[pagebreak:Concentrating Solar to Reach 18 Gigawatts by 2020]

Companies will spend between $80 billion and $200 billion on concentrating-solar installations in the next 12 years, according to a report released Tuesday by the Prometheus Institute and Greentech Media.

That includes more than $30 billion worth of plants that companies have announced in just the last six months, according the report.

"While the conventional sources of energy will have increasing difficulty in simply maintaining prices and production volumes in the face of fuel stock pressure and grid maintenance requirements, [concentrating solar power] technologies will get cheaper and better understood for a long time to come," the report states. "The dawn of large-scale concentrating solar power is here, and the forecasts shows very few clouds in the sky."

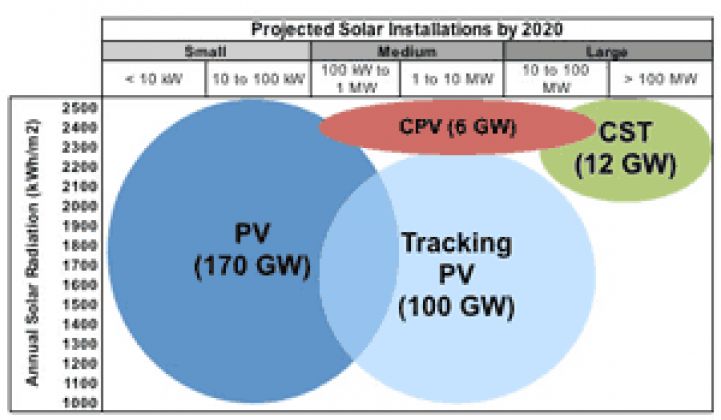

Still, the report forecasts that all those projects -- including about 12 gigawatts of concentrating solar-thermal capacity and about 6 gigawatts of concentrating photovoltaics -- will make up only about 6.2 percent of a 288-gigawatt solar market in 2020.

The report predicts that concentrating photovoltaics will have the smallest market in 12 years, becoming a "niche technology" that will do well in applications that need high efficiency in a limited space, for example.

For utility-scale applications, it will have trouble competing with solar-thermal, which has the advantage of thermal storage, while in commercial applications, standard PV will have lower costs, according to the report. However, concentrating PV will pick up some business in the 100-kilowatt to 100-megawatt markets, the report predicts.

"CPV technologies will suffer from slower ramping and scale, but should become competitive at the utility scale within the next decade," the report states.

Brad Hines, chief technology officer at Soliant Energy, which makes concentrating solar panels, disagrees that concentrating PV will be a niche technology in every market.

"I think CPV probably will be a niche in the utility space, but we’re going after commercial rooftops, and in that market, power density is highly prized," he said. "We believe we’ll compete strongly against flat-plate PV on commercial rooftops and distributed applications ... where we think power density is very important and delivers real dollar-per-watt savings."

And Robert Wilder, CEO of WilderShares, which manages several clean-energy indices, said the industry still has high hopes for concentrating PV.

"In the quiver of solar technologies, concentrating is an arrow that people are increasingly looking to," he said.

Nonetheless, he added, concentrating PV technologies today are prototypes, not commercial products. "They don’t seem to be getting there as quickly as I would like," he said.

[pagebreak:Concentrating Solar: Continued]

According to the Prometheus and Greentech Media report, standard "flat-plate" photovoltaics will have the largest market in 2020, making up 170 gigawatts of installed capacity, and photovoltaic systems that track the sun will have the next largest, making up 100 gigawatts of installed capacity.

These solar-electric technologies will dominate the market for small and medium installations, according to the report, which projects that costs for these technologies will drop below those for solar-thermal "in the medium to long-term."

Costs will vary widely depending on location, but in an analysis of two locations, Tucson, Ariz., and Seattle, the report projected that flat-plate photovoltaics would be cheaper than solar-thermal and concentrating PV.

But the market for large installations, defined as 10 megawatts and larger, is still up for grabs, according to the report.

Solar-thermal advocates say the technology that uses the sun’s heat, instead of its light, to make electricity already is cheaper than photovoltaics today and could reduce costs further at larger scales. Because heat is stored more easily than electricity, solar-thermal plants also could make it easier to deliver power when it’s needed, regardless of when the sun is out.

The report predicts that solar-thermal will account for nearly 60 percent of all utility-scale installations, which will make up 7 percent of all solar installations in 2020.

