Utilities have a new ally inside the solar industry amidst the battle over net metering and the true value of solar power.

First Solar has defended changes to net energy metering (NEM) proposed by Arizona Public Service, the state’s biggest electricity provider, with an editorial and filing at the Arizona Corporation Commission in support of the utility.

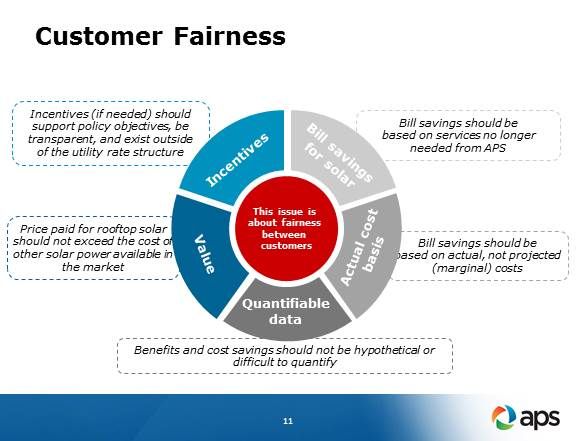

First Solar’s filing calls for “revising rooftop NEM programs” because there is an imbalance in Arizona’s treatment of solar due to “generous embedded subsidies asymmetrically provided to rooftop solar by NEM.”

In an op-ed last spring supporting the Arizona Public Service (APS) proposal, First Solar CEO James Hughes expressed support for the Corporation Commission's proposed change to “a very substantial ‘cross-subsidy’ funded by all other utility customers.”

APS is “right to seek the highest volume of solar power at the lowest cost to rate-paying customers,” he continued.

First Solar’s new filing contends that because of Arizona’s NEM program, “the total cost of rooftop PV on the utility system has become much higher than could have been foreseen, placing an unanticipated burden on utilities and ratepayers.”

Arizona’s solar policy should “fairly compensate for solar generation without discriminating among various solar applications,” according to Hughes.

First Solar is the biggest engineering, procurement, and construction contractor in the global utility-scale solar industry. It has approximately 30 percent of the U.S. utility-scale solar market, which in 2012 was 1,782 megawatts of the 3,314 megawatts installed, according to the GTM Research U.S. Solar Market Insight annual report.

Because First Solar does not do rooftop solar in the residential or commercial-industrial sectors and has yet to get its TetraSun high-efficiency PV effort started, it has little need for net metering. On the other hand, it has benefited greatly by support from utilities and approvals from regulators for its utility-scale installations.

“We face numerous difficulties in executing our Long-Term Strategic Plan,” First Solar’s last annual report states, including “difficulty in competing against competitors who may gain in profitability and financial strength over time by successfully participating in the global rooftop PV solar market, which is a segment we have deemphasized.”

“The more solar is produced on utility customers’ rooftops, the less utilities will buy from utility-scale power plants,” noted Dillon Holmes, President of Phoenix-based rooftop installer Cambio Energy. “I do not fault First Solar for having a desire to achieve solar success, but they have shown us that this is perfectly possible with current policies,” he added.

The First Solar filing argues its position is not “anti-solar.” The company, it suggests, is protecting solar. “The unforeseen economic impact of NEM may result in an indiscriminate backlash against solar of all sizes and types.”

With this filing, First Solar has taken the APS side in the debate about the costs and benefits of distributed generation and set the NEM issue up as a potential wedge between the distributed solar and utility-scale solar sectors.

First Solar is known for its aggressive business practices. In building its 230-megawatt Antelope Valley Solar Ranch One project in Southern California, the company’s limited willingness to respond to surrounding residents’ concerns made it the booming region’s most disliked developer, while NRG Solar, SunPower, MidAmerican Energy, SunEdison, and Recurrent Energy were building in the region at the same time with much less contention.

"First Solar's employees are surely going to leave en masse when they find out that their own company is leading the attack on the solar industry," a senior solar industry executive predicted privately to GTM.

Commenting on the Hughes op-ed defending the APS position on net metering, Clean Power Finance spokesperson Alison Mickey said the dispute between the two sectors “showed the solar industry has matured and is no longer just a scrappy little coalition fighting fossil fuels.” But the NEM controversy, Mickey observed, “hides bigger problems with the utilities’ fundamental business model. They have to decide whether they want to reinvent themselves from being providers of a commodity -- electrons -- to providers of services. Solar could be where they take their first steps to becoming service providers.”

First Solar and APS are now in agreement, Holmes noted, but “even the APS public relations folks aren’t daft enough to plainly state they simply want all the money associated with Arizona’s power production.”