Ten U.S. utilities currently account for 70 percent of all net energy metering (NEM) -- but most solar companies and utilities are thinking about it.

Innovative financing, unprecedentedly low panel costs and local mandates are increasing the prevalence of photovoltaic solar-generated electricity. But utilities and ratepayers without solar are concerned about potential cost inequities. Austin Energy (AE), the progressive municipally owned Texas utility, may have a solution.

NEM allows solar system owners to roll their meters backward as they earn retail rates for the electricity their systems send into the grid. In sunny places, bills can roll back to zero. This may shift some costs to the utility and the utility’s other ratepayers.

When a PV system owner doesn’t pay a bill, it deprives the utility of income although that utility is still serving that customer.

When PV system owners don’t pay for electricity, they also don’t pay ancillary charges for transmission and distribution system operations and maintenance even though both their electricity consumption and production use the infrastructure. That could make such payments higher for other ratepayers.

The result is a growing clamor from non-solar owning ratepayers and utilities to end NEM.

Solar advocates say NEM is vital to the growth of solar. It plays a pivotal role in the decision to bear the large upfront costs of installing solar because it significantly reduces the “payback period” for system purchasers.

The rapidly expanding third-party-ownership model is eliminating the hurdle of upfront costs for residential rooftop solar. But NEM remains essential to the new financing scheme’s funders because it hastens the return on their investment.

AE has been involved in solar for decades, explained AE Solar Incentives Program Manager Leslie Libby. It has long provided NEM because “costs were so high it was never going to be able to compete with coal or nuclear.” AE’s analysis, Libby added, is that even NEM, without a rebate on the system cost, is inadequate. “We still need to overcome the obstacle of upfront capital costs.”

Because of considerations pertaining to the deregulated Electric Reliability Council of Texas (ERCOT) electricity market, AE does not allow third-party ownership in its service territory, although, Libby noted, as solar approaches grid parity, a transition to third-party ownership will likely be necessary.

Solar supporters at AE could see solar delivering an array of up-to-then unquantified benefits to a city that basks under one of the richest U.S. solar resources. “If we quantified them," Libby said, “we could pay more for solar.”

The result was Austin Energy’s Value of Solar Tariff (VOST), an alternative to NEM that moves from a production-based incentive to a hard value that balances out in the utility’s bookkeeping. It may satisfy utilities, ratepayers and solar advocates.

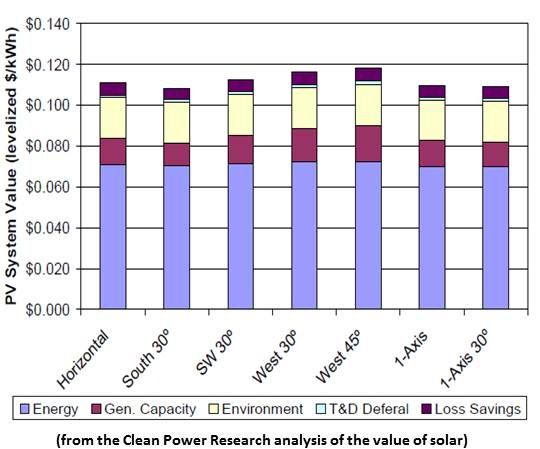

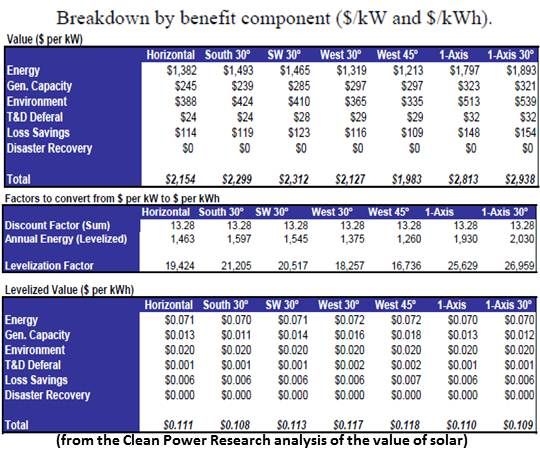

The VOST was derived from analyses by PG&E, Sandia Labs, Clean Power Research and others. It was, Libby said, “an inclusive process” that recognized the multiple added benefits solar brought the municipality, including:

1. Energy value for predictably priced point-of-consumption electricity production;

2. Generation value for the avoided cost of building traditional generation;

3. Environmental value for reduced emissions and pollution;

4. Transmission and distribution system value for reduced burdens on existing wires and infrastructure and the eliminated need for new wires and infrastructure;

5. Disaster recovery value for serving when central stations go offline;

6. Reactive power value for stabilizing voltage drops that cause outages; and

7. Loss savings value for preventing all the above-named losses.

In the 12.8 cents per kilowatt-hour 2011 update of the annually revalued tariff, “the value for solar went up,” Libby said, because the times “when solar is produced match [the times] when ERCOT needs power.”

Beginning in October, AE’s solar system owners will be billed the same five-tiered, seasonally adjusted rates ranging from 1.8 cents to 11.4 cents per kilowatt-hour and the $10 monthly Customer Charge levied on all other AE electricity consumers. No meters will roll backwards. But solar owners will also be credited with 12.8 cents for every kilowatt-hour they send to AE.

Theoretically, there should be no revenue loss to utilities or undue burden to other ratepayers because AE will only be paying for value it receives.

Solaria Vice President for External Relations and Vote Solar co-founder David Hochschild, who helped lead the recent fight to protect California’s NEM, said AE’s VOST is still an unknown. Its viability as a solar support, he noted, depends entirely on where the tariff is set. But, he added, “it’s good to see Austin Energy showing leadership.”

The VOST applies only to AE’s residential solar. AE bills list it as the residential solar rate. Some AE promotional materials call it Gross Metering.

“What it is not,” Libby insisted, is an incentive. It is a credit applied to our customer’s bill for bringing this valuable resource into our service territory. That resource has a value to Austin Energy and we are going to credit them for that value.”

What made the VOST “palatable both internally and externally,” Libby said, “is that a residential solar system owner is billed like every other customer for their total consumption. The brilliance of it is this piece. Solar system owners are no longer a special class of customer.”

At the same time, she added, “we don’t have non-solar-owners hounding us anymore. But system owners get credited at the rate the utility has agreed is the value of bringing this resource into Austin. So far, it makes sense to everybody.”