Expect big things in coming years from the distributed market in Mexico. The market is growing rapidly and bringing increasing competition as low barriers to entry encourage new players to jump in. System prices have been falling aggressively over the last six months, and more installers are exploring quality, services and financing options. What's more, this is happening in a market without subsidies -- all in all, a very good sign.

Despite an impressive growth rate, however, the market is still small. Although there are more than 100 installers operating in Mexico right now, only a handful will have a pipeline greater than 1 megawatt in 2014, and most will be doing less than 500 kilowatts. There are many challenges in new markets, of course. But one particular ingredient has been lacking in Mexico: business models that can rapidly scale distributed generation.

That may be changing this year, with a new Hanwha Q CELLS project pursuing one of the market strategies that GTM Research recently profiled in the Latin America PV Playbook. In December 2013, Q CELLS signed a twenty-year PPA with Soriana, Mexico’s second largest retail company, for 31 megawatts of distributed solar in 120 locations throughout the country. Q CELLS and partner ILIOSS, a local EPC, began construction of the first seven sites in January 2014. It and the 20-megawatt Munisol project now being developed by Sonora80M will be the largest contracts for self-supply in the country.

Where is the market now?

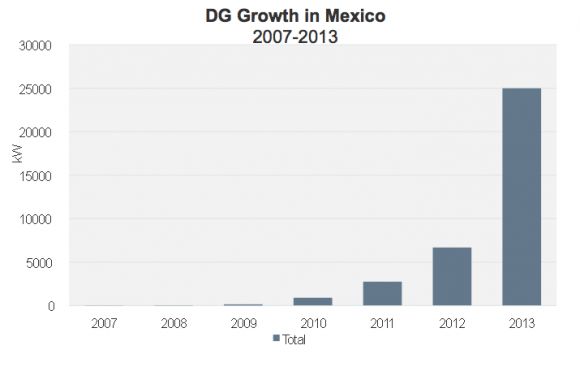

To understand the value of these self-supply business models, it helps to step back and look at the market fundamentals. Factors such as strong insolation, net metering policies, and high retail tariffs for some consumers have ensured that distributed generation has grown rapidly in Mexico, almost doubling every year. In 2013, the market experienced an unprecedented uptick, growing more than 370 percent and set to double in 2014.

Source: GTM Research, Latin America PV Playbook

This is impressive growth, but it still only adds up to approximately a 50-megawatt market for distributed generation. While some of this market is being driven by three installers with a national reach, most of it is coming from a wide array of regional installers with limited access to financing tools and a smaller workforce. These players have a very difficult time achieving meaningful scale due to longer sales cycles for each individual project.

How these business models work and why they matter

Simply put, aggregation is the future of the market.

The real advantage of the Q CELLS project is that it enables a large number of distributed PV projects to be contracted under a single twenty-year PPA with a sole creditworthy offtaker. This helps optimize both EPC margins and cost of capital through economies of scale, while simultaneously increasing the attractiveness of the project in terms of potential debt financing. Although Q CELLS is starting out by funding projects with 100 percent equity, it anticipates seeking debt financing and long-term equity partners for these projects in the near future. Because most individual projects are less than 500 kilowatts, Q CELLS also does not need regulatory approval in most cases from watchdog CRE or from the utility CFE.

The value in partnering with Soriana is clear. The retailer has nearly 700 locations across Mexico, creating a built-in market for expansion if the first 31 megawatts goes well. The stores are structurally similar, which would streamline the EPC process. The large number of stores ensures that Soriana has a balance sheet that qualifies it as a creditworthy offtaker, making that twenty-year PPA a valuable commodity while it is shopping around for financing. Soriana, of course, saves money by locking in a set rate for electricity across more than 100 of its stores while also meeting its sustainability goals.

There are a few key differences between this project and the Munisol project, which is a $75 million, 20-megawatt plant located in Sonora. The Munisol project uses a single solar farm and contracts capacity out to multiple offtakers, which include Ford Motor Company and several municipalities seeking to reduce their lighting costs. The advantages of this model are that the regulatory structure in Mexico allows developers to build a single, large project in a high insolation area (like Sonora) and then “wheel” the power at very low cost to offtakers anywhere in the country. The offtakers consume this power, offsetting their retail rates, and store the rest in an “energy bank” that can be sold off at the end of the year at 85 percent of the marginal cost at the nearest node.

There are a few disadvantages to this approach. Finding multiple offtakers has proven to be a challenge, as many in the market don't yet have a comprehensive understanding of solar. This is particularly challenging when some of the offtakers are municipal entities as opposed to high-growth, creditworthy corporations. Even with offtakers in place, the process of securing appropriate financing terms has slowed development on this project. Also, because direct sale of power is technically illegal in Mexico, the offtakers must form a single corporate entity in order to purchase the power.

As companies experiment with business models to scale distributed solar, we expect a potential upside in the distributed market this year. This comes at an important time for the PV market, since pending secondary legislation for energy reform has chilled the utility pipeline. Expect big things from the distributed market in Mexico. Our sense is that this is just the beginning.

Want to learn more about Latin American solar? Come join us at the GTM Solar Summit in Phoenix, where GTM analyst Adam James will be discussing activity in the market, including what's happening in Mexico.

***

For additional information, read the Latin America PV Playbook, the most comprehensive analysis available of the Latin American solar market. This product will help companies gain a nuanced understanding beyond just the fundamentals, focusing on the strategies that are working (and not working), as well as identifying innovative new approaches to market.