A new partnership between Clean Power Finance (CPF) and Paramount Solar, a business partner of world-leading infomercial marketer Guthy-Renker, could turn residential rooftop solar into a star of late night television.

Paramount Solar, explained CEO Hayes Barnard, evolved just over three years ago out of the successful Paramount Equity mortgage and insurance businesses. Using a client list built over nine years that has created a cumulative $10 billion in loans and 70,000 financial transactions in those financial services businesses, Paramount Solar is now selling 300 residential rooftop solar systems per month, Barnard said.

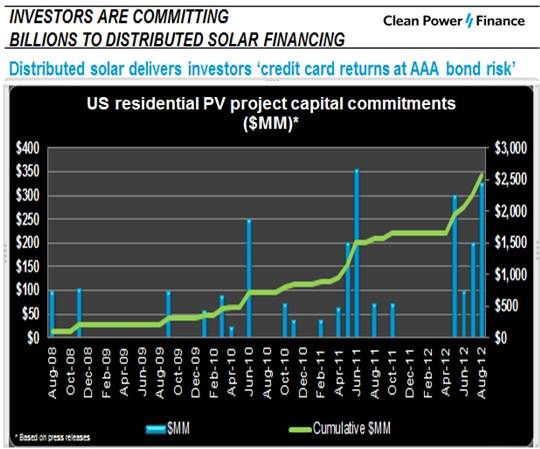

CPF began as a business-to-business sales management software platform and now has a network of 1,350 independent installers. With some 100 channel partners taking advantage of its hundreds of millions of dollars in institutional funds, it has now become, along with SunPower, Sunrun, and SolarCity, a leading administrator in the $2-billion-plus and rapidly growing third-party ownership (TPO) space.

Each of the leading players has a slightly different approach. SunPower (NASDAQ:SPWR) focuses on selling its own products; Sunrun specializes in leases and PPAs; and SolarCity has developed a full-service brand. Through CPF’s software platform and network, Paramount Solar will expand its ability to quote, sell, and design residential solar systems.

“A residential homeowner calls us,” Barnard explained. “We identify a number of things about that consumer, what their utility bill is, what their roof face is; a number of different parameters. CPF gives us the ability to look at a number of different financing options that they have configured through the funds they have. We can evaluate which tax equity fund is best for that consumer.”

Along with plummeting solar module prices, TPO financing has driven dramatic U.S. solar industry growth over the last two years. Through it, institutional funds pay for users’ solar systems through lease or power purchase agreement (PPA) contracts in return for tax equity and, potentially, a portion of the cash flow. Users get reduced electricity bills. Administrators get a fee and/or another part of the cash flow and channel the rooftop work to installers.

Paramount Solar presently operates in California, Oregon, Arizona and Colorado, states where “we had predictable, stable utility companies that supported rebates,” Barnard said, conditions that allow Paramount “to save residential homeowners money on their electricity.”

Solar, he said, was “a natural play for us because we focus on saving residential homeowners money on the largest bills in their lives.” It was “an opportunity to create a positive impact.”

Paramount customers, he added, “typically refinance or get a home loan to purchase a home seven times in their life. We look at the lifetime value of a consumer.” With solar, “we can be in a partnership with them for twenty years.”

The partnership with CPF came, he said, because “we needed competitive financing to put us on par with other players in the industry.” It “offers an astounding breadth of tax equity financing solutions and gives us the ability to offer our customers the most compelling financing solutions.”

Paramount currently mainly uses four installation providers, including CPF competitor SolarCity. “We will continue working with SolarCity,” Barnard said. “The value it brings to Paramount is, one, a great installation network in, I believe, eighteen states throughout the country. And, two, they bring to the table some competitive financing.”

With the addition of CPF’s backing, Paramount Solar is preparing a marketing push. “Currently, we’re acquiring customers at a rate we’re happy with and we think we can do that at scale,” Barnard said. In addition, he believes he can do it cost-effectively. “It’s my understanding the average cost to acquire a customer in the industry right now is about 17 percent of revenues, and we’re far less than that.”

Presently, they are testing seven media marketing channels, Barnard said, including digital channels, radio, canvassing, direct mail, email, exploiting the Paramount database and building a new database.

As for making an infomercial, he said, “we’ve definitely looked at it. But you have to earn the right to do it.” In solar, he explained, margins are thin. “If you don’t know how to put together the right media cocktail to acquire customers at scale, you are never going to make it in this space.” And, he added, “You have to earn the right to spend big dollars on an infomercial by doing some of the boring basic things right.”

Barnard said there are three pieces to the selling of solar: cost to acquire a customer, financing, and “the engineering, procurement and construction (EPC) side. We feel very confident we’ve nailed the customer acquisition piece. Now we need companies like CPF and others to help us with the tax equity and the financing side.”

As to the EPC piece, he said, “that will be the part most companies will stumble with. How to get economies of scale there, and how to give customers great service and get their systems installed as simply and quickly as possible.”