In 2012, China's Hanergy, the owner of gigawatts' worth of hydropower, wind and solar assets, acquired MiaSolé, a technologically accomplished, CIGS thin-film solar firm. The reported sales price was $30 million, according to documents obtained by the San Francisco Chronicle, as well as a GTM source close to the deal, though the New York Times reported the sale price as approximately $100 million. MiaSolé had raised in the neighborhood of $500 million in VC funding from Voyageur Mutual Funds III, Kleiner Perkins, Firelake Capital, and VantagePoint Venture Partners.

In 2013, that same Hanergy acquired gallium-arsenide solar developer Alta Devices for an undisclosed amount. Alta has set records for PV efficiency, boasting NREL-verified 28.8 percent cell efficiencies for a single-junction solar cell and 30.8 percent for a dual-junction cell. The firm raised more than $120 million from Kleiner Perkins, NEA, August Capital, et al. By using an epitaxial lift-off technique pioneered by Eli Yablonovitch, the firm can produce flexible layers of GaAs that are 1 micron thick. Substrate reuse and cost are issues in this type of technology, as evidenced by the experiences of both Crystal Solar and Solexel.

Alta and MiaSolé joined CIGS firms Solibro and Global Solar Energy under the Hanergy roof.

On Wednesday at Solar Power International in Las Vegas, GTM spoke with MiaSolé's Application Technologist and Business Development Manager Michael Gumm about the company's flexible solar modules from its MiaSolé acquisition.

Flexible solar panels have the same advantages always claimed for this form factor: light weight, less labor, no racking, better wind and earthquake performance, and the ability be attached directly to the roof with an adhesive. The company's website estimates a 20 percent savings in balance-of-system costs compared to racked glass-sandwich modules. Hanergy claims a glass-module efficiency of more than 16 percent.

I asked Gumm to address why defunct flexible PV firm United Ovonic was not able to make a go at this application, setting aside issues of quality, price and performance. Gumm said, "[United Ovonic parent company] ECD didn't control how its product was used." Selling through distributors, ECD had "no idea who was installing the product."

"In our case, we're working with major roofing manufacturers to sell modules to their contractors," said Gumm, adding, "Their contractors know how to exert quality control in adhesives and in methods of applying and handling" the flexible solar module. The peel-and-stick module comes with a 25-year power warranty, a 25-year adhesive warranty and a five-year workmanship warranty. The modules, however, cost more in terms of dollars-per-watt than crystalline silicon.

At .51 pounds per square foot, the weight of the panels is one-third the weight of racked crystalline-silicon panels and one-fifth the weight of ballasted crystalline-silicon panels. Gumm asserts that many commercial roofs in California are "made with glue-laminated beams and plywood decks. They won't hold a lot of weight."

He said that for buildings in high wind zones, "Our product has the same wind rating as a roofing system." Gumm suggests that new roofing certifications and requirements from Factory Mutual on load and wind uplift could provide a big advantage for Hanergy. Factory Mutual is the testing lab for building insurance issues that set the standards cited by architects and building designers.

According to Gumm, "The FLEX gen1 production rate is 5 megawatts, the gen2 plant opening early Q-1 2015 is 300 megawatts. We have 90 megawatts of Miasole glass modules installed worldwide. Both glass and flexible use the same cell technology."

Meanwhile, that other Hanergy purchase, Alta Devices, announced an effort with VC-funded Airware that allows builders of small unmanned aerial vehicles to better integrate solar power on the aircraft. Airware provides hardware and software for developing commercial drones. The company has a beta program underway with commercial drone firms Delta Drone and Cyber Technology and $40 million from Andreessen Horowitz, Google Ventures, First Round Capital, Felicis Ventures seed, Firelake Capital, RRE Ventures, Shasta Ventures, et al.

We'll keep track of the progress made by Hanergy on these fronts.

***

Back in 2012, MiaSolé's VP of Process Technology, Atiye Bayman, presented to the Silicon Valley IEEE PV Chapter and highlighted the solar panel vendor's use of physical vapor deposition throughout the entire production process.

Here are the slides from that presentation.

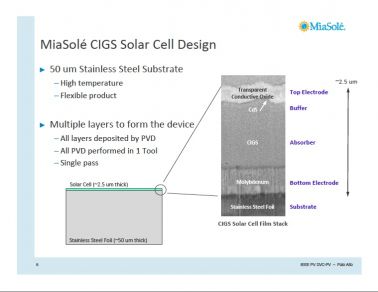

MiaSolé's thin film stack rests on a 50-micron stainless steel foil substrate. The stainless steel allows processing at high temperatures and allows the potential for flexible panels. Bayman stressed that product success is tied to LCOE and the ability to maximize energy generation. The cadmium sulfide (CdS) buffer layer is sputtered. Bayman noted that sputtered CdS is very rare, saying, "We had to learn how to sputter CdS on CIGS and then do the work to optimize thickness and transparency."

