While the move toward a Western regional grid stalled in the California legislature this fall, the discussion is not over.

Regionalization was a topic of discussion at the California Independent System Operator (CAISO) annual symposium earlier this month in Sacramento.

Bills to enable CAISO expansion were pushed back to the very end of the legislative session, due to a large amount of legislative time spent on extending cap and trade, according to CAISO Board of Governors member David Olsen.

“There just wasn’t time for consideration of all the concerns about California losing control of governance and the ability to set procurement policy,” he told GTM. “There were no public hearings. That can’t be done in the last week of a legislative session.”

Olsen says he is still optimistic about the bill moving forward in the next session, though there are no current plans yet. “We will address criticism and shortcomings” of the current bill, he said.

“The benefits [of regionalization] are clear and people understand that, but there are some mistaken perceptions,” he said. “Like that it leads to greater control by a Trump FERC. That is not true; we are already covered by FERC.”

Governance

“The main stumbling block in the legislature, I believe, is undefined governance,” said Jay Dickenson, chief consultant to the Senate energy committee. “It is not clear what authority California would be giving up to the regional body, which makes it very hard for the legislature to agree to give up that authority.”

Olsen thinks the discussion might lead to a truly independent board, not chosen by California Governor Jerry Brown or any other governors. “CAISO is the only ISO that has a politically appointed board, and FERC hates it,” he said.

Others question the need for legislation at all, arguing that CAISO, as an independent nonprofit organization, can adjust its own policies as needed.

“CAISO doesn’t need any new authority to allow new members,” pointed out CPUC Chair Michael Picker, in an interview. He notes that a Nevada utility, Valley Power, is already a full member of the CAISO balancing area. A Nevada representative could be on the CAISO board, he suggested.

“Harry Reid would be a good choice, and the legislature would probably confirm him,” he mused, referring to the former majority leader of the U.S. Senate.

“In any case,” said Dickenson, “regionalization has been Governor Brown’s project, so I would assume the next move is his.”

Benefits are clear

Meanwhile, CAISO continues to prove the case for regionalization through a regional Energy Imbalance Market. The EIM allows for energy trading in real time to procure the “final few megawatts of power to satisfy demand within the hour it’s needed,” according to CAISO.

Oregon’s Portland General Electric became the fifth utility to join it, starting this month. The EIM, which has generated cost savings of over $254 million since November 2014, now serves over 38 million consumers in eight Western states, about 46 percent of the load in the WECC region.

Six more utilities are in the queue to join the EIM over the next few years, including Idaho Power, the Los Angeles Department of Water and Power, Seattle City Light, the Sacramento Municipal Utility District, Powerex (BC Hydro), and the Salt River Project in Arizona, according to CAISO spokesperson Steven Greenlee.

With all of these utilities joined, by 2020 the EIM will cover about two-thirds of WECC load.

But the EIM is just a start. A day-ahead energy market would allow more opportunities to share resources, to spread variability over a bigger area, to export the state’s renewable energy production, and to bring in resources from out of state.

“The ISO remains committed to a regional market,” said CAISO's Greenlee, in a statement. “The EIM has only provided a modest glimpse of the benefit that a centrally optimized day ahead market could produce. Our studies into a regional market found it would create benefits up to $1.5 billion per year by 2030.”

“The success of EIM was that people can ease into it,” pointed out Picker during the symposium, “so maybe that’s the way to go.”

“The EIM is like living together before you get married, then you get married and buy a house," he said.

Strategy paper

Olsen, the CAISO board member, recently led the drafting of a strategic discussion paper for the board, with input from the CAISO management. “There is a strong alignment of the board and the staff now,” he said. “That wasn’t always the case.”

The paper discusses eight “trends and tasks for the coming years,” including regional collaboration.

“Sharing resources across the western U.S. reduces the number of power plants needed in each state, saving money and emissions,” the report states. “Collaboration improves reliability, drives down costs and minimizes transmission needs.”

