BOSTON — Siemens Gamesa, the world’s leading supplier of offshore wind turbines, recently revealed that it’s considering building a $200 million blade factory in Virginia’s Hampton Roads region — a potential cornerstone investment for the domestic supply chain.

That’s great news for the U.S. offshore wind industry, though New England officials could be forgiven for being less than thrilled with the choice of location.

An offshore wind jobs boom looks set to wash up on American shores. An analysis released this week by the American Wind Energy Association found that offshore wind could support 83,000 U.S. jobs by 2030, assuming the country builds 30 gigawatts by then and supply-chain investments are made quickly.

But where those jobs end up is still an open question. And it’s one that officials in New England — a region that includes Massachusetts, Connecticut, Rhode Island, Maine, Vermont and New Hampshire — may have reason to be nervous about.

New England is the cradle of the American offshore wind market and in many ways its spiritual home. It hosts the country's only operating project (Block Island, off Rhode Island) and its only tailor-made offshore wind port (New Bedford, Massachusetts). Many of the U.S. industry's most important companies are currently based here.

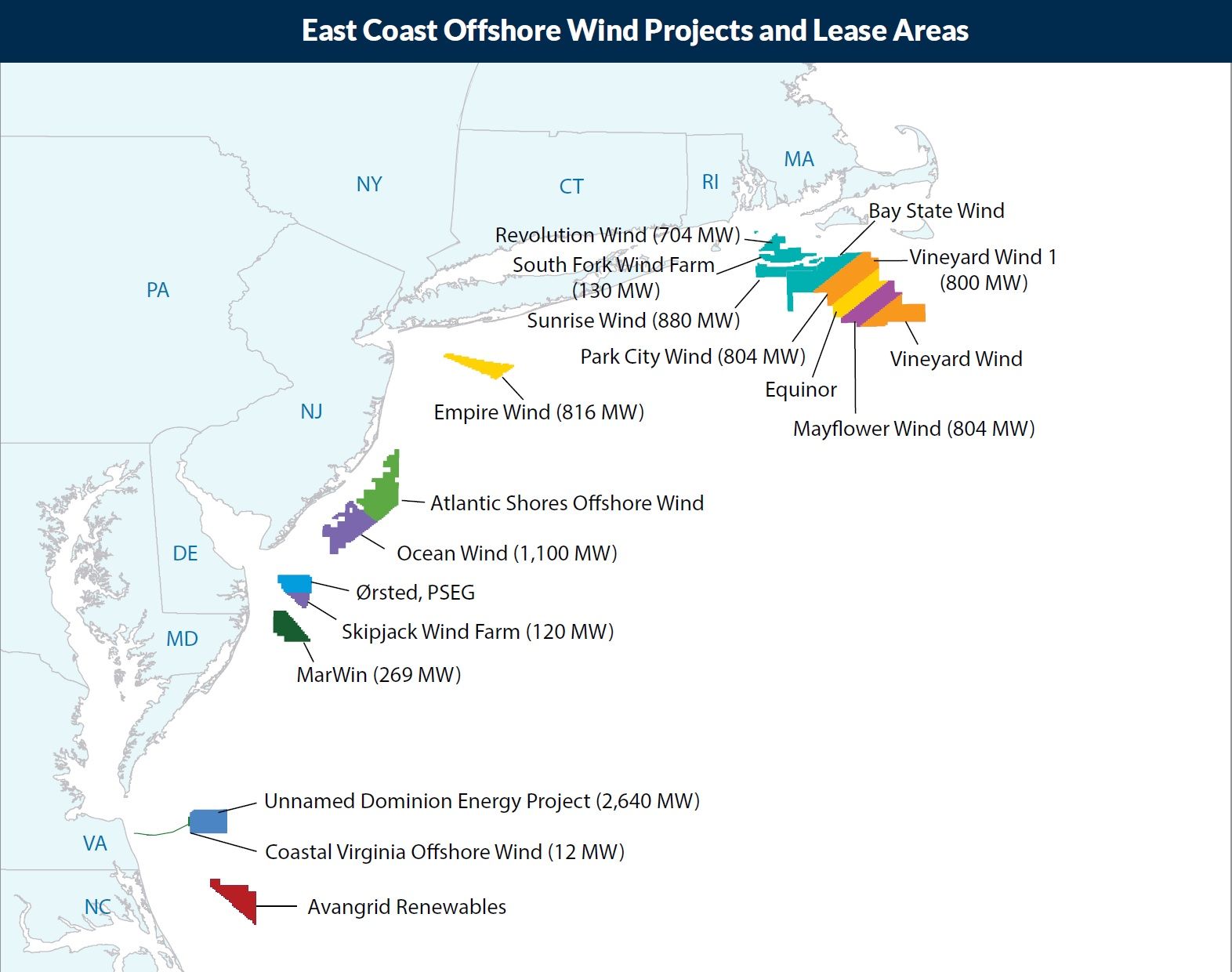

But the region’s future role in the industry — particularly in manufacturing — looks uncertain. Waterside space is tight in southern New England, where many projects are clustered. A number of states in the Mid-Atlantic region, where the population and electricity demand are far larger, now have much higher offshore wind targets.

“We do have a relatively higher labor cost, so it’s hard to compete with the Mid-Atlantic,” said Bruce Carlisle, managing director for offshore wind at the Massachusetts Clean Energy Center, speaking last month at an industry event in Boston. MassCEC operates the state’s offshore wind port in New Bedford, where it’s hoping to see more supply chain investment.

