China's Hanergy has acquired gallium-arsenide (GaAs) solar developer Alta Devices for an undisclosed amount, according to sources close to the company. Hanergy has become the acquirer of last resort for VCs looking to liberate their advanced solar ideas at fire-sale prices. Alta joins Solibro, MiaSolé, and Global Solar Energy (all CIGS thin film) under the Hanergy roof.

Alta CEO Chris Norris has not returned email or phone calls, nor has a small crowd of Alta employees and investors.

Alta Devices has set records for PV efficiency and has raised more than $120 million from investors including KPCB, NEA, August Capital, Crosslink Capital, DAG Ventures, NEA, Presidio Ventures, Technology Partners, Dow Chemical, Aimco, Good Energies, Energy Technology Ventures, and Constellation Energy.

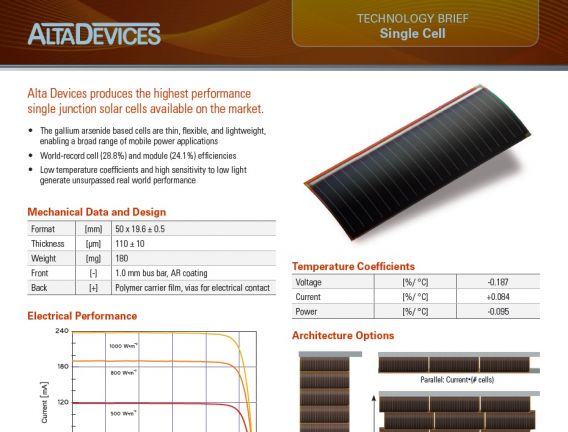

Alta has made technical strides in flexible gallium-arsenide photovoltaics, setting records for the materials system and able to boast NREL-verified 28.8 percent cell efficiencies for a single-junction solar cell and 30.8 percent for a dual-junction cell. (The theoretical maximum solar cell efficiency limit for a single-junction device, the Shockley-Queisser limit, is 33.5 percent. SunPower's crystalline silicon Gen 3 cells have efficiencies in excess of 23 percent.)

But the best investors in the world and the best cell efficiency in the world will not get to market if the costs are too high or if parts can't be built consistently at scale, as has been rumored about Alta.

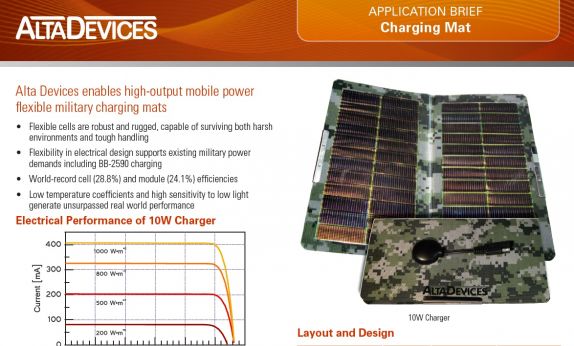

In a recent tell, Alta Devices made the announcement that it was moving into solar charging and military applications. Along with BIPV, those are the applications of last resort for less-than-successful solar firms. More recently (and more desperately), the firm has been talking about powering the "internet of things." Yes, efficiency is crucial and price-per-watt is much less important in these sectors -- but cost is still king.

Alta Devices uses an epitaxial lift-off (ELO) technique pioneered by Eli Yablonovitch that produces flexible layers of GaAs that are 1 micron thick. Substrate re-use and cost is an issue in this type of technology, as it is with Crystal Solar and Solexel. Alta still has to scale and scrub away cost in the face of technical and economic challenges with ELO and the firm's novel MOCVD processes.

Late last year, Chris Norris, the firm's CEO, spoke of a 10-watt iPad cover in the MIT Technology Review, which reported that Alta had "started selling solar panels to the military to power small unmanned aerial vehicles, and by the end of next year it plans to start selling an iPad cover powerful enough to make plugging in unnecessary."

In an earlier interview, the CEO said, "We have about 2 megawatts of capacity in place in our pilot line located in Sunnyvale. We have been shipping small volumes throughout 2012 and will be focused on fully ramping the pilot line in 2013." He had told GTM earlier that the firm remained "agnostic" about whether the end product would be a cell, a flexible module, or a rigid glass module.

We have asked if GaAs and Alta will ever transition onto the rooftop. Can GaAs production scale big? Can these niche markets provide the growth and heft that a VC-funded startup needs? Some of those questions were answered by today's acquisition.

Other solar startups with cell-level innovations such as Solexel or Silevo are going after module markets rather than portable power, a choice with its own set of challenges.

And the firm's GaAs solar cell.