes to handling lots of solar power on partly cloudy days. Out in the Nevada desert, it adds up to about $3 to $8 per megawatt-hour.

Those are the numbers churned out of a Department of Energy-backed project with Las Vegas-area utility NV Energy and Navigant Consulting, based on a computer model simulating 10 different scenarios for solar PV systems at both rooftop and utility scales. Turns out that 150 to 1,000 megawatts of intermittent PV penetration requires a lot of fossil fuel-fired backup generators to help smooth it out on cloudy days -- and that costs utilities money.

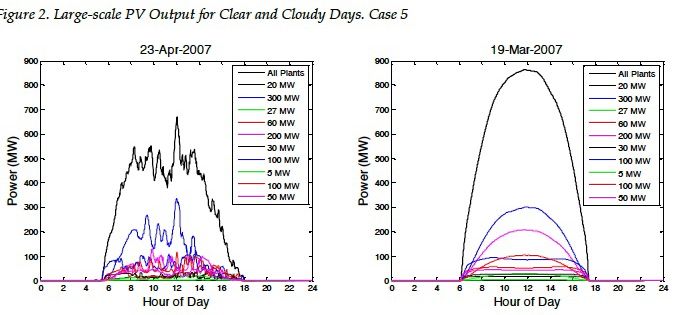

Take this snapshot of two days' worth of minute-by-minute simulation of weather patterns and insolation using data from 2007, which is NV Energy’s record peak year of power use.

The sunny days are a smooth, easy-to-predict rise and fall, allowing supporting natural gas-fired plants ramp up and down slowly and smoothly, saving on wear and tear and burning fuel at top efficiency.

But add scattered, partial clouds to the mix, and the picture grows jagged and unpredictable, with jumps of tens of megawatts for smaller-scale penetration, and hundreds of megawatts in minutes for scenarios of 300 megawatts or more. NV Energy can handle that today -- it won’t break the grid, in other words -- but it will cost the utility extra in fuel burn and cause earlier and more frequent turbine breakdowns by forcing them to ramp and cut back so hard and so often. Think of it as driving at a smooth speed on the freeway, versus driving in stop-and-go traffic that suddenly speeds up to 60 MPH all at once.

Between 150 megawatts and 1,000 megawatts, the costs climbed from about $2 million to $20 million, adding up to $3 to $5 per megawatt-hour, the study found. Added up, those costs were remarkably similar whether the simulation was all utility-scale solar, all distributed rooftop solar, or a mix of the two, although making sure big PV farms were spaced farther apart helped a bit.

They also started taking effect at as little as 3 percent of total generation mix, with individual projects ranging from 5 megawatts to 300 megawatts in size. And with the unpredictability of the real world, “the impact results in this report should be deemed as the minimum,” Navigant wrote.

You can see why utilities haven’t tried to build that much solar and wind under their own power -- it costs them extra. That’s why it’s taken government mandates to push them into signing up existing and future wind, solar and other renewable power sources in multi-year contracts, or to implement policies that make it easier and more profitable for their customers to install it on their own.

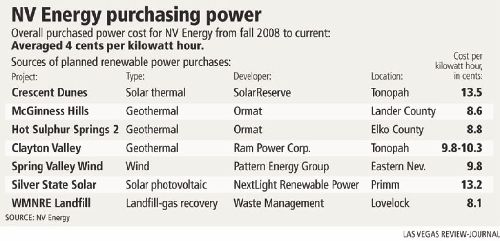

This isn't exactly news, of course, and it would be surprising if utilities and big solar (and wind) developers weren’t arguing over numbers like these in their PPA contract negotiations on a daily basis. Still, it’s interesting to see some real dollar figures emerge. For comparison, here are some of the costs NV Energy is paying for both steady geothermal power and intermittent solar power, in cents-per-kilowatt terms, according to the Las Vegas Review Journal:

Still, not every utility service area looks like Las Vegas, which combines massively wasteful use of power and massively cheap power from Hoover Dam. But certainly states with big renewable portfolio mandates, such as California with its 33 percent by 2020 mandate, will have utilities worried about backing up all their intermittent solar and wind power.

NV Energy is already getting more than 1 gigawatt, or 12 percent, of its overall power mix from renewable resources. While much of that is geothermal power, about 5 percent of its power comes from solar. The utility is also in prime U.S. solar country, with lots of PV and solar thermal projects slated for the region, whether in the state or across the border in California.

Interestingly, the study didn’t look at hydropower to balance PV, even though the country’s biggest dams lie in NV Energy’s territory. It also didn’t look at energy storage, though the $3 to $5 per megawatt-hour figure may offer some guidance on what utilities will be willing to pay for storage systems that can reliably balance big PV. Wind farms have hundreds of megawatts of battery-based storage installed and on the way in Japan, the U.S. and around the world, but it’s almost always cheaper to use natural gas-fired peaker plants or pumped hydro.

Overall, NV Energy would need to keep about 1 megawatt of generating capacity online for regulation for every 25 megawatts of PV, the study found, and it would have to be fast, with 1 megawatt-per-minute in ramping capacity for each 75 megawatts of solar.

It would also have to include less-efficient combustion turbines, rather than the latest combined cycle gas turbines, which could add up to $5 per megawatt-hour in extra costs. That includes about $5 million to “commit and run a 50 MW peaking unit during daytime hours (4100 hours per year) and $800,000 for accelerated maintenance,” Navigant states, though it cautions that its model needs to be updated to get clearer data on that front.