Southern California Edison has just revealed the winners of a massive 250-megawatt energy storage procurement, one that could set new standards for incorporating distributed and customer-owned energy assets into grid operations.

On Wednesday morning, SCE announced contract winners for its Local Capacity Requirement (LCR) RFO, a long-term plan to bring about 2,200 megawatts of grid resources on-line by 2022 to help the Los Angeles and Orange County regions make up for the closure of the San Onofre nuclear power plant.

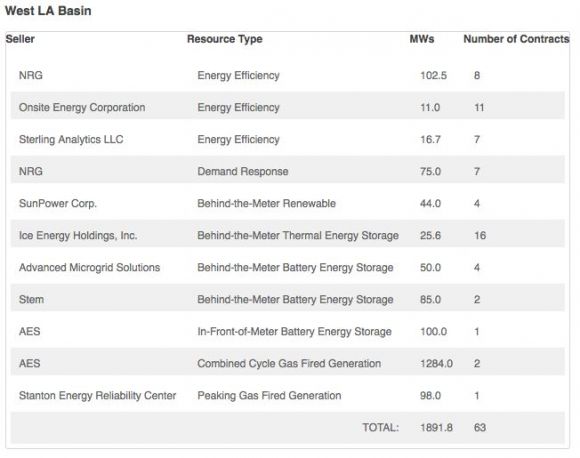

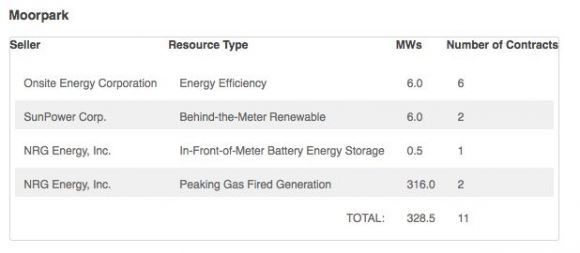

Wednesday’s RFO selection list includes eleven companies with a combined 74 contracts to provide a total of 2,220 megawatts of “incremental capacity” for its West Los Angeles Basin and Moorpark areas. Much of that new power will come from natural-gas-fired power plants, as SCE’s selection list makes clear.

But there are also lots of “preferred resources,” including renewable energy, energy efficiency, demand response -- and an outsized amount of distributed and grid-connected energy storage. SCE was required to get at least 50 megawatts of energy storage under the terms of the LCR. But it ended up signing contracts with parties promising to deliver five times that amount.

The biggest winner there is AES Energy Storage, which will build a 100-megawatt “in-front-of-meter” battery system in SCE’s West Los Angeles Basin region, further cementing its lead as the nation’s biggest grid-scale energy storage provider.

But there’s even more distributed, behind-the-meter energy storage in SCE’s mix, including 85 megawatts of behind-the-meter batteries from startup Stem, and another 50 megawatts of battery-centered “hybrid electric building” projects from stealthy startup Advanced Microgrid Solutions. (We will be covering details of both projects later today.) Another 25.6 megawatts of thermal energy storage will come from Ice Energy, a startup that turns rooftop air conditioners into load-shifting assets.

No utility has made such a big investment in customer-owned, distributed energy storage assets of this type before, making this a step into the unknown on the part of SCE. The LCR process will set up power-purchase-agreement-type structures with the contract winners, providing them a guaranteed revenue stream.

Financial terms of the contracts weren’t disclosed, however, making it hard to measure the costs of the various energy storage projects against competing resources. In the meantime, California regulators are still working out the complex details about how behind-the-meter energy storage assets will be rate-based and compensated for their grid services in the future.

California’s groundbreaking mandate to procure 1.3 gigawatts of grid energy storage by 2022 will need projects like these to prove that behind-the-meter distributed assets can be relied on, just like big central power plants are today. By year’s end, the state’s big three investor-owned utilities -- SCE, Pacific Gas & Electric, and San Diego Gas & Electric -- are required to submit their plans for signing up about 200 megawatts of cost-effective grid storage for the first round of procurements to meet this mandate.

Here's the complete list of contract winners, broken out by the two sub-regions SCE has targeted for grid support: