For years, China and the West drew a clear boundary in the global auto industry: Western auto giants dominated the technology and designs, while the Chinese companies focused on the manufacturing.

Today, however, Chinese auto entrepreneurs strive to drive across that boundary with narrowing technological gap in alternative energy cars, but translating their technology progress into commercial success -- for domestic consumption and export -- is a mission that could take time.

China's top battery maker BYD, backed by U.S. billionaire investor Warren Buffett, will serve as an early test case on how well or rapidly the West will adopt Chinese cars with a plug-in hybrid and ambitions to go all-electric. BYD also has development deals with Daimler and Volkswagen. Coda Automotive, which has developed a car that relies on Sino-U.S. technology and know-how, will be another. Coda plans on selling all electric cars to U.S. consumers this years.

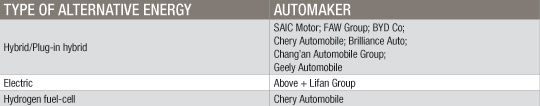

For instance, China's largest auto producer SAIC Motor is about to sell the Roewe 750 hybrid vehicle in the second half of this year. In 2012, the company will launch commercial sales of the Roewe 550 plug-in hybrid vehicle and a self-developed pure-electric vehicle.

More green cars are expected to go online soon. According to the government plan issued in 2009, China's alternative energy vehicles -- pure-electric, plug-in hybrid, and hybrid -- should reach a total of 500,000 units of production capacity by 2011.

If these companies succeed, others will follow. India's Reva, meanwhile, is targeting Europe with its small, inexpensive electrics.

In part, this strategy is driven by two factors: a concerted push by the government to create an electric car industry and a lot of experience with batteries. Thanks to its strong advantage in making batteries, a core component of alternative energy vehicles, BYD's electric and hybrid cars can beat many foreign cars of its kind in terms of better performance and cheaper prices, argues Scott Laprise, auto analyst from CLSA Asia-Pacific Markets, an independent brokerage and investment group in Hong Kong.

"BYD's F3DM [a plug-in hybrid] should be as good as the Chevy Volt. I would say the Chevy Volt has no chance [to compete]," comments Mr. Laprise, who just submitted a personal purchasing order on F3DM, an electric-hybrid vehicle much like General Motor's upcoming Chevy Volt.

Last year, BYD sold more than 100 F3DMs to the local government of southern China's Shenzhen community, a move to help the city cut carbon emissions. Currently, the company offers its newly developed plug-in hybrid vehicle, the upgraded F3DM, to mass consumers in China at RMB 169,800, or US$24,800.

"This is an opportunity for Chinese car manufacturers to close the technology gap," said Klaus Paur, director at TNS's North Asia automotive division, a U.K. market research firm.

Others are a lot less enthusiastic. Sujeet Kumar, CTO of battery company Envia Systems, notes that the major international car makers have opted for Japanese, Korean or U.S. lithium batteries for their cars. None of them use Chinese batteries because, he argues, Chinese manufacturers remain a decade behind in attaining the level of quality control that is necessary for automotive manufacturing. Days after Kumar told us that, a deal seemed to confirm it: Chinese auto parts supplier Wanxiang signed a joint venture with Indiana's EnerDel to produce batteries for electrics.

Historically, it has taken car manufacturers years to master styling, quality and branding. South Korea's Hyundai found early success with its inexpensive cars, but quality control issues -- and the resulting word-of-mouth -- caused a quick reversal. Additionally, most Chinese companies used to serve low-end markets, so they may need time to adjust their sales strategy for high-cost alternative energy cars. One well-regarded reviewer, Wayne Cunningham, characterized Coda's car as being "basically ugly."

Chinese companies also may not enjoy a huge cushion in pricing. BYD has been planning on coming out with an all-electric as well, but the early price is estimated to be $40,000, substantially higher than the $32,800 (pre-tax-incentives) price tag of the Nissan Leaf. Ford will also come out with electric cars and base them on a global design platform that will cut manufacturing costs.

And, of course, all-electrics aren't easy to develop. Embarrassingly, BYD had to scale back plans to start producing all-electrics this year. Now, it will make a few test vehicles for a taxi service and monitor the results before committing to wider production.

Either way, China's leaders are placing their bets on this segment, both for domestic consumption and export, and are looking for ways to boost its development. Along with setting up R&D funds, the government also offers subsidies to local authorities and transport companies that purchase alternative energy cars. The subsidy for each hybrid, electric and fuel-cell car is up to RMB 50,000 (US$7,352), RMB 60,000 (US$8,824) and RMB 250,000 (US$36,765), respectively. A number of companies showed off prototypes at the Beijing Auto Show.

Another option for Chinese manufacturers: Western big brothers. Just as Legend (now Lenovo) got help from multinationals like Acer and IBM, so too will Chinese car markers. Coda's car is based around a gas-burning car that is now sold in China. However, a substantial portion of the electronics and much of the quality control engineering used in the design comes from the U.S. Similarly, Mission Motors, which has created an all-electric motorcycle, is in the process of signing deals with Chinese motorcycle makers. EcoMotors, which has created a very efficient engine that can burn diesel or gas, is also trying to set up joint ventures and/or licensing arrangements with Chinese car makers.

Still, expect a long and winding road.

"It [the idea of selling the E6 in the U.S.] is already quite successful," TNS's Mr. Paur pointed out. "But if you say its commercial success will come quickly, I would have my doubts."

***

Michael Kanellos contributed to this report.