A $37 million equity round just completed by Clean Power Finance (CPF) more than doubles funding for an important residential solar finance player. Edison International (NYSE:EI) and two other power sector investors buying into the deal is also big news.

This round brings total investment in the firm to more than $62 million with investment from Kleiner Perkins Caulfield & Byers, Google Ventures, Claremont Creek Ventures, Clean Pacific Ventures and Sand Hill Angels. Hennessey Capital joined in this round, as did Edison and “two other major power sector companies” which declined to be named but which, CPF told GTM, “look a lot like Edison.”

The $37 million infusion will allow CPF to grow a business that already ranks among the top four in third-party ownership (TPO) financing of residential solar.

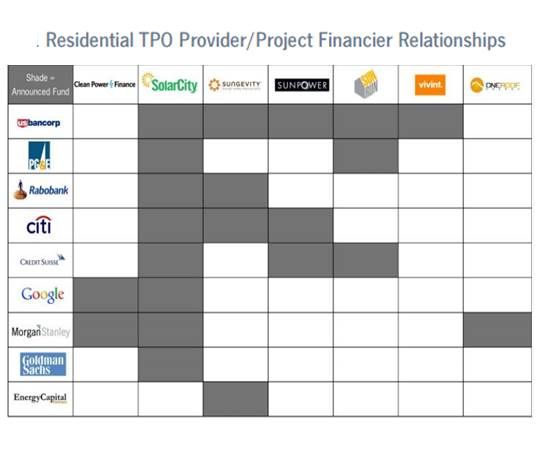

For staid utilities to be dipping their toes into residential solar financing, CPF suggested, shows how substantial the TPO marketplace has become in investors' eyes. It also hints at confirmation of talk in TPO circles that another “top-ten utility” is about to put up a TPO fund like those of institutional investors like Morgan Stanley (MS), Goldman Sachs (GS), Credit Suisse, PG&E, and Google (GOOG).

“Utility holding companies are increasingly interested in solar, particularly residential solar,” CEO Nat Kreamer noted. “The power company of the future will own both centralized generation and distributed generation (i.e., residential solar) assets.”

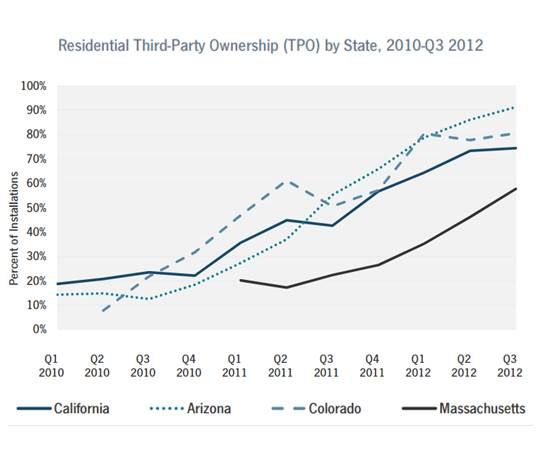

“There are more than ten companies offering residential solar leases/power purchase agreements (PPAs) in thirteen states,” according to GTM Research’s report U.S. Residential Solar PV Financing: The Vendor, Installer and Financier Landscape, 2013-2016. “In the more mature state markets such as California, Arizona and Colorado, TPO now comprises over 70 percent of all residential solar installations. And in a few states such as Arizona, the number has risen to over 90 percent.”

TPO financing draws capital funds to solar’s low-risk, steady returns, while through leases and PPAs, installers can offer businesses and homeowners solar systems with little or no upfront costs. Fund investors get the 30 percent federal investment tax credit and the federal accelerated depreciation as tax shelters. They also get a portion of the lease or PPA payments as a revenue stream. Installers get the work because businesses and homes get solar electricity at below-utility-bill rates.

CPF “has quickly risen to become, in many minds, the fourth top-tier TPO vendor along with SolarCity (SCTY), Sunrun and SunPower (SPWR),” according to GTM Research.

Kreamer discounted SunPower’s strength in the market and argued CPF is a better platform than Sunrun and SolarCity to bring power companies into solar finance because, while the other two players draw earnings from retaining an equity interest in each system, CPF’s business model is built on earning a fixed fee of 5 percent to 12 percent of the transaction for marketing and underwriting services from each deal.

SolarCity’s public disclosures show them retaining $14,000 of net value in an average $38,000 deal, Kreamer added.

Sunrun and SolarCity oversee every aspect of system installation, operation and maintenance in-house, while CPF provides a white-label software platform used by a wide range of independent solar installers.

“More than half CPF’s overall revenue, which grew 325 percent in 2012, comes from those fees,” according to Kreamer. The rest comes from licensing the CPF Tools software platform through which its network of installers works, as well as from fees for managing its client investment funds’ solar asset portfolios.

That means, Kreamer noted, that CPF’s growth is an indicator of the success of its solar installer customer base.

“The top-level indicator of volume growth is credit applications per day,” Kreamer said. “We broke the $4 million barrier this year and we are averaging $3 million per day in credit applications.” For 240 business days, he estimated, “that is $720 million in credit applications per year.”

Though it varies by market and credit ranking, one-third to two-thirds of the applications (in dollars) are converted to installations, Kreamer said.

The enterprise SaaS software and financial services offerings make CPF recognizable to Silicon Valley investors looking for familiar business models, Kreamer noted. “Investors have solar hardware hangovers, but see that downstream solar is where you can make money,” he added, “Connecting sellers and buyers of solar financing is capital-light, high-scale, and high-margin.”

In addition to broadly building the CPF business model, the company will use the new capital to develop new financial products, Kreamer said, promising an upcoming announcement. He has long talked about finding a way to bring TPO to homeowners with FICO scores lower than the 700 ratings currently being financed.