Clean energy investment is shifting from developed economies to emerging ones, creating new opportunities for American companies in the process, according to a new report by The Pew Charitable Trusts.

The report found that clean energy investment is increasing not only in fast-growing countries like China, India and Brazil, but also in smaller emerging markets.

Countries in the Group of 20 -- including China, the United States, the European Union, Japan, India and Brazil -- accounted for more than 90 percent of global clean energy investment over the past decade. In 2011, investment hit nearly $275 billion.

That same year, developing countries brought in $13.8 billion, or 5.8 percent of the global total. In 2013, that figure increased to $16.7 billion, or 8 percent of the global total.

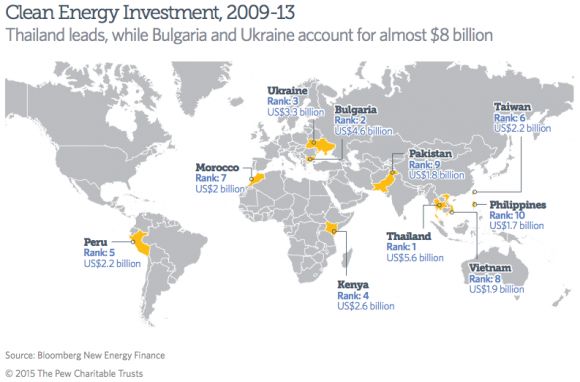

The 100 countries outside the Group of 20 and the Organization for Economic Cooperation and Development (OECD) attracted a total of $62 billion in clean energy investment from 2009 to 2013, according to Pew. Almost half of that investment ($27.9 billion) went into 10 markets, where clean energy capacity grew by 91 percent over the five-year period.

Thailand emerged as the leader of the top 10 emerging markets, attracting $5.6 billion in clean energy investments between 2009 and 2013. Bulgaria and Ukraine are the second- and third-largest, bringing in $4.6 billion and $3.3 billion, respectively. Unlike small countries coping with energy poverty, clean energy growth in Bulgaria and Ukraine is driven predominantly by the desire for independence from foreign energy suppliers, like Russia's Gazprom.

Kenya ranked fourth with $2.6 billion, and Peru ranked fifth with $2.2 billion. Taiwan, Morocco, Vietnam, Pakistan and the Philippines round out the list of top 10 emerging markets.

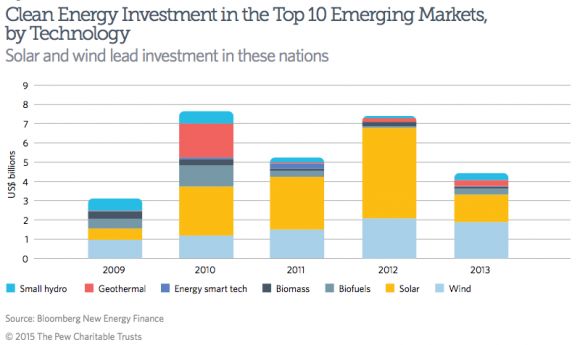

Fossil fuels continue to represent the majority of installed energy capacity in these countries (67 percent). However, new clean energy capacity grew by 91 percent between 2009 and 2013, while the deployment of fossil-fuel-powered plants grew by less than 10 percent over the same period.

The solar industry attracted the most investment of all renewable sectors at $12 billion, followed by wind at $7.7 billion. In recent years, the top 10 emerging markets have also seen $4.3 billion invested in geothermal, biomass and small hydropower.

