Zach Pollock is an Analyst at GTM Research. You can follow him on Twitter @ZDPollock. You can also learn more about his (and his colleagues') smart grid market research at www.gtmresearch.com.

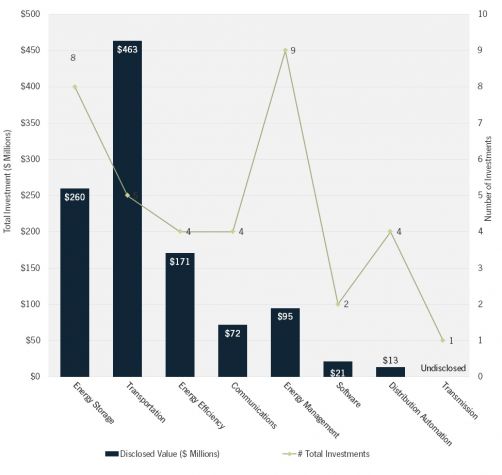

It’s no secret that 2012 wasn't a banner year for cleantech investing, and smart grid was no different. As deployment of smart grid technologies has begun to slow, investment activity has followed suit. Late-stage funding dominated smart-grid and smart-grid-related investment in 2012, totaling approximately $1.1 billion, with an average deal size of $29 million (though skewed by $100-million-plus investments in companies tangential to smart grid, such as plug-in hybrid maker Fisker Automotive and Bloom Energy).

In total, more than 80 percent of all dollars invested went to energy efficiency, transportation, and energy storage, while more clearly defined smart grid segments, including communications, distribution automation, transmission, energy management and software received an anemic $200 million through nineteen disclosed investments and one undisclosed investment.

What explains the disproportionate investment levels in efficiency (mainly via LEDs), transportation, and energy storage? The answer is that all three market segments operate outside of the regulated utility industry -- a sector where adoption of nascent technologies is typically constrained by staunch public utility commissions and long budget cycles.

In other words, Silicon Valley has largely outpaced the incremental nature of the utility sales cycle. Short of additional stimulus funding or drastic regulation on carbon emissions and/or renewable generation, we are unlikely to witness the same fervent investment levels that were observed post-stimulus.

However, there were some bright spots for smart grid investing in 2012. Based on total deal count, energy management continued to be a hot sector for VCs, accounting for approximately $95 million. Boulder, Colorado-based Tendril led the sector, closing $25 million in May and an additional $15 million in December, bringing the company’s total funding to $111 million. Tendril also acquired energy auditing software maker Recurve earlier this year. If Tendril’s restructuring and recent funding is indicative of the sector as whole, 2013 may by the year where the energy management market finally materializes.

Additionally, Philadelphia-based Viridity Energy closed a $15 million dollar series C round in August, led by Japanese investment bank Mitsui and Company for its VPower demand response platform. The Mitsui investment demonstrates continued interest from Japanese firms following the $2.3 billion acquisition of Swiss smart meter and communications provider Landis+Gyr by Toshiba in 2011, and a $30 million debt offering for Silver Spring Networks led by Hitachi earlier this year.

The international investment trend is likely to continue as Tepco finalizes its smart metering RFP and begins the vendor selection process in late 2013. In addition, given the lingering generation shortages post Fukushima, and a strong governmental and cultural emphasis on demand-side management, we anticipate that Japan will be one of the first international markets where home-area networking will be adopted at scale.

In other communications activity, On-Ramp Wireless closed a round of series C funding totaling $10.1 million in July. Siemens and British Gas (the retail arm of Centrica) invested approximately $18.8 million in broadband over powerline communications provider, Power Plus Communications.

Despite the modest venture capital activity, communications has been an area rife with activity. In the past year, just under $3 billion has been spent on acquisitions via deals, including Siemens’ $382 million acquisition of RuggedCom, ABB’s reported $35 million acquisition of Tropos, Itron’s $100 million purchase of SmartSynch, and the $2.3 billion buyout of AMI provider Elster by British private-equity firm Melrose.

Meanwhile, investment in distribution automation devices and power electronics was the weakest of all segments, totaling $13.3 million. Activity in this area was led by Varentec -- the stealthy Khosla Ventures-backed ARPA-E recipient whose automated voltage controllers are intended to manage the two-way flow of power more effectively than traditional electro-mechanical grid assets.

What to look for in 2013

The $14 million investment in situational awareness and analytics solutions provider, Space-Time Insight, in late 2012 foreshadows a year of further convergence between IT and utility operations. Without question, software and analytics solutions will see the most activity as physical infrastructure build-out slows and utilities search for new ways to streamline the management of network/grid operations while extracting additional value from new data sources.

In addition, we expect to see particularly strong interest in edge-of-grid distributed resource energy management solutions capable of providing real-time intelligence to manage and mitigate the effects of high penetration distributed generation and new loads such as EVs.