Hurdles Ahead

Still, concentrating solar-thermal faces a number of challenges that it would have to meet to take market share from PV, said Travis Bradford, president of the Prometheus Institute and an author of the report.

For one thing, both solar-thermal and concentrating PV technologies only can use very direct sunlight, amounting to 60 to 80 percent of the light that standard solar panels can use, according to the report.

While those technologies offset that disadvantage with higher conversion efficiencies, meaning they can make more electricity with the sunlight they get, the fact that they need such direct light limits the locations where they can be cost-effective. In other words, solar-thermal and concentrating PV make more sense in latitudes with plenty of direct sunlight, while standard PV might deliver more electricity in latitudes with less direct light.

Wilder agreed that concentrating solar technologies are more site-specific, but disagreed that standard PV will necessarily be cheaper that solar-thermal in the long run, especially in large installations.

"That’s some Herculean hoping [to expect] that crystalline PV becomes cheaper long-term because, short-term, there’s no question that concentrating [solar-thermal] is cheaper," he said.

(According to the report, PV already is cheaper than solar-thermal in some locations today, such as in cloudy Seattle, while it’s more expensive in others, such as in sunny Tucson.)

Although PV costs have the potential to drop more steeply than concentrating solar-thermal costs, Wilder said he’s not sure that PV ever will be less expensive, per watt, than solar-thermal.

"Concentrating starts out fairly cheap compared to PV and can see some modest reduction in cost, while PV starts out significantly more expensive, but the hope for reductions are significant," he said. "I think PV will get down to grid parity for retail power. But what they’re talking about now is grid parity at the wholesale level, and I’m not convinced that crystalline or thin-film PV will for sure get to that kind of cost point."

[pagebreak:Concentrating Solar: Continued]

The main reason for his doubt is the ability to build large solar-thermal projects.

The debate about whether large fields of PV panels or solar-thermal equipment make more sense is not a new one (see Solar Desert Debate Heats Up and Large PV Gets Big Boost). But while some advocates contemplate that so-called "very large-scale" PV could one day include projects with capacities in the gigawatts, planned solar-panel parks today are not as large as some of the solar-thermal projects already underway.

"[Concentrating solar-thermal] is just more scaleable than PV; it’s just more easily scaled to 500 megawatts," Wilder said. "That would be an eye-popping big flat-panel plant. Using flat panels at utility levels is being done in Europe, but to a flat-panel solar farm, 100 megawatts is enormous. By contrast, it’s really no sweat to plan a 200 megawatt solar-thermal plant."

The largest solar-panel installation today is a 23-megawatt park in Spain, according to PV Resources, while Florida Power and Light is building a 300-megawatt solar-thermal plant using technology from Ausra (see FPL and PG&E Back Solar-Thermal and Ausra to Build 177-Megawatt Solar-Thermal Plant).

"It’s mainly a function of economics," Wilder said. "It would be bloody expensive to produce [that much] electricity using flat panels. It’s hard to say when and if that’ll happen."

Speed of Cost Fall Uncertain

The truth is, because concentrating solar power is still at such an early stage, with only a handful of examples online, it’s difficult to predict how quickly costs will fall, Bradford said.

"It’s a little easier to know what the costs of PV will be because it is already at scale, and some of these other technologies aren’t," he said. "PV is going to get cheaper than it is today, in line with our forecast in normal experience curves that we all understand. The degree to which CSP will be competitive with that will determine whether it can meet or exceed those cost improvements in PV."

Bradford said he thinks concentrating solar power will do well in the sunniest climates, as well as in applications where heat, as well as electricity, is needed. While the ability to store heat is an advantage today, the amount of that advantage will vary depending upon whether good electricity-storage technologies -- such as better batteries -- also emerge, he said.

"It’s kind of a race for that utility-scale market," he said. "There are advantages and disadvantages to each of the technologies, and one might be better than the others in particular types of locations."

But the key factor in determining which technology will dominate utility-scale installations will be cost, he said.

"The question about [solar-thermal] will be the dominant technology for utility-scale solar applications depends solely on its ability to get cheaper faster than PV, and that will be somewhat a function of how quickly it will be deployed and scaled up," he said. "CSP doesn’t just have to get cheaper than it is today, which it will, it has to also get cheaper than PV gets cheaper if it wants to continue to grow in market share."