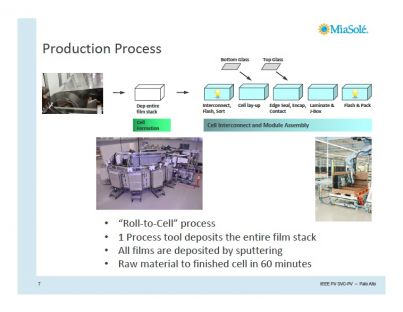

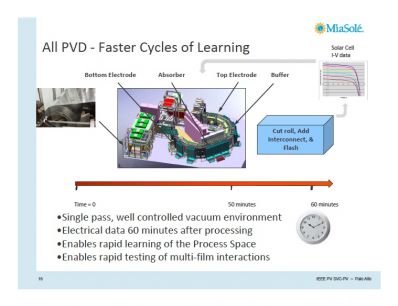

The thin film stack is produced in a "single-pass deposition" using a single tool that is entirely PVD. The stack is created in 60 minutes from roll to flash-tested cells. Production is not in a clean-room environment.

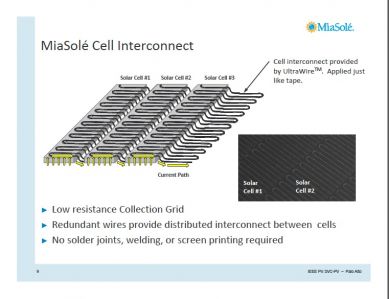

The cell interconnect tape has wires weaved onto it that make contact with the top electrode. According to Bayman, the interconnect tape provides a low-resistance connection with no solder, no screen printing, and no welds.

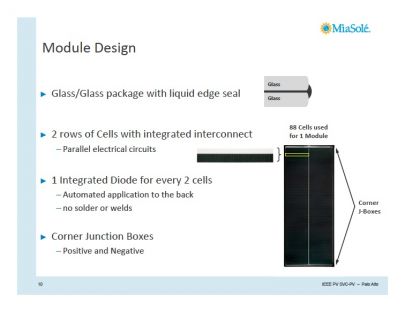

A liquid edge seal keeps moisture away from the 88 cells that consist of two serial-connected strings of 44 cells. There is one bypass diode for every two cells and one positive and one negative junction box per panel. That makes one bypass diode for every 3 watts versus one for every 80 watts for crystalline silicon modules.

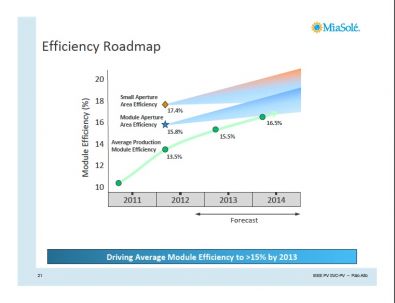

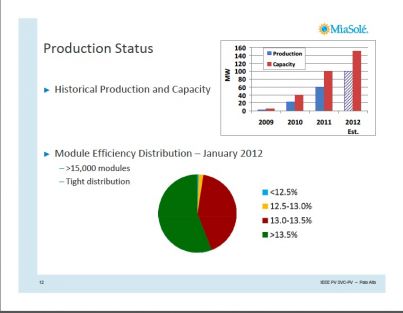

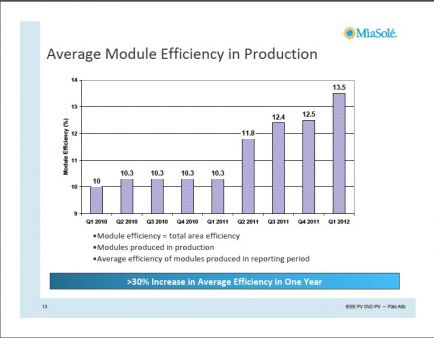

Bayman cited an average module efficiency of 13.5 percent, with more than half of the production greater than 13.5 percent efficiency. She claimed that all-PVD processing means faster cycles of learning limited mostly by the time needed to analyze the material.

The all-PVD machine in the slide below has a footprint of approximately 45 feet by 45 feet.

Contaminants in CIGS correlate with defects. Defect density also correlates with open circuit voltage. Sources of contamination include the stainless steel, nickel, iron and chromium, and other materials.

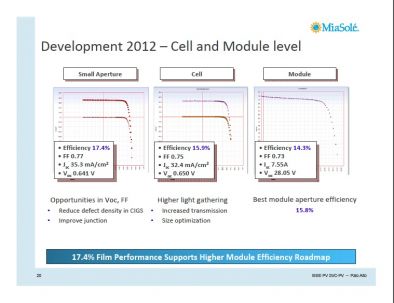

The best module produced on the current production equipment had an efficiency of 14.3 percent. Bayman expects to see 15.5 percent in 2013 and 16 percent in 2014.