The increasing penetration of wind energy on U.S. grids is affecting electricity markets in a big way.

First, the good news.

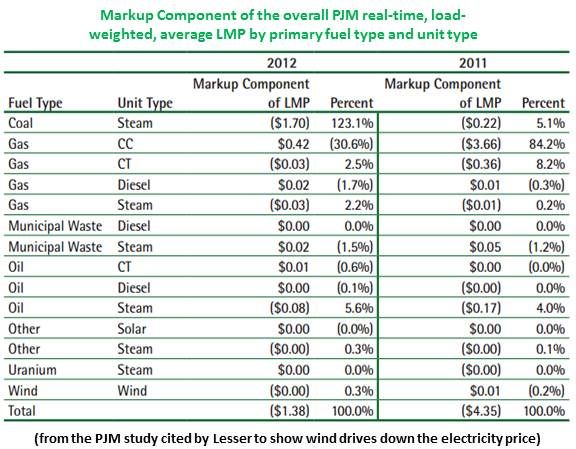

“Nobody disputes the fact that adding more wind energy to the grid displaces more expensive sources of generation,” explained American Wind Energy Association (AWEA) Transmission Policy Manager Michael Goggin. “That has two impacts. One, it reduces the total use of fuel and therefore the total fuel cost. It also drives the market price for electricity down, which is creating billions of dollars in savings for consumers."

Now, the other concern.

“The wind production tax credit (PTC) has greatly exacerbated the number of hours where electric prices are negative,” economist Jonathan Lesser, a researcher for the nuclear and fossil industries, recently testified to a Congressional subcommittee. “As schedulable generating plants shut down because it is uneconomic for them to operate, they jeopardize reliability, and increase the costs of maintaining reliability because additional gas-fired generators must be placed on standby or operated at a higher cost.”

Lesser is conflating the two effects of wind, Goggin said, and exaggerating the significance of the second.

Negative pricing happens when an energy generator would rather pay the grid operator to take its produced electricity than shut down. For nuclear power plants which can only run at full speed or not at all, for example, it is much more costly to shut down and start up than to pay to avoid having to do so.

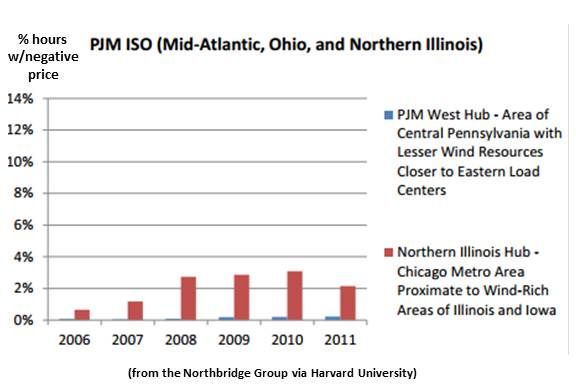

In extremely infrequent instances, in isolated regions where wind development is ahead of the transmission build-out needed to move it to larger load centers, the market price is set by wind, Goggin explained. When there is nothing but wind to sell, wind project owners can pay grid operators to take their output. With the PTC, they can sell as low as negative $23 per megawatt-hour and still break even.

“This almost never happens,” Goggin said, "and it is important not to get the impression from Lesser’s testimony to the subcommittee that it is commonplace and is due to the PTC.”

Subsidies, and in particular the wind production tax credit, Lesser testified, allow intermittent generation developers to “pay only a small fraction of the true costs they impose on the electric system. This is having adverse economic impacts.”

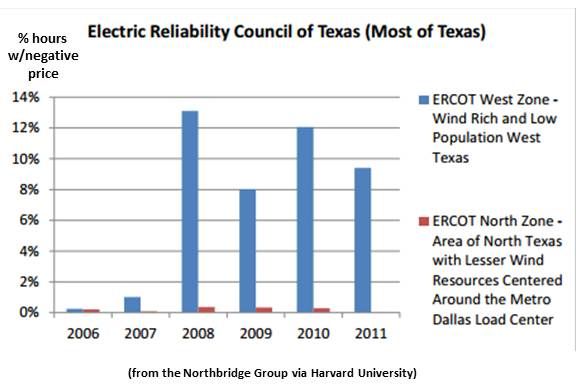

“Federal incentives for renewable energy,” Lesser quoted the Texas Public Utility Commission’s Donna Nelson as saying, “have distorted the competitive wholesale market in ERCOT.” Lesser went on to quote Nelson as saying that there are “a number of days with a negative clearing price in the west zone of ERCOT where most of the wind resources are installed.”

“The majority of U.S. cases where this is happening are in West Texas [which accounts for] only about 5 percent of ERCOT’s output,” Goggin said. “It is only in that 5 percent in the western zone, and over the last couple of years, that you have seen some negative prices. And it is going away at the end of this year, even there, when their new transmission goes on-line.”

Wind only sets the market price if it is the most expensive resource on the system, and that almost never happens because wind has a zero fuel cost, Goggin explained. If wind is setting the price, it means that everything else in the area has been turned off, and that only happens on very localized parts of the grid.

“You never get to a situation where across an entire system like PJM or the California ISO there is only wind,” Goggin said. “And as the grid gets built out, those isolated areas and rare instances are going away. In Texas, we have already seen about a 60 percent reduction in the instances of negative pricing over the last year because of new transmission, and, by the end of this year, it should be almost eliminated.”

It would require a massive amount of wind and other renewables to create a threat to match Lesser’s concerns, Goggin said. “In PJM, the average demand is something like 70 gigawatts to 90 gigawatts or more, and there are 6 gigawatts of wind. They have a long way to go. At some point in the future, there might be enough wind so that it could set the market price. But that is many years away, and we will have figured out how to structure electricity markets to accommodate more of the energy we want by then.”