New England has a large cluster of projects, but the Mid-Atlantic has higher offshore wind targets. (Credit: AWEA)

Massachusetts, which boasts New England’s largest offshore wind target at 3.2 gigawatts by 2030, has chosen to emphasize low-cost power over local job creation. That’s helped to deliver headline-grabbing prices — $58 per megawatt-hour in the latest round — which in turn has spurred other states to embrace offshore wind. Whether it's an approach that delivers as many jobs as the state is hoping for remains to be seen.

In its latest procurement, Massachusetts’ utilities chose the “low-cost energy” option put forward by Mayflower Wind, a joint venture of Shell and EDPR. Other proposed projects had focused more heavily on local manufacturing.

The delay of the 800-megawatt Vineyard Wind project, originally slated for completion across two phases in 2021-2022, may also alter calculations for the local supply chain. Since Vineyard was unexpectedly hit with its delay last August, Dominion Energy confirmed plans for a 2.6-gigawatt project in Virginia, while New York and New Jersey have continued to add fuel to their markets.

Carlisle said he’s frequently asked whether Massachusetts should be doing more to incentivize in-state job creation through its offshore wind procurements. Speaking at the recent event hosted by the University of Delaware’s Special Initiative on Offshore Wind, Carlisle stressed that Mayflower Wind’s winning bid did come with “very significant economic development” commitments.

That said, “if I were the one picking the procurements, would I have picked the low-cost [project]? Probably not.”

A challenger emerges to the south

The biggest rival for jobs is the Mid-Atlantic, a region that loosely stretches from New York down to Virginia. The population in those states tends to be much larger than in New England, and some of them have more waterside space for factories, laydown yards and other critical offshore wind facilities.

By and large, the Mid-Atlantic got a later start in offshore wind, or, in cases like that of New Jersey, saw early efforts stall out. But over the past few years, the region has embraced the market with a passion.

Last week Virginia passed legislation mandating 5.2 gigawatts of offshore wind by 2034, and even before Siemens Gamesa’s announcement, the state was seen as a strong contender for future factories.

New York and New Jersey, meanwhile, now have combined targets totaling 16.5 gigawatts for 2035. New Jersey’s governor talks about his state getting half of its electricity from offshore wind by the 2030s. Both states are vying aggressively for jobs.

Maryland, too, looks set for an influx of investment in the port facilities around Baltimore. All told, the Mid-Atlantic now represents one of the largest future offshore wind markets in the world, making it a powerful draw for the supply chain.

The potential emergence of markets even farther south, offshore the Carolinas, adds to the lure of the Mid-Atlantic as a location for factories.

“What I worry about is the demand in the Mid-Atlantic. […] If you go farther south, the wind speeds aren’t as good, but they’ve got some pretty powerful procurements coming up,” Hilary Fagan, executive vice president for business development at the Rhode Island Commerce Corporation, said onstage at the Boston event.

Canada and Maine eye roles in the market

Even some regions without huge targets could begin to pick up jobs in the sector. Maine, for one, has no big projects in development today but is nevertheless hoping to carve out an early role in the market.

“We don’t think we have to wait [for our own projects] to be engaged in that,” said Dan Burgess, director of the Maine governor’s energy office, speaking at the Boston event.

Searsport, Maine holds promise as an offshore wind port, Burgess said. Searsport is no stranger to the wind industry: It’s already seen a gigawatt of turbines pass through its gates en route to onshore projects in Maine and Vermont, he said.

Maine, at least, is part of New England; even farther north, companies in Canada are starting to pay close attention to the market. Marine Renewables Canada, an industry group based in Halifax, Nova Scotia, held a U.S. offshore wind "readiness" workshop this week for interested Canadian companies.

Several ports in the provinces of New Brunswick and Nova Scotia could play a role, as could facilities as far away as Newfoundland. The troublesome Jones Act, which requires that any transportation of goods and equipment between American ports must be done by U.S.-flagged vessels, could work to Canada’s advantage.

Elisa Obermann, executive director at Marine Renewables Canada, said the intention of Canadian companies is not "competing for potential opportunities" with American ports. Instead, the focus is “looking at where there may be gaps" and how Canadian firms "could support early U.S. offshore wind projects as they ramp up," she told Greentech Media.

“We have in Canada, especially in Atlantic Canada, a number of companies that have capabilities from working in related marine and offshore sectors — predominately the offshore oil and gas sector.”

A big pie to slice up

Many in the offshore wind industry still diplomatically downplay tensions that the competition for future jobs may engender. The market looks set to go from no pie at all to a very big one, leaving lots of pieces to go around.

“Unless we really screw it up, I think we’re all going to win," said Fagan of the Rhode Island Commerce Corporation. "If we can get the talent and supply chain here [in New England], I think we could probably benefit from the demand down there,” she said of the Mid-Atlantic market.

Even if New England were to miss out on some of the big factories, it would almost certainly remain a central hub for parts of the industry, particularly white-collar jobs: developers, engineers, financiers. Last week Denmark’s Ørsted, the world’s leading offshore wind developer, opened an “innovation hub” in Providence, Rhode Island.

“People look at landing a blade factory or a tower facility as the ultimate goal, and yeah, it would be great,” said Carlisle of the MassCEC. “But let’s shift our perspective a little and look at all the engineering, innovation, R&D, all down through our marine network supply base."

"There’s going to be plenty of activity to go around," Carlisle said. "The supply chain is going to grow and take hold here. We are going to be one of the regions people are going to look to for that expertise."