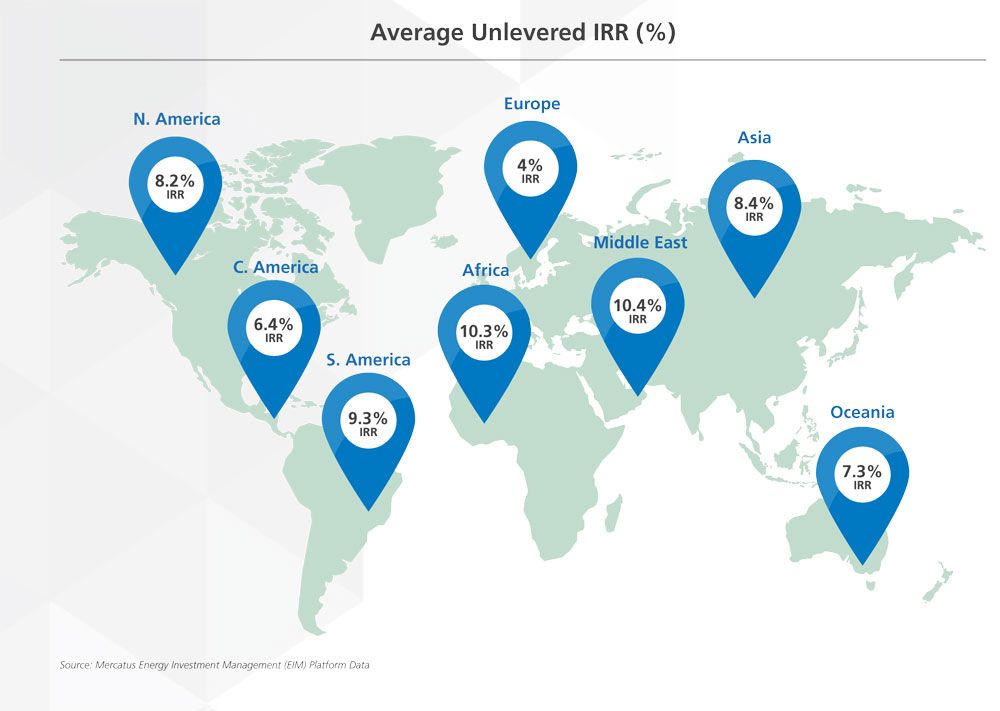

The rate of return for solar projects in most of the developing world is more than double the rate in Europe, according to new data from Mercatus.

Mercatus offers digital renewable energy deal assessment software that hosts more than 80 gigawatts of renewable energy projects. Using data from the global portfolio of projects on its platform, Mercatus’ findings support the trend that emerging markets are now the leader for clean energy investment.

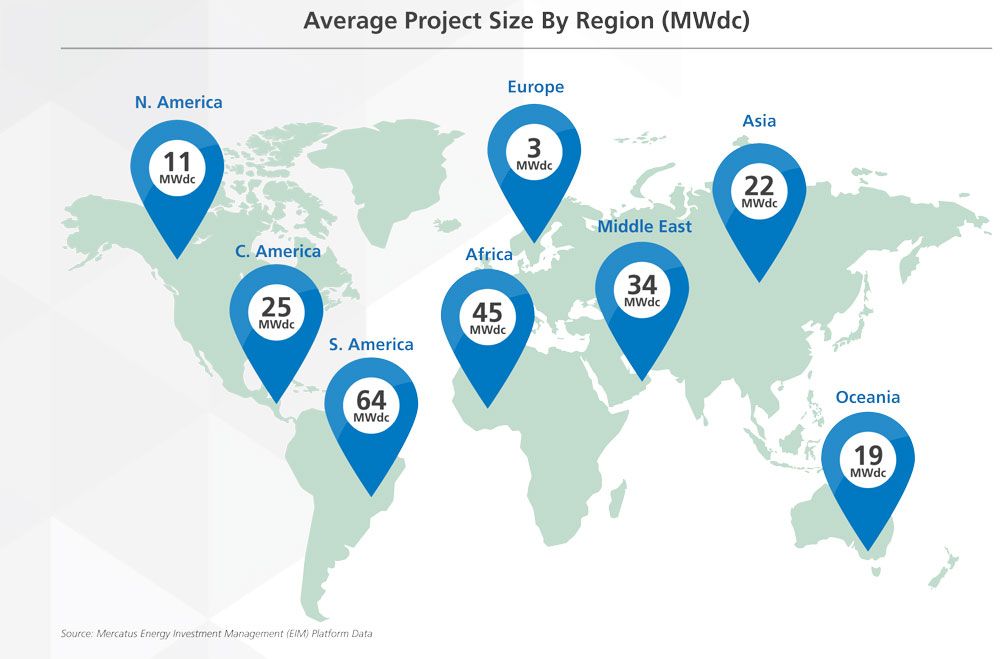

Utility-scale projects, the bigger the better, are the hallmark of renewable projects in emerging markets when compared to smaller-scale solar installations in developed nations, according to Mercatus. South America, for instance, had an average solar project size of 64 megawatts, compared to 11 megawatts in North America and 3 megawatts in Europe.

It’s not just the size of projects on the Mercatus platform that is larger. The average return for projects in emerging markets is significantly higher than in Europe, and markedly higher than in the Americas.

The average solar project in Africa and the Middle East in Mercatus’ platform brings an average rate of return of over 10 percent, more than double the 4 percent figure in Europe.

“If there was an exchange-traded fund for these developing world projects, I think discerning investors would seriously consider buying stock,” Haresh Patel, CEO of Mercatus, said in a statement.

Market maturity and fierce competition keeps returns lower in Europe, the report says. In emerging markets, there is growing electricity demand, but also numerous risks, particularly associated with offtakers, which makes the projects less attractive for development and pushes returns higher.

“Maintaining a clear picture of ongoing business risks in emerging markets contexts becomes imperative,” the report states, “but can be challenging given increasingly complex operations dispersed across geography and technology.”

The overall megawatts installed are still small in many emerging markets, but the growth potential is huge. In 2015, Bloomberg New Energy Finance found that South Africa’s clean energy investment climbed to $4.5 billion -- up more than 300 percent.

And Morocco pumped more than $2 billion into renewables last year, up from virtually no investment in 2014. Mexico and Chile also saw triple-digit growth rates.

Those growth rates should be coming to other countries too. Jordan has a goal of 10 percent of its electricity from renewables by 2020, and India has a goal of 100 gigawatts of solar by 2022.

In India and other countries, Mercatus found that companies were beginning to diversify not only in terms of geography, but also in technology. Wind companies are investing in solar and vice versa. In India, wind turbine supplier Suzlon just announced it will acquire five solar firms for future projects, according to PV Tech.

India was spotlighted in the report as a country to watch given its solar target, but also keep an eye on Mexico, according to Mercatus -- and not just for solar, but wind too. Brazil could develop up to 6 additional gigawatts of wind in the next two years.