Bigger is almost always better in the wind industry, even if it means difficult logistics.

That's the key takeaway from a new report on next-generation wind turbines from MAKE Consulting. The research shows global onshore turbine size increasing at a 3 percent compound annual growth rate between 2012 and 2022, as original equipment manufacturers seek to extract every ounce of potential from the wind resource.

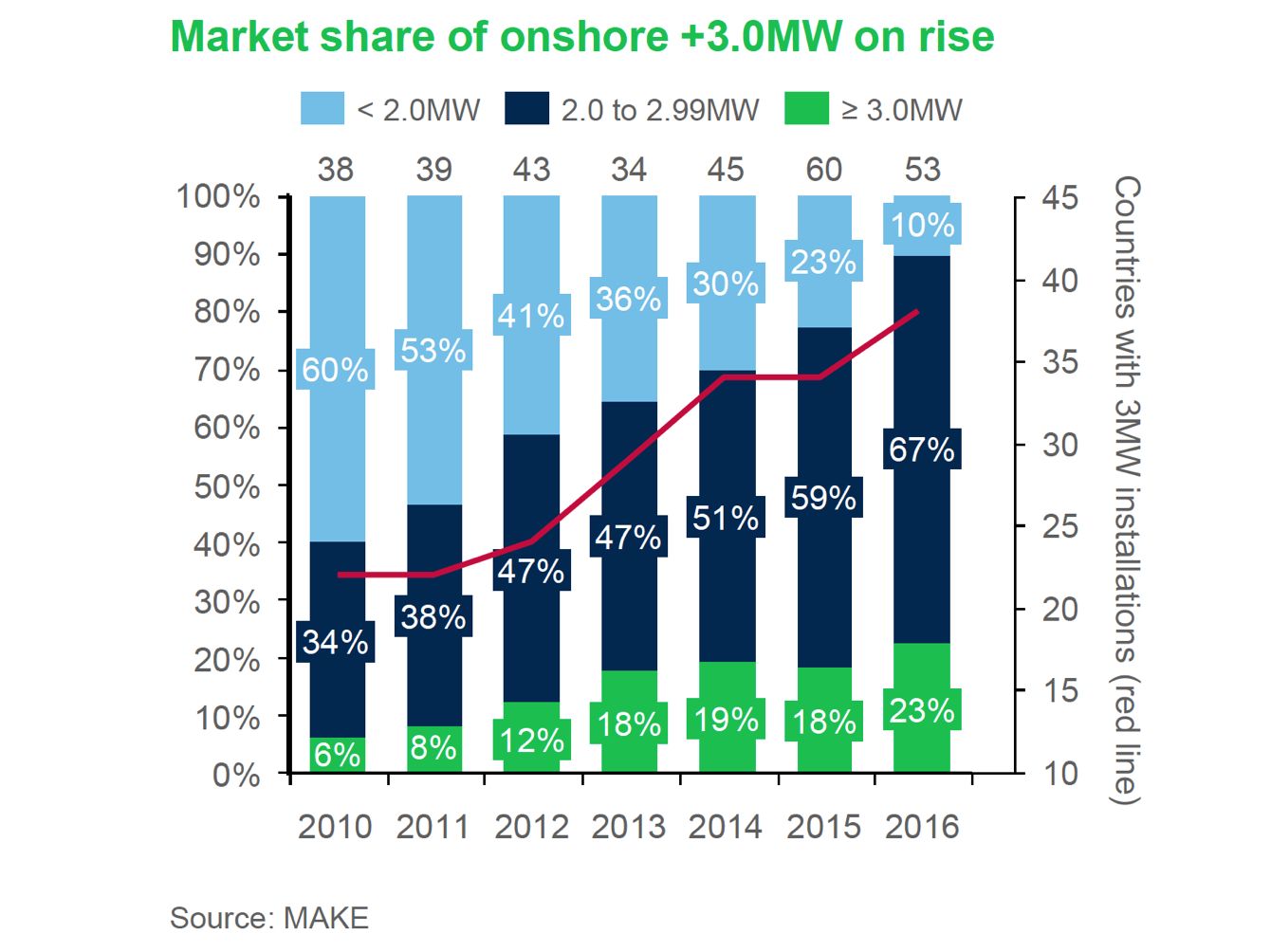

The proportion of larger turbines entering the market has grown steadily since 2010. Back then, 40 percent of onshore machines were 2 megawatts or larger.

Last year that proportion had risen to 90 percent, with 23 percent of onshore turbines at 3 megawatts or more.

The move to larger models is being led by Europe, which is heading into the 4-megawatt space. It's also being pushed by emerging markets that are bypassing sub-3-megawatt machines altogether.

In 2016, 3-megawatt platforms had been installed in more than 38 markets. “Wind class migration is expected to continue as new models are introduced [and] older products receive wind-class upgrades," reads the report.

Rotor size is the most important differentiator for new onshore products, according to report author Shashi Barla. However, the way OEMs mix and match power ratings and rotor sizes varies from one company to another.

Vestas, for example, offers six rotor diameters for its 2-megawatt machines and four for its 3-megawatt platforms.

GE, in contrast, reuses the same rotors across differently rated machines. Its 100-meter rotors can be fitted to turbines from 1.6 megawatts to 2.85 megawatts, for example, while its 103-meter blades can be fixed on 1.7-megawatt up to 3.2-megawatt products.

Regardless of the approach, the goal is to reuse components where possible, so an OEM can cut costs and shorten development cycles.

The larger rotors help wind-farm owners scoop more energy from suboptimal sites, which are increasingly the norm in maturing markets where all the prime spots have already been taken.

The limited availability of high-wind sites worldwide is reflected in the number of onshore turbine products available for different wind-speed classes.

MAKE counts just 20 products suited for the International Electrotechnical Commission (IEC) Class I conditions, with annual average wind speeds of 10 meters per second.

For medium wind, or IEC Class II conditions, there are at least 42 products, along with another 40 for IEC III. High-wind turbines are “not a focus for new platforms due to diminishing resource,” MAKE concludes.

Besides increasing rotor diameters, another way to improve production at less-than-ideal sites is to reach the stronger, steadier winds that occur at higher altitudes.

While a 10 percent change in power rating or hub height has a less significant impact on energy production than an equal increase in rotor diameter, MAKE expects growth in tower heights to intensify.

By 2020, developers will be installing almost 2,400 towers of 120 meters or more a year, says the firm, compared to fewer than 1,000 installations of these models in 2014. Bigger blades and towers, though, are more difficult to move around.

One way to address this issue would be to split up each blade so it could be transported in pieces and snapped together on site. “But OEMs remain reluctant to push commercialization of modular blades due to cost [and] complexity,” the report observes.

And bigger turbines are not necessarily the best option in every market.

While in European and Latin American markets, it makes sense to go for big products to maximize farm-level production, in the U.S. and China, for example, smaller machines may be required to cope with the capacity of grid interconnections.

None of this applies at sea, where turbine power ratings, rather than rotor spans, are the primary product differentiator for OEMs.

Whereas 82 percent of offshore turbines ordered between 2001 and 2005 were under 3 megawatts, today there are no machines of that size on order.

Instead, 71 percent of orders are for products 5 megawatts or greater, and 16 percent are for turbines of 8 megawatts or greater. “Despite long project cycles and R&D timelines, commercial demand continues to favor the largest turbines,” says the report. “The next generation of 12-megawatt-plus turbines will gain market share within the next five years.”

Editor's note: MAKE Consulting is owned by GTM's parent company, Wood Mackenzie.