In the future, “we will require ready access to a much larger pool of [renewable] resources than is available in California alone. [...] Trading these diversified resources benefits all states.”

The CAISO board sees a future where “procurement remains each state’s prerogative, as established in the Federal Power Act. Cooperative planning among state commissions, [load-serving entities] and [regional system operators] optimizes meeting Resource Adequacy needs on a regional basis.”

Learning from other regions

Former Iowa regulator Libby Jacobs, now a consultant, underscored the state-regional relationship in her remarks, pointing out that being part of the Midcontinent ISO (MISO) was not an impediment to individual states in the Midwest making their own policies.

In fact, MISO uses state policy as a basis for long-term planning. To develop a set of transmission lines known as Multi-Value Projects, MISO tallied up the amount of renewables called for in state RPS laws, estimated their likely location and production, and plotted new lines to enable them.

“If we had started the conversation without CAISO in the picture, it would have been an easier conversation. There’s got to be a way to reframe the conversation around the economic benefits that will come from this, and push aside the more parochial considerations," said Steve Chadima, senior vice president for external affairs at Advanced Energy Economy.

“The political aspect is the one that could trip us up,” he said.

But according to Carl Zichella, head of NRDC's Western transmission efforts, “I don’t think we’re that far apart."

"There are transitions [underway] that are in everyone’s interest to make the most of. But certain tenets need to be observed, like independence. There is a common interest in not transgressing against each other’s sovereignty.”

Picker thinks coal politics are an important issue for whether states will join with California in a regional ISO.

“I stay up at night thinking about coal miners losing their homes and cars, becoming climate refugees,” he told GTM in a side interview.

At the same time, he notes, coal retirements create new opportunities by freeing up transmission lines. The demise of the huge Mohave coal plant in southern Nevada has opened up a path for New Mexico wind to reach California.

“Maybe there will be two ISOs,” he said, “including one for states that have had too much coal job loss that they can’t join California. Like Montana, where cheap renewables have carved the heart out of the coal industry.”

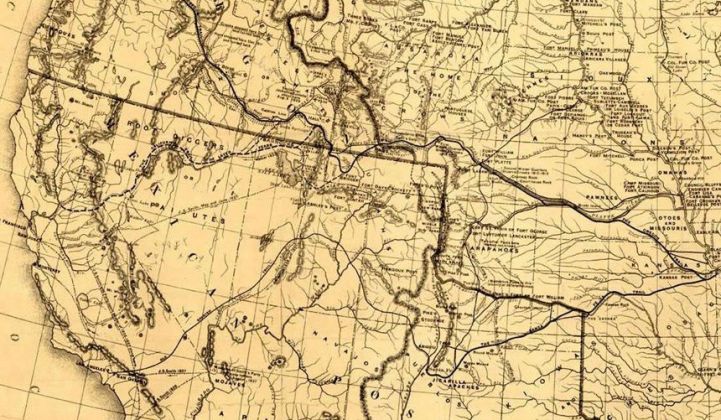

Picker thinks this may drive some utilities to join Mountain West, a coalition of 10 power providers with 6.4 million customers and 16,000 miles of transmission line east of the Rockies.

“There’s a natural geographic dividing line, the Rockies and the Great Basin.”

Mountain West announced last month that joining the Southwest Power Pool “would provide opportunities to reduce customer costs, and maximize resource and electric grid utilization,” and that it “intends to commence negotiations with SPP through a public stakeholder process” starting in October.

***

Come join us for GTM's first annual U.S. Power & Renewables Conference in November. You'll get an in-depth look at how the renewable energy market will interact with the U.S. power market, and how those interactions can impact overall industry development and market growth. Curated by GTM Research, MAKE and Wood Mackenzie energy analysts, we’ll take an expansive view of key issues and timely topics, bringing together a diverse group of energy experts and stakeholders to discuss demand dynamics, economics and business model shifts, and policy and regulatory implications.