Far from not using wind, climatological systems where wind is plentiful -- like those in which Xcel Energy operates -- may have too much for the existing transmission system to handle, a situation that is prompting an outcry from fossil fuel generators.

Xcel Energy works in a bilateral market in Colorado where only its obligation to the state to deliver reliable, least-cost power limits its control of how much wind gets used along with traditional generation sources. It also works in two Midwest centralized power market systems where renewable integration is managed by Independent System Operators (ISOs).

"Under current rules, there's recognition that you can't really dispatch wind," Tom Imbler, the vice president of commercial operations for Xcel Energy, explained. Grid operators, he said, are "dispatching the thermal generation and other resources around the wind. The wind becomes kind of a must-take."

The need for curtailment of wind can happen when there is a transmission overload, most likely because lines are out for maintenance in a windy region at a time when high winds are likely. It can also happen when demand is low and further reduction in fossil fuel generation would put the plant at risk of going into shutdown mode, requiring a prohibitively expensive restart. With the rules not requiring the curtailment of wind, the wires can be overloaded and the price for wind would be an expense (i.e., a negative price). Imbler called such incidences "infrequent" in Xcel's recent experience.

"The RTO always has the right to curtail wind if it's creating a line overload somewhere in the system. What is under development," he said, are rules that allow system operators "to curtail it for economic reasons as well as reliability reasons."

Imbler said new practices are also facilitating the integration of wind.

"Lesson number one, if you're a utility and you want to add a lot of wind to your system," Imbler said, is "you have to invest in the technology and time to develop better wind forecasting models. That's something we've spent a lot of time and effort on."

Xcel Energy's efforts have paid off. For the first half of 2010, it had "a twenty-percent reduction in overall load forecast error," Imbler said, "compared to the first half of last year."

Xcel now receives information from meteorological (met) towers in its wind projects from which it is obtaining better operational details in real time and "more meteorological data and more granularity on the production side." Using information obtained through "wind management systems," the company has built "specialized forecast models" for each of its major installations. It is also preparing to place met towers at a distance from its projects so as to detect on-coming weather.

Xcel Energy chooses to add wind capacity, Imbler said, based on "our customer load growth and any type of mandated environmental objectives."

Both Colorado and Minnesota, the states where Xcel Energy is most predominant, have renewable electricity standards (RES) requiring it to obtain 30% of its power from renewable sources by 2020. The result is that the company must plan to "achieve the lowest cost balance" of traditional and renewable sources.

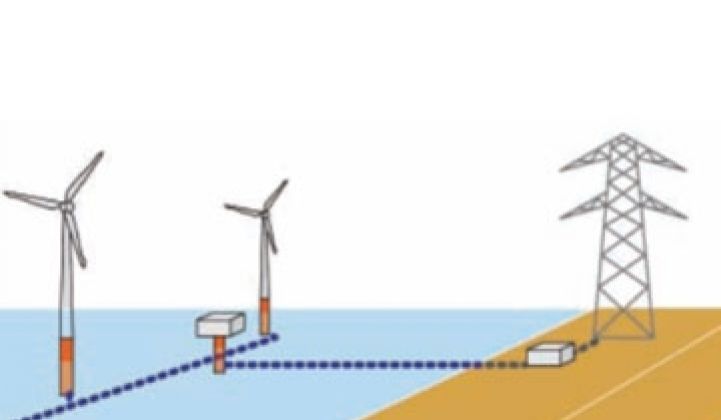

Inadequate transmission capacity exacerbates the wind-fossils tension, but Imbler reported improvements on the horizon. "I was very concerned -- up until a year or so ago -- about the transmission cost allocation issue," he said. "Not only have we figured out who's going to build it, we've figured out who's going to pay."

The essence of the breakthrough is the sharing of costs. "It's socializing some of the bigger projects across the membership," Imbler said. "Instead of the costs just being borne by the utilities, they're being spread out," he explained. "An example is Minnesota, where customers will be paying for a transmission upgrade in Michigan."

This becomes equitable, Imbler said, "because a reciprocal arrangement will happen when there's a significant upgrade in the Minnesota system." Imbler believes ratepayers will understand the social good in taking on such a cost burden. As Xcel Energy has added wind, he said, "we've actually increased customer satisfaction."

"I think you will see the acceleration of the retirement of old, small coal plants," Imbler said, because of the cost required to retrofit them with environmental controls. Large, modern coal plants, he said, "have a role in our supply mix for a number of years to come." But Xcel Energy is "not building any new coal stations," he said. "When you look at our resource plans, you'll see a mix of gas units and renewable resources, solar, wind and biomass."

Confident that even larger amounts of renewable resources can be added, Imbler mentioned one caveat: "There are costs." He could not say precisely what those costs will be. "We only have a couple of years of operating these thermal fleets with the significant wind penetration," he said. "We take all the wind we can because it's a zero-cost fuel and a no-carbon fuel," he explained. "But to do that, we have to move those thermal units up and down a lot more."

On the other hand, Imbler did not think the added cost would be any greater than the Xcel Energy-projected twenty-dollars-per-ton cost of carbon in an emissions-constrained marketplace. "I think we will continue to reduce the cost of integrating the wind by operating better and smarter. My expectation is that the integration costs of a megawatt of wind power will probably be less than the cost of carbon at twenty dollars a ton."