Two of the most important players in concentrating solar power (CSP) will partner on the most ambitious solar power tower project yet planned.

Spain’s Abengoa Solar (PINK:ABGOY), which has already built 743 megawatts of operating CSP tower and trough projects, will partner with California’s BrightSource Energy (BSE), which is in the process of completing its first utility-scale solar power tower in the Mojave Desert. The pair will jointly develop the two-tower, 500-megawatt Palen Solar Electric Generating System.

This is a new chapter in Palen’s story. It was permitted as a PV project owned by the now bankrupt Solar Trust, then acquired in bankruptcy proceedings by BSE in June of last year. BSE applied to the California Energy Commission (CEC) last December for a permit amendment allowing the change of CSP methods.

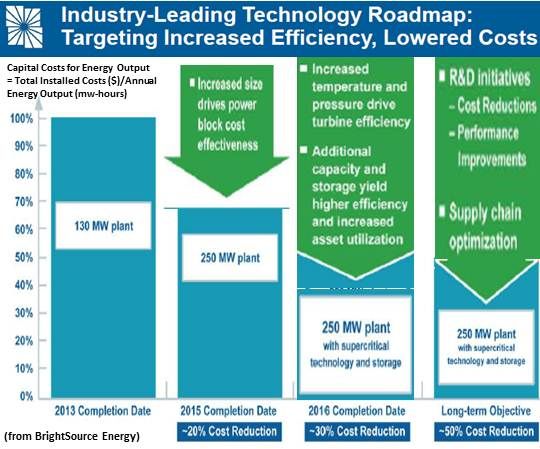

The Palen project will be designed by BSE and incorporate its second-generation 750-foot-tall towers using pressurized steam and air-cooled technology, but will not have storage capability.

“What BrightSource does best, where we want to deploy our capital,” explained BSE Senior Communications Director Keely Wachs, “is in technology development and deployment.”

Abengoa will handle the engineering, procurement and construction (EPC), a phase that is optimistically targeted for the end of this year and expected to employ up to 2,000. After the project's 2016 completion (which would be in time to qualify Palen for the 30 percent federal investment tax credit), Abengoa will also oversee operations and maintenance (O&M).

“We were the EPC on Coalinga,” BSE's Wachs said. “We had no place doing that and it cost us. But we always looked at that as a demonstration facility, and when you go through those processes, you learn a lot. What we learned is that if we can share project development costs, we can use our capital and resources on technology.”

“We are one of the few companies in the world comfortable with both tower and trough technologies," explained Abengoa Solar U.S. General Manager Armando Zuluaga. "At Palen, we are joining BrightSource in their development. We did our due diligence and invested. At the time they decided to use tower technology, we were not involved.”

But, Zuluaga added, “The fact that we are joining BrightSource in this project doesn’t mean we are abandoning trough technology."

As the EPC contractor, Abengoa just brought on-line Shams 1, a 100-megawatt UAE trough facility and now the world’s biggest operating single-site CSP installation, in conjunction with multinational energy giant Total (NYSE:TOT) and Middle Eastern renewables mega-entrepreneur Masdar.

“In South Africa,” Zuluaga noted, "we are building a 100-megawatt trough plant in parallel with a 50-megawatt tower project, in different locations at the same time. The decision of using one technology or the other is made on a case-by-case basis.”

The companies will work together on permitting and financing.

Permitting, which is always challenging in California, will be easier because Palen is in a DOI Solar Energy Zone in Riverside County. The second-generation BSE design may also help with permitting because the tower height, twice that of the three at BSE’s 372-megawatt Ivanpah complex, will allow for a heliostat field that is 13 percent smaller than the CEC-greenlighted Solar Trust PV project.

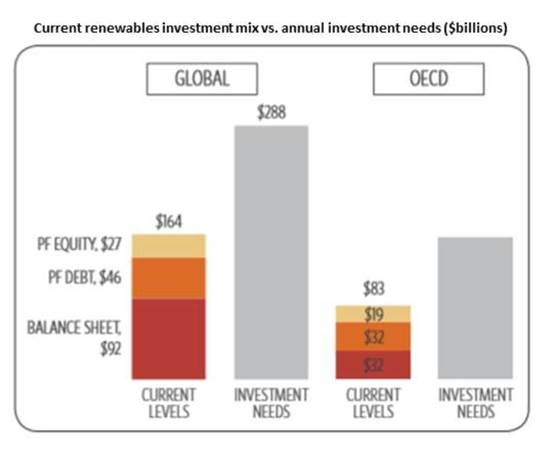

Source: Climate Policy Institute

Financing is a different matter. A major positive is the fact that Palen already has a 25-year power purchase agreement (PPA) with PG&E for the plant’s full 500-megawatt nameplate capacity.

Both Wachs and Zuluaga downplayed potential obstacles to financing. “Securing finance is a challenge today for any kind of project, but Abengoa has been really successful in securing financing for different projects in different geographies around the world. We are confident we will be successful in this one."

But success at obtaining financing in the era of DOE loan guarantees -- both Solana ($1.45 billion) and Mojave Solar ($1.2 billion) benefited from them -- does not mean financing will come readily for multi-billion-dollar ambitions in today’s post-loan-guarantee CSP marketplace. Just ask SolarReserve CEO Kevin Smith, who is still shopping for backers for permitted tower projects in California, Arizona, and Colorado. The 150-megawatt Rice project in California even has a PPA with PG&E.

But no financing.

One final note: In partnering with Abengoa for EPC services, BSE moved on from multinational contracting giant Bechtel, its partner at Ivanpah.

Does that mean BSE is dissatisfied with Bechtel, or that Bechtel, which is also doing EPC at several important photovoltaic solar power plants, has changed its take on CSP?

“Bechtel has been an incredible EPC contractor at Ivanpah,” Wachs said in answer to the question of whether there is a rift between the two, “and Abengoa being the EPC contractor at Palen does not rule out Bechtel building other solar power towers with us elsewhere around the world.”

“Bechtel remains committed to solar thermal and solar PV,” Bechtel President of Renewables Jim Ivany replied in answer to the question of whether his company has changed its take on CSP. “We are nearing completion on two of the largest solar facilities in the world, including Ivanpah and California Valley Solar Ranch, in addition to the Catalina Solar Photovoltaic Generating Project. We look forward to building future projects in both market segments.”