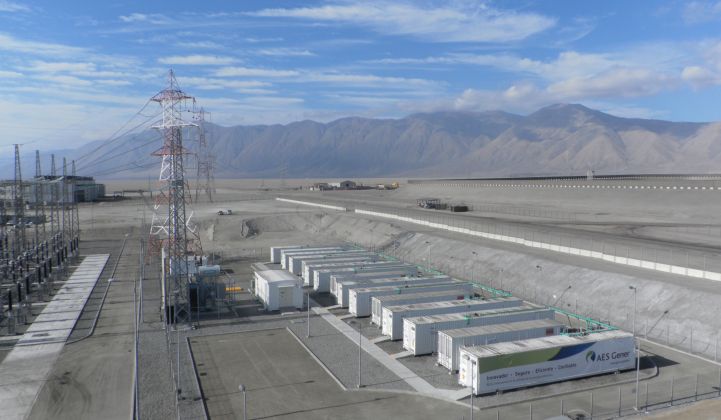

Peak power substitution involves the use of storage to replace simple cycle gas-fired “peaker” plants. In March 2014, AES Energy Storage launched a new modular energy storage solution capable of cost-effectively replacing some peak power plants. Called Advancion, AES’ solution uses lithium-ion batteries.

On a global basis, about 30 gigawatts of new peaking capacity are added each year to keep up with population growth and increasing electricity demand. At an average cost of $1 million per megawatt for a gas-fired peaker, AES Energy Storage can now penetrate a $30 billion annual global market. Coal plant closures will further accelerate market opportunities for Advancion, which is aimed at replacing old fossil plants that primarily provide reliability in city load pockets. These plants are often located in inner cities where there is an air emissions compliance issue. Substituting zero-emissions energy storage is ideal in those locations.

AES’ nominal configuration for Advancion is a 1-to-4 power-to-energy ratio; in other words, each megawatt of storage will be capable of discharging for four hours. Surveys show that many peaker plants operate for four hours or less a day when called upon, and they may only operate only 5 percent or 6 percent of the hours in an entire year. That makes them attractive candidates for replacement with energy storage -- if the price is right.

At this year’s NY-BEST Capture the Energy Conference in Troy, New York, John Zahurancik, VP, AES Energy Storage, quoted pricing of $1,000 per kilowatt and $250 per kilowatt-hour. In other words, AES says it will sell an installed system for $1 million per MW with a 4-megawatt-hour discharge capability. If that proves to be the case, this pricing is shockingly lower than most industry observers thought possible. Zahurancik said that AES’ target pricing is being facilitated by “adjacent low-cost industries” that provide key components. It may also be that AES is doing a little forward curve pricing and counting on further decreases in Li-ion costs before it starts to deliver Advancion to customers. AES is also qualifying multiple battery providers, and as quality improves from some of the cheapest Li-ion suppliers, that too may play a role in how AES dials in its aggressive pricing.

Industry Impact

AES Energy Storage has put thought into its market entry price, and they have it right. The company has developed a clear set of criteria for Advancion’s U.S. target customers and knows how to market to that segment. Peak power substitution makes even more sense in overseas markets, where electricity demand is growing faster and the cost of natural gas is higher than in North America (often by a factor of two or more). AES can reach overseas markets through its utility parent. Energy Strategies group predicts AES will succeed in this market. Already the leader in frequency regulation, the peak power substitution market is twenty to 40 times larger.

AES’ Advancion pricing may push flow battery companies toward longer-duration market opportunities (over six hours) where their price per kilowatt-hour can be more competitive. Vanadium redox flow batteries, while a proven and highly robust flow battery technology, are nowhere near being able to offer AES’ target pricing for four-hour peak power substitution (alone). Their best bet is to focus on market segments that require multiple applications, extreme reliability and long life. Even bromine-based flow batteries will need to take a careful look at AES’ pricing to make sure they can compete in the peak power substitution market.

AES’ pricing should serve as a wake-up call for a lot of storage companies and VC investors. Many companies talk about being able to perform peak power substitution. But their current pricing would be far higher compared to AES’ price target. It may be time for some of those companies to find a new primary application, a new storage technology -- or a new industry.

Companies pursuing newer storage technologies seem to have a clearer idea of what it’s going to take to compete with AES and Li-ion in general. For example, Eos Energy Storage is talking about target pricing of $200 to $250 per kilowatt-hour for its zinc hybrid cathode Znyth battery. Aquion Energy, which just raised an impressive $55 million Series D financing round to expand manufacturing for its Aqueous Hybrid Ion (AHI) batteries and systems, has stated its price target is about the same as that of common lead acid batteries. Those are aggressive goals. And the question still remains how low Li-ion really can go in light of Tesla’s planned Giga factory, which could radically reset the cost structure of the global Li-ion battery supply chain. It’s all part of an intensely Darwinian struggle. As in nature, only the truly fit will survive.

***

Chet Lyons is the founder of Energy Strategies Group, an energy storage consulting firm that assists innovative manufacturers, utilities, project developers and investors in establishing an early, profitable and sustainable role in the rapidly growing energy storage industry. Chet has held key positions at DNV KEMA Energy & Sustainability, Beacon Power Corporation, American Superconductor, Evergreen Solar, Energy Resource Associates and Johnson Controls. He recently authored the GTM Research report, Grid-Scale Energy Storage in North America, 2013: Applications, Technologies and Suppliers.

Contact: [email protected]; Direct: (978) 886-3609; www.energystrategiesgroup.com