In 2009, Switch Automation started developing an energy monitoring device for apartments in Australia. But the company eventually decided the hardware model wouldn’t scale.

“You could see the writing was on the wall,” explained Deb Noller, Switch’s CEO. “It was too complex.”

In 2011, Switch reinvented itself, moving into a space with fewer deployment barriers and almost no capital barrier: up into the cloud.

“There was a giant shift in the way companies were going to make money,” said Noller. “Everything was going to the cloud.”

Indeed, the shift is well underway in the energy efficiency and smart grid space. Most of the major companies in the building controls sector are developing energy-management software for the cloud. EnerNOC, Honeywell, Johnson Controls, Schneider Electric, Siemens, and many others have developed their own software-as-a-service products. And emerging companies like Hara, FirstFuel, Noesis and Retroficiency have also developed web-based monitoring tools for building efficiency.

It’s starting to get mighty crowded up there in the cloud with all those fancy dashboards.

After deploying its software at five apartment buildings and three dozen commercial sites in Australia, Switch Automation is now trying to break into the U.S. market.

So how is the company trying to differentiate itself amidst the flurry of activity in the U.S.? Green buildings.

“There's a heap of companies developing dashboards, mostly based on utility data reporting. But we’ve really honed our market focus. For now, we’re focusing on green buildings and companies that need to do regulatory reporting,” said Noller.

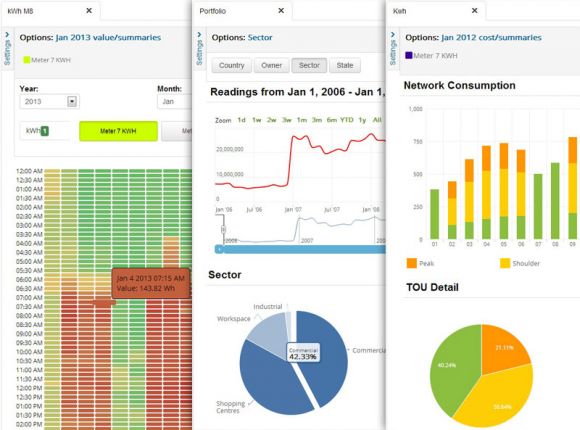

Below are some screen shots of the company's web-based software, built on HTML-5, which monitors all types of building management systems and utility meters:

As it moves into the U.S., Switch is targeting building managers who are specifically focused on sustainability -- either through managing an already "greened" facility or helping meet regulatory requirements for sustainability. (This is partly why the company is making progress in Australia, where there's a carbon tax). The software monitors electricity, heating, water, carbon emissions, and spits out a range of other data. The software also sends out reports to different groups of people within a building (apartment tenants or office workers, for example) with any alerts or messages on how well their area is performing.

But green buildings are only the start for the U.S. market. Switch wants to eventually focus on any type of building where the product makes sense.

"Ultimately, I don’t care about regulation; I care about saving energy and saving money," said Noller. "If we can’t make a difference, then what are we doing?"

Software might have been easier for Switch to develop than a piece of hardware. But there are still major barriers to deployment. Finding the right ally -- electrical contractors, building managers, or companies with large building portfolios -- is the most difficult piece of establishing a business channel in the U.S.

"There’s a giant leap from old school to new school in this area," said Noller. "We just have to find the right person or company to get those initial projects off the ground."

Which is why focusing on green buildings -- facilities where management is more likely to be progressive about energy efficiency -- makes a lot of sense for now.

The other barrier is competition. With so many corporate heavyweights developing similar cloud-based products, Switch will need to prove it has a unique offering.