Exelon, the biggest owner of U.S. nuclear power, has renewed its fight to kill wind’s production tax credit -- and if Exelon gets its way, solar’s investment tax credit may be next.

Sources say renewal of wind’s $0.023 per kilowatt-hour production tax credit (PTC), which expired at the end of 2013, will fight its way into the revision of the upcoming Senate Finance Committee’s tax extenders package.

The solar industry is already pushing for the Senate to revise its investment tax credit (ITC), which will drop from its present 30 percent level to 10 percent after December 31, 2016.

According to some sources, Exelon’s lobbying effort may make the PTC too controversial for some legislators to back in this election year, compelling some to ignore the ITC for as long as possible.

“This year, it’s the wind industry. Next year, it will be the solar industry,” said Joseph Dominguez, Exelon's Sr. VP of Policy and Regulatory Affairs. “We’re just handling these subsidies piecemeal instead of looking at the problem more holistically.”

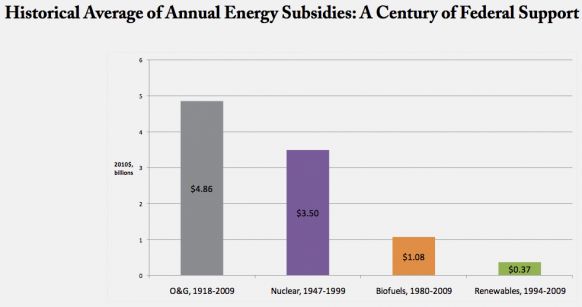

Dominguez said Exelon favors greenhouse gas regulation or a market-based approach to greenhouse gases that would apply to all sources of power generation “without undermining those that aren’t subsidized.” (He did not mention nuclear’s federal support.)

Exelon says the reason for its opposition to wind’s PTC, for which its membership in the American Wind Energy Association (AWEA) was revoked, is because wind is driving out nuclear in the Midwest and other wind-rich markets.

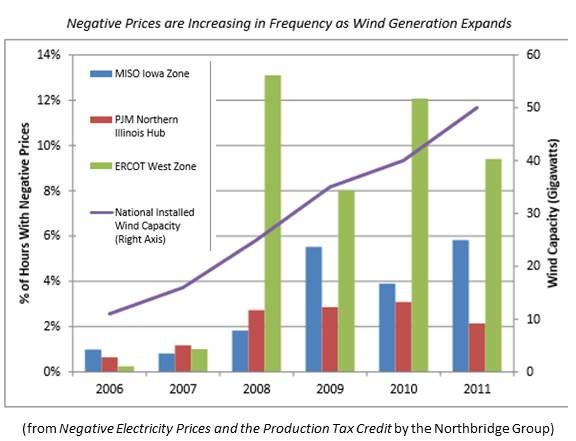

“The market signals for all generators to ramp down production to avoid a system overload by sending a negative price,” explained Dominguez. “But wind generators are chasing the production tax credit, so they ignore the price and continue to operate. Unfortunately, nuclear units aren’t protected in the same way.”

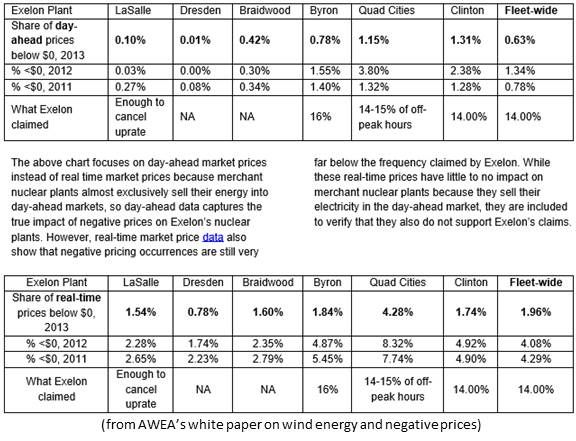

Exelon documentation shows 14 percent of its “off-peak 2012 pricing” as negative at its Illinois Quad Cities units, according to Dominguez.

Exelon is conflating “two very different phenomena,” according to a new white paper by AWEA Electricity Analyst Michael Goggin. Though wind displaces more expensive sources, lowering the cost of electricity, this results in negative pricing only in “exceedingly rare and geographically isolated occurrences." But that has “no significant impact on other energy sources,” according to Goggin, and the issue is being eliminated by transmission system expansions.

“Regional grid operator data document… [that] Exelon’s claim for the rate at which its Illinois nuclear fleet sees negative prices is more than 20 times too high,” Goggin wrote.

“The AWEA data is incomplete,” Dominguez said, because it uses day-ahead pricing and not “real-time, actual energy prices.”

Day-ahead prices determine a nuclear plant’s economics, Goggin responded. And real-time price data don’t support Dominguez’s point either. “Negative prices in the real-time market still occurred at less than one-seventh of the rate Exelon claimed.”

Three factors unrelated to wind cause negative pricing, according to Goggin. Local transmission outages cause more than half of all occurrences. The others are extremely low electricity demand and the inability of Exelon’s nuclear plants to ramp down when transmission is out or demand drops off.

“The real challenges for Exelon, and the economics of nuclear and merchant generation in general, come from cheap natural gas and low electricity demand,” Goggin states, citing utility experts and Exelon reports and statements.

“The fleet remains competitive with natural gas,” Dominguez said. The tipping point for Exelon in the Midwest has been “more subsidized wind megawatts than the system can handle and the distortion it is creating through negative pricing.” Where the company faces “a lot of subsidized resources,” he said, “units are in jeopardy of closing.”

“Wind energy does not have a negative impact on electricity markets and does not cause nuclear plants to shut down,” said John DiDonato, NextEra Energy Resources VP of Wind Development.

NextEra owns and operates about 17 percent of installed U.S. wind capacity, about 14 percent of installed U.S. utility-scale solar, and eight nuclear reactors.

“Merchant nuclear plants are challenged primarily by low natural gas prices,” DiDonato said. “Killing the PTC will not change this.”

“Negative pricing is not driven primarily by wind,” agreed Frank Prager, Xcel Energy VP of Policy & Strategy. Xcel, which supports the PTC, is the biggest provider of wind to U.S. customers and also operates nuclear plants.

Nuclear is important as baseload generation, but “there are issues with how nuclear plants respond to the changes in the marketplace and the need for more flexibility in dispatch,” Prager added. “And of course, low gas prices are one of the big factors changing everything in the electricity market.”

Xcel has seen a wide range of pricing issues in the same wind-abundant Midwest markets where Exelon operates “but the negative price issue has been very, very rare for us, and we do not see it as a significant challenge.”

Exelon’s call for a more comprehensive, technology-neutral approach doesn’t have political legs in the short term, Dominguez acknowledged, but “it has legs in the longer term…[and] we’re not going to get to a more comprehensive solution if we continue to just extend one-off subsidies.”

“Eliminating the PTC would serve only to kill job-creating investments in renewable energy projects across the country,” DiDonato said, as well as obstructing “clean, reliable and affordable energy that is produced right here in America.”

Source: DBL Investors