In the early part of First Solar's rise to the top as a U.S. solar module maker, the firm encountered a glitch in its manufacturing process that compromised the performance of a small portion of its modules.

An estimated four percent to eight percent of the cadmium telluride (CdTe) thin-film modules manufactured by First Solar between June 2008 and June 2009 had a “process control” issue which resulted in a potential “premature power loss once in the field,” according to First Solar Chair and Interim CEO Mike Ahearn.

The process control issue, which the company has been dealing with in financials since 2010, involved global production and all three of First Solar’s CdTe manufacturing facilities at the time (in Ohio, Germany, and Malaysia). The issue was identified in June 2009 and the process factor was “addressed.” Subsequently, First Solar has been fulfilling its warranty obligations with its customers. “The vast majority were in Europe,” said First Solar’s Vice President of Communications Ted Meyer. Most were in Germany, where the bulk of First Solar’s modules were being sold at the time.

First Solar’s remediation program includes module removal, testing, replacement and logistical services and additional compensation payments to customers under certain circumstances.

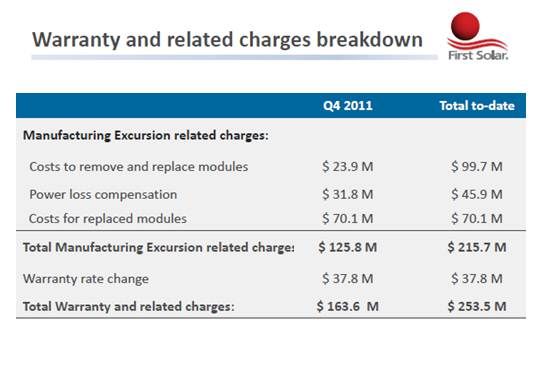

“A large volume of claims made under the remediation program were processed in the fourth quarter,” Ahearn said during the presentation of the Q4 2011 financials. The amount expended by First Solar in that quarter to remove and replace modules was $23.9 million, bringing First Solar’s to-date total for such costs to $99.7 million.

In addition, First Solar has compensated some module purchasers for their power losses. That expense was $31.8 million in Q4 and $45.9 million to date.

Finally, the cost of the replaced modules to First Solar was $70.1 million. It was entirely incurred in Q4 2011.

First Solar has now “processed over 95 percent of the total claims submitted” and, to date, “the total cost of remediating the manufacturing excursion is $215.7 million,” said Ahearn. That includes, he added, “$145.6 million above and beyond our standard warranty.”

For about four percent of the warranty claims, Ahearn said, “we have not yet been able to determine if remediation is required.” They could create additional costs of “as much as $44 million,” Ahearn reported.

That worst-case scenario would ut the cost of remediating the "manufacturing excursion" at approximately $259.7 million.

Credit Suisse analyst Satya Kumar wrote that “the warranty issues are a big deal” in arriving at a “neutral” rating for First Solar’s stock. “We are very disappointed that FSLR has now taken a cumulative $253 million of warranty and related charges as its panels are underperforming in the field.”

For First Solar, the issue is largely resolved, and “while the cost of the program has been much higher than we would’ve liked,” Ahearn said, “we believe we have done the right thing in demonstrating our commitment to our customers beyond our product warranty.”

Ahearn said the experience taught the company a lot. “Our analysis of hundreds of PV systems and modules returned under warranty” along with “analysis of system-level performance for sites under O&M agreements has given us unique insight into the real world performance of our products.” This will, he said, help drive “continuous improvement of our technology.”

“It was a discrete event,” explained Meyer. “We have no litigation related to the manufacturing excursion.” And the issue has not shown up in the subsequent three and a half years, as First Solar has continuously expanded, he noted.

In a separate issue, Credit Suisse's Kumar cited a National Renewable Energy Labs (NREL) report finding “high temperature degradation of CdTe panels” an issue.

Meyer said the panel underperformance “was unrelated to climate” and First Solar has no concern about the performance of the panels it has subsequently installed and is installing in its solar power plants. The company, he said, has tests showing CdTe thin film to get better “energy yields” and “performance ratios” than silicon modules.

But, Meyer pointed out, because the company is now building in the U.S. desert Southwest, the Middle East and other places much hotter than Europe, its Q4 financials included a one percent higher set-aside in the event of warranty-related expenses. The set-aside, a completely separate matter from the manufacturing excursion, is listed as a “warranty rate change” of $37.8 million. That $37.8 million, Meyer said, “covers all of the five-plus gigawatts we have in the field going forward.”

“Our experience has shown that our warranty rates for hot climates are slightly higher than the return rates for temperate climates,” explained First Solar Chief Financial and Accounting Officer Mark Widmar. The one percent extra set-aside will “account for potential returns going forward.” And, Widmar added, the company will watch its modules' performance and its “warranty accrual rate” and “adjust the rate as appropriate.”

Ahearn remains confident in the First Solar product. “Our modules cost less and perform better than crystalline silicon,” he explained. “A significant part of our competitive advantage is in our manufacturing cost and where we intend to be three years from now would be substantially below even the cash cost of a silicon module.”