NEW YORK CITY --- Newsflash: It’s still hot. And maybe hotter than it has been all week.

For the fifth day in a row, demand response providers have dispatched load resources across New York state. On Thursday, EnerNOC dropped megawatts from Idaho to Vermont.

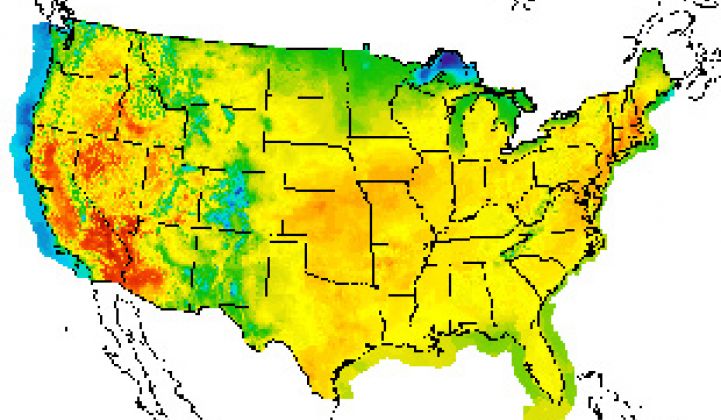

As the heat index languishes in the triple digits across much of the Northeast and Mid-Atlantic, the grid is humming along, albeit with extra effort. There are pockets of small outages, but perhaps the surprise of this heat wave is the fact that the grid is handling it pretty well, so far.

Of course, we’ll see if that holds true in Texas next week, when temperatures are slated to hit the high 90s. Unlike the New York Independent System Operator (NY-ISO) or PJM, Texas’ grid operator, ERCOT, does not have adequate reserve margins, so the grid might not be able to handle peak or near-peak conditions.

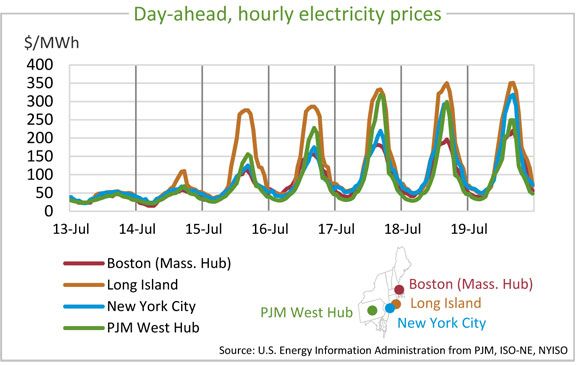

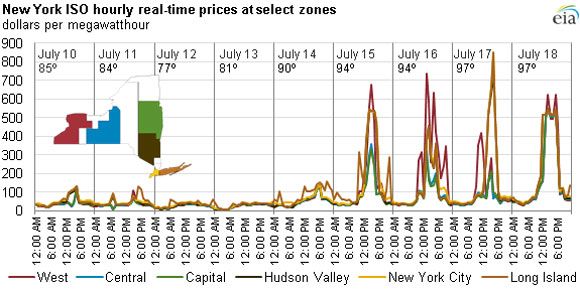

New York is on the verge of breaking its all-time peak of 33,939 megawatts. The cost of electricity has spiked in response to demand, particularly for New York City on Thursday, where electricity was more than $800 per megawatt-hour, according to the U.S. Energy Information Administration. (Market cap in ERCOT is $5,000 per megawatt-hour this summer.) New England is likely to get within 1 percent of its peak load on Friday, and Boston is forecasted to be even hotter than New York.

The lack of outages is even more impressive when you add in the fact that some generators aren’t running at full capacity. There was a partial shut down at Pilgrim nuclear power plant in Massachusetts on Wednesday because the water it uses for cooling from Cape Cod Bay was above the maximum 75 degrees allowed, the first time that has happened in the plant’s history. EIA reported that other nuclear power plants in Pennsylvania and New Jersey were also running at reduced capacity. The issue of warming waters used for cooling, or lower river flows, was already a problem during the drought last summer, and will be an increasing problem in years to come, according to a new report about the energy-water nexus from the Union of Concerned Scientists.

Every year, there are new records for demand response, even if most of that comes from large commercial and industrial players, rather than a truly expanding market of load shed from the big players down to corner stores and individual homes. There are some shifts that could be a turning point for demand response's increasing role in grid flexibility. Last year, PJM saw increased payments for demand response because of FERC Order 745, and utilities are revamping their residential peak energy offerings, such as Baltimore Gas & Electric's new Smart Energy Rewards program.

Maybe, just maybe, this is the summer where we will first see smart grid technologies come to the rescue across the country when the mercury rises.