A recently published primer on net energy metering (NEM) from the solar industry explains why it is under attack by utilities across the country -- and explores how the two opposing sides might come to terms.

“As the penetration of distributed solar generation increases, the debate on NEM policies and impacts is intensifying,” concluded the authors of a new report, Ratemaking, Solar Value and Solar Net Energy Metering: A Primer, from the Solar Electric Power Association (SEPA). “Utilities in some regions have observed distributed solar adoption at rates not previously forecast and are now seeing significant amounts of grid-tied solar on their systems.”

“Between 2011 and 2012, the number of newly installed solar NEM systems increased from 61,400 to 89,620 -- a 46 percent annual growth rate -- bringing the cumulative total to 302,380 NEM systems,” the SEPA study reported. “By year end 2012, U.S. solar generation under net metering totaled more than 3,500 megawatts-AC. It is striking to consider that in 2005, when EPACT passed, total grid-connected solar capacity nationwide was only about 200 megawatts-AC.”

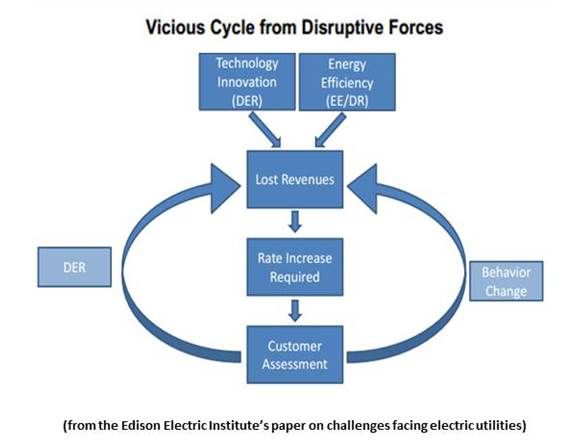

The utility industry is starting to think about these disruptive changes. As a recent report from the Edison Electric Institute concluded, "Disruptive forces, if not actively addressed, threaten the viability of old-line exposed industries.”

When NEM policies were first put in place to reimburse rooftop solar owners at retail rates for the electricity their systems send to the grid, there was little understanding of its impacts, according to SEPA’s primer. It was intended to promote distributed generation, but programs were capped, usually at a percentage of a utility’s peak demand, in order “to monitor, evaluate, and evolve NEM policies over time.”

NEM was not designed to assess solar value, SEPA reported: “Concerns about rate design, customer equity or revenue losses were best put off.” But with current growth, “utilities, regulators, policymakers, and solar stakeholders understand that -- for better or worse -- NEM policies have become consequential.”

In the past, according to the EEI study, regulators managed rates to protect utilities. With the proliferation of distributed solar, it predicted, there will be pressure from utilities “to undo these cross subsidies.”

And that is happening, according to the SEPA primer. Utilities have recently proposed that solar customers pay network-use charges such as access fees, solar riders, or standby charges, to make up for reduced revenues.

Ratepayer and solar advocates have also weighed in. The challenge in finding an equitable alternative to NEM is in accurately assessing the benefits of solar to the system and the costs to non-solar owning ratepayers, according to SEPA. Both “quick fixes” and “targeted innovations” have been proposed:

- In 2009, Xcel Energy (XEL) proposed a solar charge, but it was withdrawn due to stakeholder pushback.

- In 2011, Public Service of New Mexico (PNMXO) proposed a solar charge but it was withdrawn, again due to stakeholder pushback.

- In 2011, Dominion Power Virginia (D) pushed legislative changes allowing a standby charge on net-metered residential systems of 10 kilowatts or larger that were approved by the state commission for this very small segment of the market. North Carolina followed suit.

- In 2012, San Diego Gas & Electric, Pacific Gas & Electric (PCG), and Southern California Edison (SCE-E) proposed network-use and similar charges, but the California PUC declined to consider them.

- In 2013, California legislation ordered a PUC-administered study on the costs and benefits, ratepayer impacts and costs of services that many in the solar industry expect to be definitive.

- Also in 2013, SmartFIT from Clean Power Research and SunCredit from CPS Energy were proposed as alternatives to NEM.

There have also been efforts this year to undo or alter net metering in Louisiana, Idaho and South Carolina. NEM cost-benefit studies and cost-of-service studies are being carried out in Arizona, California, Colorado, Michigan, Ohio, New York, Texas, Vermont and other states.

In what solar industry leaders have called "the most significant fight for solar in the country," the Arizona Corporation Commission (ACC) has opened a formal docket to address net metering.

State regulators across the country will make the final decisions based on expert testimony and utility recommendations. Final appeals can be directed to the courts, but those decisions must be shown to be arbitrary and capricious in order to be reversed.

“The mere fact that we are seeing the beginning of customer disruption and that there is a large universe of companies pursuing this opportunity highlight the importance of proactive and timely planning to address these challenges early on so that uneconomic disruption does not proceed further,” the EEI study warned. “Ultimately, all stakeholders must embrace change in technology and business models in order to maintain a viable utility industry.”

“There is a risk that utilities and stakeholders could focus too keenly upon modeling distributed solar impacts, generating more detailed and more costly analytic methodologies, at the expense of productive dialogue,” the SEPA report concluded. "The regulatory task is to enlist a variety of data, analytic tools, stakeholder inputs, and careful, experience-based judgment in the right proportions to arrive at the best possible solar policies and rates."