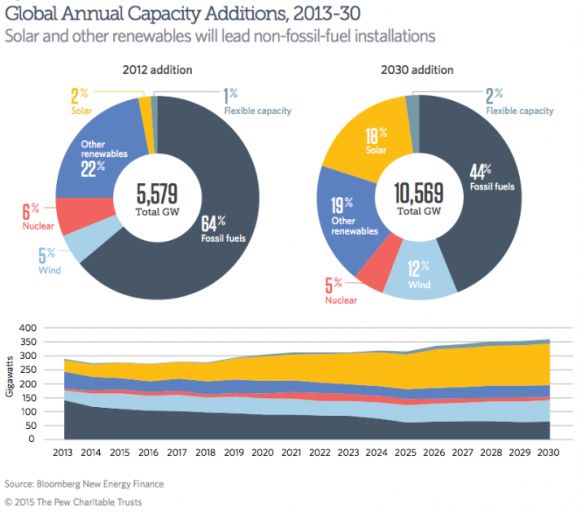

Overall, renewable energy is expected to provide the majority of all new electricity capacity worldwide by 2030 -- roughly 3,000 gigawatts of an estimated 5,570 gigawatts, according to Bloomberg New Energy Finance. Less than 30 percent of new capacity will come from fossil fuels.

This anticipated growth in clean energy could attract more than two-thirds of the $7.7 trillion worth of energy investment projected over the next 15 years.

Developing countries, collectively referred to as the “global south,” will account for more than two-thirds of all new energy demand by 2030. As a result, an ever-increasing amount of investment in solar and other renewables will likely flow into these economies over the same period.

The diversification of clean energy markets is sometimes cast as a competition for investment dollars, where countries either win or lose. A previous Pew report concluded that by capturing 29 percent of clean energy investment among G-20 countries in 2013, China had solidified its leadership in "the global clean energy race.” This narrative helps to create a sense of urgency, but arguably it's an overly simplistic approach that doesn't fully consider other economic, environmental and health issues surrounding investments in clean energy.

The new Pew report tells a different story. Rather than frame the shift in clean energy investments as a zero-sum game, Pew highlighted new opportunities created by the growth in scale and scope of the clean energy industry.

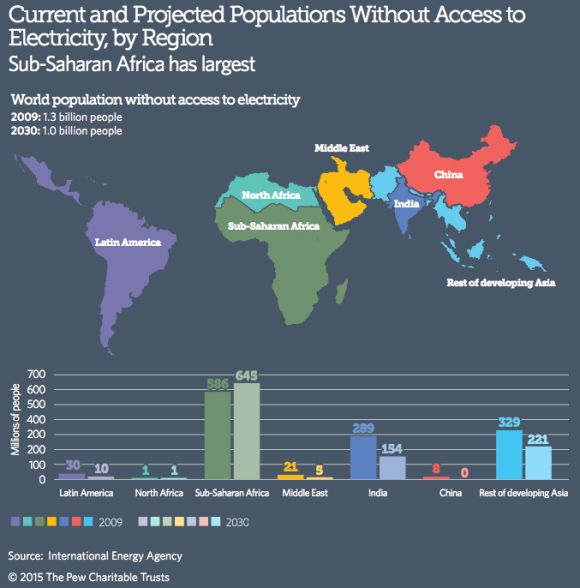

For one thing, more support for clean energy in emerging markets will help to end energy poverty, while securing a more sustainable future for growing nations. More than 1.3 billion people are considered to be “energy-poor,” defined as lacking access to modern electricity services, according to the United Nations. The vast majority of these people live in sub-Saharan Africa and Asia.

At the same time, the shift represents an enormous opportunity for American companies. The Renewable Energy and Energy Efficiency Export Initiative (RE4I), a collaboration between eight U.S. federal agencies, was designed to promote trade opportunities for U.S. clean energy goods and services. The U.S. needs to prioritize programs like RE4I in order to capitalize on this growth opportunity, according to Phyllis Cuttino, director of Pew's clean energy initiative

"A clear takeaway from our research is that emerging markets have the potential to be important export opportunities for clean energy technologies from the United States," Cuttino said in a statement. "With demand growing in coming years and decades, the United States should enhance its clean energy competitiveness and seize this new trade potential. Consistent policy prioritizing the innovation and deployment of renewables is essential."